What it would be like if the incredible amounts of capital invested in companies throughout the U.S. went to women? For one thing: We’d likely have more sustainable, family- and environmentally-friendly policies. For another: Investors would make more money.

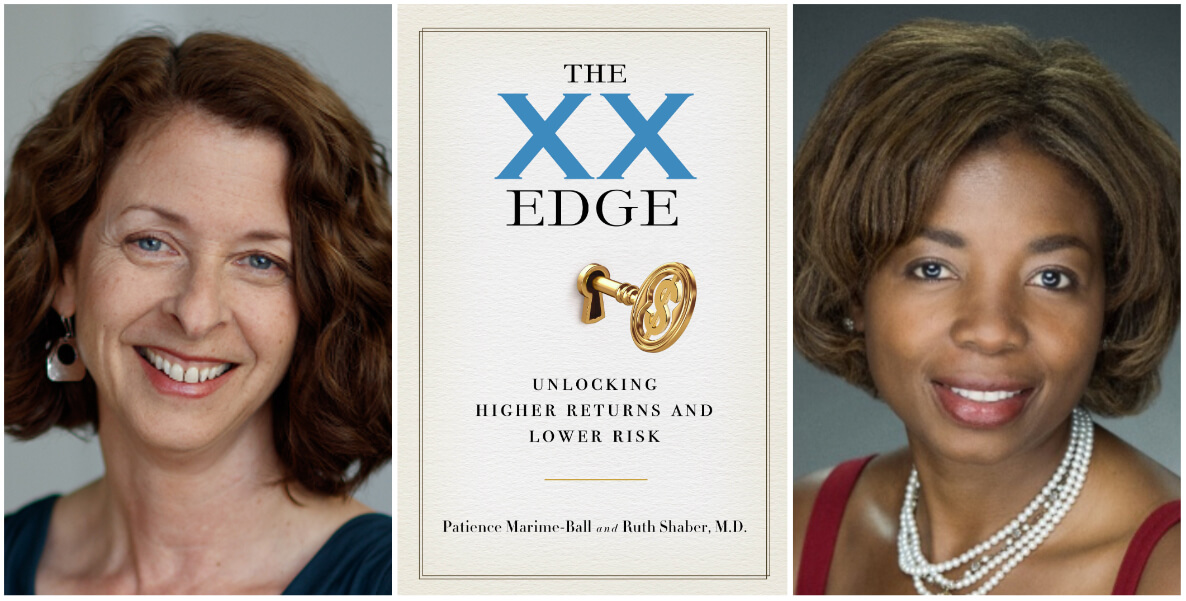

That’s what investors Patience Marime-Ball and Ruth Shaber call The XX Edge, and what they lay out in great detail in their book by the same name, The XX Edge: Unlocking Higher Returns and Lower Risks.

“The evidence is clear,” they write, “that when women share in the control of capital (as board directors, CEOs, fund managers, entrepreneurs, borrowers, heads of government), better financial and social outcomes are the result.”

And yet, according to research that came out earlier this year, only 2 percent of the $330 billion in venture capital funds went to women-led companies in 2021 — the smallest share since 2016, according to Bloomberg, even while it amounted to a record number of dollars ($6.4 billion). It was the second year in a row that the percentage of capital flowing to women went down — a sign that despite the evidence to the contrary, (mostly) male venture capitalists still believe women are a higher-risk investment.

Here’s the thing: They aren’t. As Marime-Ball and Shaber note: New companies led by women perform 63 percent better than those led by men over a 10-year period; gender-diverse teams are 21 percent more likely to see outperformance in profitability over those led exclusively by men. It brings to mind what Sarah Kunst, managing director of Cleo Capital, said at our 2020 Ideas We Should Steal Festival: “Every filthy rich individual in the world would be 20 to 30 percent filthier richer if they were investing in diverse teams.”

“Women’s leadership at both the micro and macro level will be essential for the pivot of the financial markets to address climate change. And the resulting development of new investment vehicles, new renewable energy industries, and new job markets is making lots of money for investors and growing the economy.”

Marime-Ball, is founder and CEO of Women of the World Endowment (“WoWE”), the first mission-aligned endowment investing in and through women. Shaber is a doctor, who runs Tara Health Foundation, which invests in evidence-informed programs that promote health, well-being and opportunity for women and girls. The two will be in Philly, talking about their work and book at the Free Library of Philadelphia with Renee Chenault-Fattah on Wednesday, July 20, at 7:30 pm.

