Over the years, we’ve played a part in popularizing the political idea that Philadelphia has an income problem more than we have a housing affordability problem.

This isn’t an argument for complacency about rising housing costs—a topic we write about often—but rather is an argument for greater awareness from our local political class about the important ways that Philly’s housing challenges differ from those in the big cost-crisis regions, and the different strategies that need more emphasis here.

Voice your supportDo Something

Zillow has a list of over 1,200 homes you could buy right now in Philly for less than $200,000, many of which look very new and nice inside, and aren’t just in neighborhoods far away from the big job centers. Objectively, that’s a pretty cheap price for a home in a big East Coast city with all the amenities that exist here.

Philadelphia still has an income problem more than an affordable housing problem, and we’re now on the cusp of being able to shrink that income problem in a serious way.

At the same time, Philadelphia also has the highest poverty rate of any major U.S. city—around a quarter of our population—so our comparative advantage on housing affordability doesn’t carry much meaning for the very large group of residents who have a hard time affording even the most inexpensive housing.

But thinking about this as primarily a problem with housing, rather than primarily as a problem of too-low wages, has led city officials down a path where all their big ideas end up being outlandishly expensive while yielding a pathetic number of actual homes created.

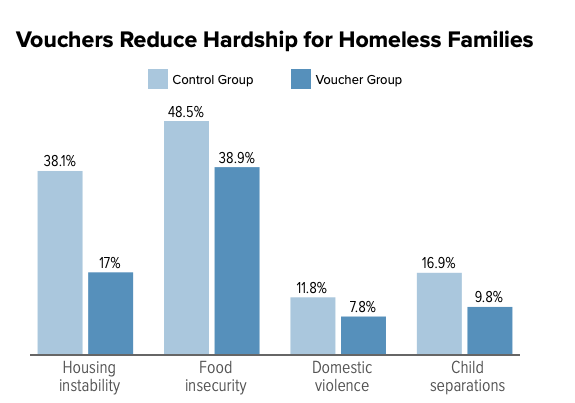

The main upshot for public policy from this view is that the issue isn’t so much about something that’s going wrong with the housing market, so much as there’s a need to get more money into the hands of people who need it most, and close the gap between what this high-need group can pay, and the going rate for housing.

We have a few examples of existing policies already that fit with this theme, like the existing Housing Choice vouchers program administered by the Philadelphia Housing Authority, and several of the programs administered by the City’s Housing Trust Fund, which funds things like Basic Systems Repair, mortgage down payment assistance, and some other types of assistance that pay for people’s needs. The Kenney administration is also exploring a new “shallow” rent subsidies initiative, which will be the city’s first try at a municipal rental assistance program.

These kinds of programs compete with an agenda of directing more and more tax money toward publicly subsidized construction—a favorite of politicians and an array of other interests—which hasn’t proven capable of delivering an impressive rate of affordable housing construction under the current cost structure, where projects routinely see costs upwards of $300,000 to $400,000 per unit.

There’s a place for some of this, too, and it’s also true that this local spending makes federal funds available to Philadelphia that would otherwise go someplace else. But there is nonetheless tension between directing our limited tax dollars for housing toward new construction at the expense of providing more direct rent subsidies to more renters in need. The wait list for the federally-funded Housing Choice vouchers was closed to new applicants a decade ago, and there’s no sign of when it might reopen again.

These existing programs, frustratingly, don’t come close to matching the scale of Philadelphia residents’ needs, which are orders of magnitude larger than what the city can afford to do all on its own.

Elected officials continue to make some questionable strategic and funding choices even within that narrow band of what we can do locally, and they should try to make some better ones going forward, but even so, the problems are much bigger than what we as a municipality can bite off alone.

What Joe Biden could do for housing in Philly

Joe Biden is now sworn in as president, Democrats have majorities in the House and Senate, and there are some priorities on their early agenda that could go a very long way toward solving Philadelphia’s affordability problem on the income side of the equation. And that means it’s time for those of us who have been making this argument about the housing affordability issue to get fully and publicly behind those efforts.

There are a whole range of ideas under consideration by the Biden team and within Democratic policy circles that could help a lot in this area, but there are two in particular that would be especially helpful for resolving Philadelphia’s affordability conundrum that everyone here should be paying attention to: raising the minimum wage, and making Housing Choice vouchers universal.

