“Philadelphia is one of the highest-taxed cities in the United States.”

But you knew that, right? It’s common knowledge. Everyone knows it. Everyone also knows that Philadelphia has been growing slowly because of its high taxes.

Beware of what “everyone knows.” Sometimes ideas get repeated so often, they become common knowledge that turns out to be wrong.

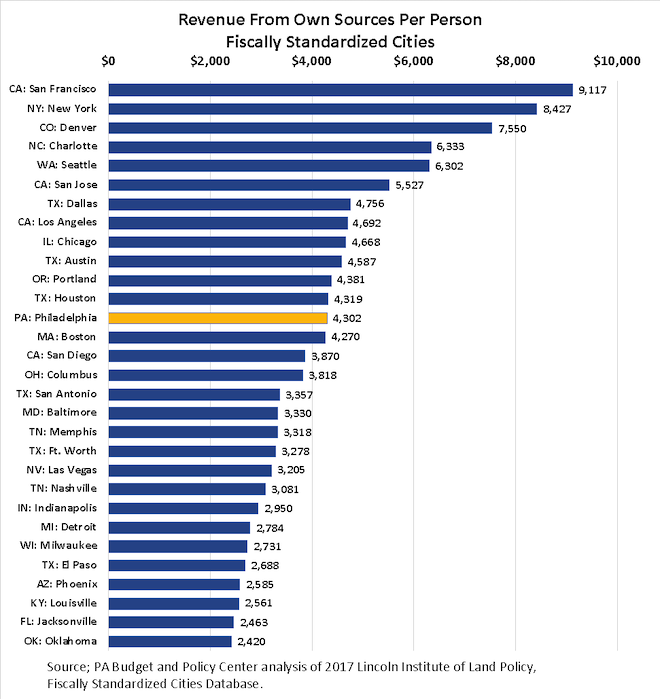

The truth is that of the 30 largest cities in the United States, Philadelphia ranks 13th in tax revenue per person per year.

The falsehood that Philadelphia has one of the highest tax rates in the country is not a neutral fact. It has political implications. It reinforces the narrative that blames Philadelphia’s high taxes for its anemic job growth.

At $4,302, Philadelphia’s per person revenue is just $500 per person more than the median value of $3,844 for these 30 cities. This rate is also far behind the most heavily taxed cities on a per capita basis, including San Francisco ($9,117), New York ($8,427), Denver ($7,550), Charlotte ($6,333), and Seattle ($6,302). San Jose, Dallas, Los Angeles, Chicago, Austin, Portland and Houston also take in more tax revenue per person than our city. (All data here are from 2017. They exclude Washington, D.C., which has the highest taxes of any city but which is not comparable to the other largest cities because it provides services that are provided by the states in which other cities are located.)

The truth is that in comparison to its peers among the largest cities in the country, Philadelphia is not a highly taxed city.

How is it possible that what “everyone knows” is so wrong?

One answer is that Philadelphia is one of the nine cities among the 30 largest that is also a county. In the other 21 cities, many local government services (that Philadelphians receive from the City) come from the county governments where those cities are embedded. So, Philadelphia’s tax revenues pay for what both city and county governments provide in 21 of the largest 30 cities. That pushes Philadelphia’s per-capita taxes up relative to the other cities.

To look only at taxes raised by cities, which reveals Philadelphia’s taxes as high, 6th out of those 30, is a patently unfair and absurd comparison. To fairly compare the tax burden of living in Philadelphia to that of the 21 cities embedded in independent county governments that provide some of the services provided by our city, we have to add the share of county taxes that provide local services to those city governments.

Here’s the quickest way to undermine the claim that the best way to create jobs and economic growth in the city is to cut taxes: Show that not only are Philadelphia’s taxes not particularly high—but are lower than that of other cities that supposedly are generating jobs faster than Philly.

Some of us have known about this discrepancy for years, but the data needed a fair comparison of the tax burden of Philadelphia to other large cities. Data that took into account the impact of county governments — or their absence — was not easily available. Since 2017, however, nonprofit, nonpartisan Lincoln Institute of Land Policy has provided data that combines city revenues and a proportionate share of the county revenues devoted to city residents for more than 200 cities in the United States. They call this data series “fiscally standardized cities.”