Below is an excerpt from The XX Edge that explores what it would mean for the environment if — when? — more women are empowered to be financial leaders:

What will the world look like when women are fully part of the financial decision-making that impacts the environment? Would climate change be mitigated when women have financial leadership? Would the resulting impact on the environment lead to higher returns on investments and economic growth? The impact of women’s leadership on climate will affect both the micro (community) and macro (national and government) levels. The impact will be a cleaner, more sustainable environment as well as economic growth and financial returns for investors because women are closer to the problems that result from climate change, including migration, food insecurity, loss of clean water, and disruption from extreme weather events. This proximity makes them better positioned to develop innovative solutions. Furthermore, more collaborative leaders with longer-term thinking are well suited for the collective long-term action that’s needed to confront climate change.

At the micro or community level, women are often the most impacted by weather events and are often the source of creative solutions that take the long view into account. When women are in the financial decision-making circles that manage these local events, their firsthand knowledge of the problems contributes to solutions that not only include the needs of women in their communities but are beneficial for all. At the macro level, whether through the control of corporate strategies or as heads of state or CEOs, women are more likely to make financial decisions that contribute less to climate change and result in environmentally beneficial policies. These environmentally beneficial changes from both micro- and macro-level activities result in significant economic growth.

Women are on the front lines of the battle to combat the impact of climate change. The nature of women’s circumstances, including less access to human rights, frequently working agricultural jobs, and being more likely to live in poverty, makes them more vulnerable than men during climate-related disasters. Climate disasters not only create new and unforeseen threats, such as “once in a lifetime” freezes, heat waves, and floods that now occur yearly, but also serve to exacerbate existing inequalities. If women are already primary caregivers, housekeepers, and food providers, the burden of nursing an injured or ill person back to health, recovering a home from a flood, or finding water for the household following a disaster will naturally befall them. In these cases, climate change exacerbates the unequal risks inherent in traditional gender roles.

This increased risk rate for climate-related struggle makes women better suited than men to address and fight climate change because they know more intimately the challenges we are all facing. The scope of the problems requires a collaborative leadership model to generate solutions, where individuals and grassroots organizations share stories and innovative solutions across communities and continents. Leaders across the globe then need to accept, fund, and implement these solutions.

What about at the macroeconomic or systemic level? How will women’s leadership in the environment sector produce higher financial returns for investors? The answer to this question can be seen in how women’s influence over ESG investing has changed the investment landscape. In March 2021, Joan Michaelson reported in Forbes that ESG is now the most popular investment strategy, and it has financially outperformed other investment strategies. She says that while ESG was “previously considered a niche investing strategy . . . [it] is now the star, and women are a key part of why.” Michaelson reports that female investors are almost twice as likely as their male counterparts to prioritize ESG elements when deciding which companies to invest in. And as investors are reassured that they can make money with ESG strategies, there’s been a significant shift of capital into these products. According to the Forum for Sustainable and Responsible Investment (also known as US SIF), “As of year-end 2019, one out of every three dollars under professional management in the United States — $17.1 trillion — was managed according to sustainable investing strategies.” This is up 42% from $12 trillion just two years prior.

What can we learn about the impact of women in leadership at companies and the performance of those companies on environmental issues? A recent report from the International Finance Corporation provides evidence that more women in business leadership positions leads to higher environmental, social, and governance standards, with a particularly clear connection when women constitute a critical mass of 30 percent or more on company boards. The Sasakawa Peace Foundation reported in 2020 that when boards have three or more active female members, their companies have more consistent climate-related disclosures and a better track record of developing policies and methods for addressing climate change.

Women in leadership in non-climate roles include climate measures in their fields of expertise. We have seen that women do not wait until they have been invited to a climate summit; they implement climate measures wherever they are. Other studies show that 60% of women want to work for firms who care about sustainability, compared with 38% of men, and “women are more likely to perceive global issues—such as pollution, conflict, and inequality—as ‘very serious’, to care about how and where products are made, to be more concerned about environmental problems, and to be classified as sustainably minded consumers.”

So how does all of this relate to your investments, preparing for the next economy, and the value of women’s financial leadership? Women are driving ESG investing, which is very profitable for the financial industry. In addition, there are benefits for the environment and growing the economy. The Smith School reported in 2020 that an increase in a firms’ ESG performance in each country is associated with a statistically significant positive effect on living standards in that country, as measured by GDP per capita. Environmental performance has a statistically significant positive effect for growth in per capita GDP in emerging economies. But ESG performance must be more than just commitments. Companies must follow through.

Women’s leadership at both the micro and macro level will be essential for the pivot of the financial markets to address climate change. And the resulting development of new investment vehicles, new renewable energy industries, and new job markets is making lots of money for investors and growing the economy.

Wednesday, July 20, 7:30 pm, free but RSVP here, Parkway Central Library, 1901 Vine Street.

![]() MORE ON WOMEN IN BUSINESS FROM THE CITIZEN

MORE ON WOMEN IN BUSINESS FROM THE CITIZEN

MOST POPULAR IN EVENTS ON THE CITIZEN RIGHT NOW

Header photo shows Patience Marime-Ball (L) and Rush Shaber, authors of The XX Edge