When public policy debates dive deep into data, most readers fall asleep. But when errors get made about taxes and poverty, it’s time to wake up. In an effort to prove that Philadelphia is not one of the highest taxed cities in the country, Marc Stier in a Citizen column that ran last week confuses tax revenues with tax rates — a mistake easily illustrated by a simple scenario.

Imagine small town A with 100 residents, each making $100,000 and paying a 1 percent wage tax. Across the river is town B, also with 100 residents, where everyone makes $30,000 and pays a wage tax of 3 percent. Town A generates tax revenue per person of $1,000; town B generates tax revenue per person of $900. Does that mean Town A is more heavily taxed than Town B? Obviously not. What matters is the tax rate, the percent of earnings that go to taxes. Town B has a tax rate three times as high as Town A.

It’s really that simple. In suggesting that Philadelphia is not a highly taxed city because other cities generate more revenues per capita, Stier confused the tax rate paid by city residents with tax revenue per capita. Why is San Francisco at the top of Stier’s list of high tax revenue cities? Because its median housing value was six times that of Philadelphia in 2019 ($1.2 million versus $183,000) and its median household income was more than twice Philadelphia’s ($124,000 versus $47,000), making San Francisco one of the most prosperous and Philadelphia one of the poorest of America’s 30 largest cities.

We have the highest poverty rate because we have the slowest job growth, the lowest density of businesses and the least opportunity compared to our peer cities and our suburbs. The pandemic has opened our eyes to how our tax structure is a self-inflicted wound. This crisis provides the opportunity to get things right.

Of course, the quality of services and schools each town provides matters. And Stier is right, if Town B is also its own county and pays for certain services that Town A receives from a larger surrounding region, that might explain why Town B may need to have a higher tax rate. But it doesn’t change the fundamentals: if you make $50,000 per year and can choose between living in Town A, paying $500 in taxes, or dwelling in Town B and paying $1,500, which would you choose?

Tax rates matter; not only in comparison to other cities, but to nearby suburbs as alternative places to live and work.

Stier makes a second error, perhaps of interest only to policy geeks. The data source he cites tabulates own source revenue per person, rather than tax revenue per person. Own source revenue includes not only taxes, but also user charges, fines and other earnings. Imagine that Town A somehow was creative enough to secure a deal in which all the tolls on the bridge crossing the river in either direction between Town A and Town B are paid to Town A. If these tolls bring in $30,000 per year on top of $100,000 in tax revenue, Town A’s total own source revenue will be $130,000, or $1,300 per person, $400 more per person than Town B’s $900. But Town A will still have a lower tax rate.

When you focus on tax rates, you quickly see that Philadelphia’s resident wage tax is higher than any other city in the nation, except New York; and because NYC has a progressive local income tax, its higher rates apply only to higher-income households. High tax rates mean less earned income goes into the pockets of our residents, as demonstrated by studies published annually by the Office of the Chief Financial Officer of the District of Columbia. Their most recent report found that Philadelphians with annual incomes of $25,000 face the second highest state and local tax burden among 51 large U.S. cities, while households with annual incomes between $50,000 to $100,000 have tax burdens ranking among the top ten.

So how does this play out in the real world?

Pre-pandemic, between 30 and 40 percent of the working residents from each City Council district reverse commuted to the suburbs each day. These 224,500 reverse-commuters still pay Philadelphia’s 3.8 percent wage tax. But they work alongside suburban peers who pay a wage tax of just 1 percent or less to their local government, where a stronger property tax base provides more funding for schools. This creates some potent incentives to move to the suburbs: a shorter commute, a pay raise and better-funded schools. (see CCD’s report A Small Down Payment on Growth). No surprise that more middle income households of all races have been moving out of the city than moving in.

What about the 284,500 suburban residents who, pre-pandemic, commuted into Philadelphia — making up 35 percent of the workforce in each Council district? If their employer directs them to work remotely, they remain exempt from the City’s wage tax. In short: stay home, get a raise and let your employer save money on office costs, while all those janitors, building operations staff and adjacent retailers and restaurants employees, who can’t work remotely, lose their jobs.

