The fight over Philadelphia’s tax on sugary beverages did not end in 2017, when City Council overwhelmingly passed the tax ordinance. If anything, it’s an issue that represents a real divide in Philadelphians of different backgrounds and neighborhoods.

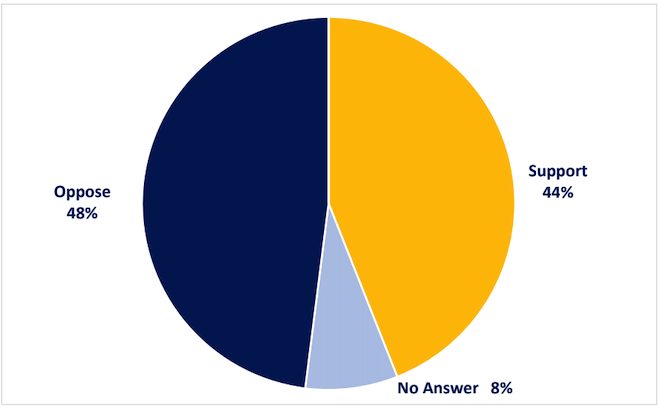

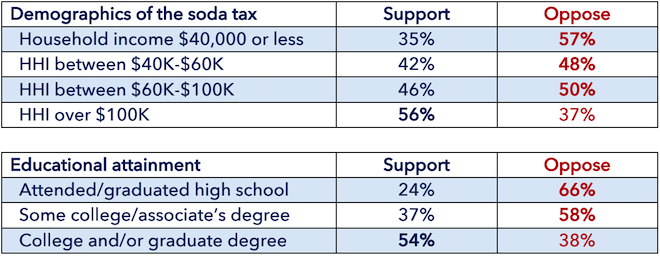

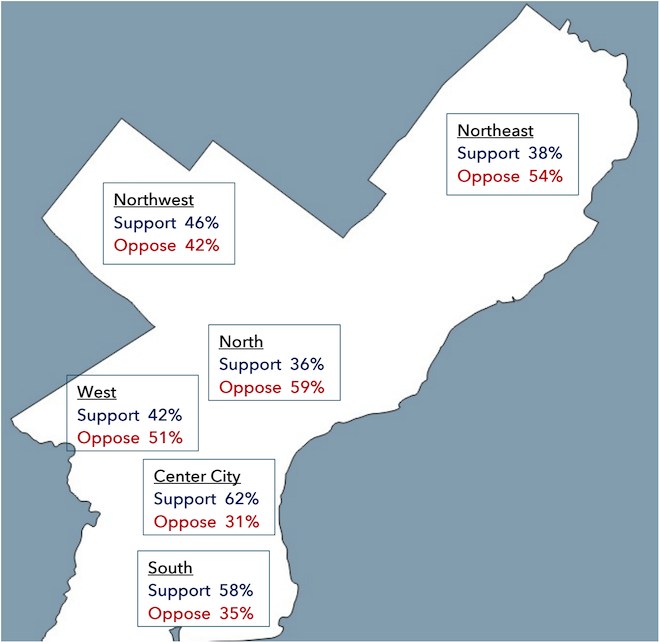

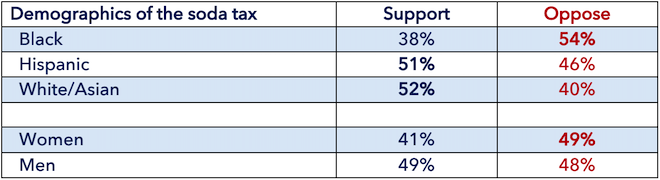

The latest data from A Greater Philadelphia’s February poll of Democratic Philadelphia residents found that nearly half oppose the soda tax—primarily those in North, Northeast and West Philly, who are less educated, earn less than $40,000 and are African American.

This is the latest data analysis from a survey conducted in February by nationally recognized pollsters McLaughlin & Associates and Frederick Polls, as part of civic nonprofit A Greater Philadelphia’s fact-finding mission to inform their goal of building a citywide movement in support of higher expectations, more effective leadership and better governance.

The Citizen is partnering with A Greater Philadelphia to publish the results of the poll. See the first three analyses, about public safety and City Council, here and another on school choice here.

![]()

Soda tax poll analysis and results from A Greater Philadelphia

Philadelphia became the largest city in the United States to implement a tax on soda and other sweetened beverages in 2017. Although City Council voted 13-4 in favor, polls conducted in 2016 showed varying levels of voter support. This latest poll shows support varies significantly depending on voters’ income and education levels.

The tax generated $70 million for the City in fiscal 2021, or about 1.25% of the municipal budget. About half of that revenue was allocated to fund the City’s pre-K initiative; most of the rest was spread across the general fund (according to the Controller’s Office).

Voters in the North, Northeast and West regions of Philadelphia strongly oppose the tax, Voters in the more affluent Northwest, South and Center City areas are more likely to support it. Opposition is strongest among voters with a high school diploma or less education, with nearly three to one in that group opposing the tax. Voters whose households earn less than $40,000 per year also registered

strong opposition, by a margin of 57% to 35%, as did Black respondents, 54% to 38%.

Q. Do you support the soda tax as a way to reduce obesity, reduce sugar-related health problems and generate money for pre-K education, or do you oppose the tax because it hits poorer people hardest and hurts the city’s economy as residents buy groceries outside the city to avoid the tax?

Somewhat curiously, women are more likely to oppose the soda tax than men.

![]()

MORE SODA TAX COVERAGE FROM THE CITIZEN

Header photo by Erik Mclean on Unsplash