That is the source of the data above showing that the taxes Philadelphians pay for local government services are far closer to the median of what residents in the 30 largest cities than the highest amounts pay.

Keep in mind, however, that though Philadelphia is not highly taxed, there are reasons that the city needs to spend more money than most other cities. Of the 30 largest cities in the United States, Philadelphia has the fourth-highest poverty rate at 24.3 percent, far above the median of 17.9 percent. Philadelphia has the sixth-highest murder rate among the 30 largest cities. Poverty and high crime rates add to the burden on government services in our city and drive up spending and taxes. So does the lack of state aid for Philadelphia’s schools; Pennsylvania ranks 45th out of 50 states for its share of financial support for K-12 schools.

That’s only part of the story

As stated above, one reason that the conventional wisdom about Philadelphia’s taxes is wrong is that until recently, it was not easy to find the data to disprove it. But the lack of data is only part of the story. To challenge the conventional wisdom, one needs to use the data properly. That’s where things get a little odd.

A 2019 report from Pew that drew on the Land Institute’s data, carefully and thoroughly explained why data that looks only at city revenues and excludes county revenues devoted to providing local services in the city, is seriously misleading. The report wrongly said that Philadelphians pay the 6th highest taxes, not the 13th highest taxes among the 30 largest cities in the country. Instead of using newly available data to dispel the myth about Philadelphia’s taxes, the report reinforced it.

Then, it was picked up by The Philadelphia Inquirer, on WHYY radio, and on television.

How did Pew’s error happen? I am sure it was not deliberate.

It’s possible, however, that Pew inadvertently used the wrong data. The way the Land Institute labels its huge data file is confusing. I spent an hour or two studying the data labels before I understood which weirdly-labeled data series contained the fiscally standardized data.

It’s especially easy to make an error because of the “everybody knows” factor. The report presented incorrect data showing that Philadelphia has some of the country’s highest taxes for a big city. But it looked correct, because that’s what everybody already believed. No reporter, editor, academic, or politician would question it.

Until now.

This has political implications

And, of course, there is a third reason no one questioned what is actually a seriously misleading use of data to reinforce a falsehood about taxes in Philadelphia. The falsehood that Philadelphia has one of the highest tax rates in the country is not a neutral fact. It has political implications. It reinforces the narrative that blames Philadelphia’s high taxes for its anemic job growth.

That narrative has dominated discussion of Philadelphia’s economy for two decades. It has been advanced, to one degree or another, by Mayors Kenney and Nutter, by many members of City Council, by the Chamber of Commerce, by Center City District, and by most of the wealthy and politically-connected Philadelphians who insist we must cut business and wage taxes to push our economy forward. It was, of course, the first thing many people said in response to Councilmember Kendra Brooks’s proposal to create a wealth tax in Philadelphia.

That the Pew report reinforces a political-economic narrative held by some of the most powerful people in our city almost ensures that no one will question it.

Here’s the quickest way to undermine the claim that the best way to create jobs and economic growth in the city is to cut taxes: Show that not only are Philadelphia’s taxes not particularly high, but are lower than that of other cities that supposedly are generating jobs faster than Philly. (Another way to undermine that narrative is to show that Philadelphia’s job growth is, in fact, not anemic compared to those other cities, something we will explore in another piece.)

Clearly, dispelling this myth is important. If we are to have an honest conversation about taxes and economic growth — and, more importantly, about poverty — in the run-up to the next mayoral election, we need to start with the truth.

The truth is that, by the standards of the other largest cities in the country, Philadelphia is not highly taxed.

Marc Stier is the director of the Pennsylvania Budget and Policy Center and Chair of the We The People–PA campaign. He lives with his family in Mt. Airy.

The Citizen welcomes guest commentary from community members who stipulate to the best of their ability that it is fact-based and non-defamatory.

![]() RELATED STORIES ABOUT TAXES FROM THE CITIZEN

RELATED STORIES ABOUT TAXES FROM THE CITIZEN

Philadelphia Integrity Icon 2022: Meet Winner Rebecca Lopez Kriss

Photo by The New York Public Library on Unsplash