This is why a larger percentage of lost jobs in industries that require face-to-face interaction have not come back when compared to those that can rely on virtual meetings. We can encourage people to come back, but our tax rates urge them to remain remote.

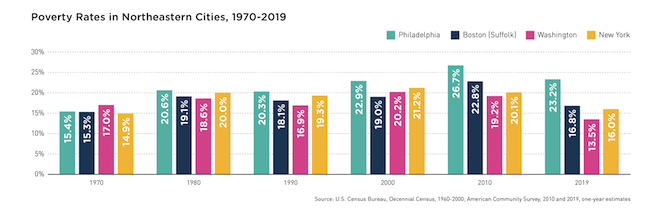

How did we get in this fix? In 1970, Philadelphia’s poverty rate was almost identical to that of Boston, New York and Washington. But in the next three decades, we lost 255,000 jobs and 430,000 working and middle-class residents. To try to compensate, we doubled the wage tax in the 1970s and raised it again in the 1980s. Starting in 1985, we became the only big city to tax both the gross receipts and net income of businesses. The actual number in poverty rose by 100,000 between 1970 and 2000, but we lost more than four times as many working and middle-class residents.

By comparison Boston, New York and Washington also lost between 85 to 90 percent of their 1970 manufacturing jobs, but they replaced them with a broad range of post-industrial jobs. In 2019, Boston had 27 percent more jobs than in 1970, New York had 17 percent more and Washington DC had 25 percent more. Philadelphia failed to grow as many new jobs and was 22 percent below its 1970 job levels in 2019 with a lower density of businesses in the city and a lower concentration of Black and brown businesses than all three other cities. (see CCD’s Business Density and the Role of Black and Minority Owned Businesses.)

Even during the boom years from 2010 to 2019, Philadelphia was among the slowest growing large cities, adding a disproportionate share of low wage jobs, while our suburbs and peer cities grew far more family-sustaining jobs. Philadelphia residents are thus less likely to be employed full-time, have household incomes that are lower and housing affordability challenges that are greater. And look what happened to our poverty rate in the last 50 years, compared to our peers. Note too, that as we grew jobs in the last decade, our poverty rate came down.

Are taxes the only factor? Of course not. Investments in schools, services and infrastructure are essential and households and businesses consider public services when deciding where to locate. But it is how we fund local services that is most problematic.

Philadelphia remains overly dependent on wage and business taxes

That creates disincentives for firms and workers to locate or expand in the city. We rely less than other cities on the more stable property tax. Our tax mix deters job growth, lowers resident incomes, and increases poverty. As a result, far too much of the City’s budget must be devoted to problems related to poverty, unemployment and crime and not enough is invested in economic development, parks, libraries and other public amenities.

A diminished real estate tax base that results from the absence of business and low household incomes has also meant that the City has had to support increased expenditures for K-12 education and early childhood programs from the General Fund and by levying new taxes. The reliance on wage taxes that dropped precipitously during the pandemic, also meant that Philadelphia used a far larger share of federal American Rescue Plan funds to close budget gaps than cities supported by the more stable real estate tax. This means less revenue to invest in economic development and in growing Black and brown businesses, initiatives that could spur faster recovery.

Throughout Philadelphia there is a renewed interest in the basics — clean and safe — as the pendulum returns to a common-sense middle ground about reformed, but enhanced, public safety in cities across the country. We need to find similar common ground when it comes to taxes. The best way for Philadelphia to achieve progressive goals is by enhancing prosperity and creating more jobs. Improving public schools is essential for the city’s future, but a major reason for underinvestment in education is the city’s weak real estate tax base.

We have the highest poverty rate because we have the slowest job growth, the lowest density of businesses and the least opportunity compared to our peer cities and our suburbs. And our high tax rates are a major contributing cause. The pandemic has opened our eyes to how our tax structure is a self-inflicted wound. This crisis provides the opportunity to get things right.

Paul R. Levy is president and CEO of the Center City District; Stephen Camp-Landis is vice president of research. The Citizen welcomes guest commentary from community members who stipulate to the best of their ability that it is fact-based and non-defamatory.

![]() MORE FROM THE CITIZEN ON YOUR CITY TAXES

MORE FROM THE CITIZEN ON YOUR CITY TAXES