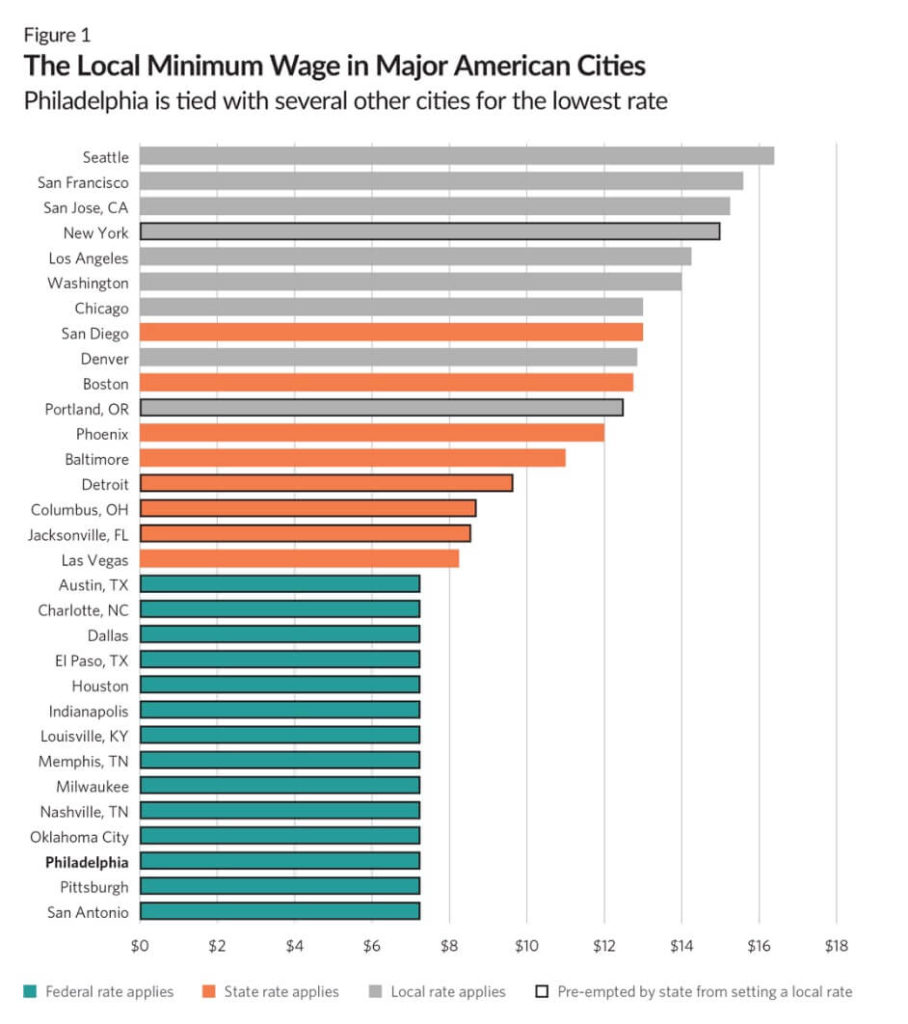

Raising the minimum wage is an idea that has been near the very top of the Democratic Party’s governing agenda for years, both at the federal and state level here in Pennsylvania, where it’s still pegged to the federal minimum at $7.25 an hour. About 9 percent of working Philadelphians were earning the minimum wage of $7.25, or less, as of 2018, which was about 44,000 people.

Politically, this is an issue that polls incredibly well across the spectrum, unites most of the Democratic Party’s factions, and, on the substance, contrary to the warnings of some economists regarding the disemployment effects, so far it has not been shown to be a serious deterrent to employment, even in some of the wealthier cities who have pushed the limits with a local minimum, like as Seattle, San Francisco, San Jose, and New York, all of which have local minimum wages set at $15 or higher.

Those cities at the top of the chart all have the ability to set higher local minimums than their states, which Pennsylvania cities are preempted from doing by state law. Had Democrats taken the state House in the 2020 election, we would have been in for some debates about raising the state’s minimum wage, or ending the preemption of local wage increases in Philadelphia and other big metros, but with Republicans still in control of the legislature, the chances are looking more remote.

So there’s a lot to like about setting a higher minimum wage at the national level, rather than state-by-state or city-by-city, as it takes away one of the key practical arguments about the possible downsides from employers shopping around for jurisdictions with low wage floors. Philadelphia doesn’t become relatively less competitive with our neighbors if the minimum wage goes up across the country, and neither does Pennsylvania with respect to its neighbors.

Combined with other Biden administration priorities like an expanded child tax credit, it’s possible, and even likely, that the federal government could soon be doing significantly more to support the incomes of the lowest-earning groups, who make up a large share of Philadelphia’s population. This would enable many more people to afford the local going rates for housing without public subsidy.

Thinking about this as primarily a problem with housing, rather than primarily as a problem of too-low wages, has led city officials down a path where all their big ideas end up being outlandishly expensive while yielding a pathetic number of actual homes created.

The other Biden campaign promise that could make a major difference, which we’ve written about previously, is the proposal to make the Housing Choice (Section 8) voucher program universal, and available to everyone who meets the income requirements, similar to SNAP.

Like many places, Philadelphia has many more people who meet the income requirements to receive Housing Choice vouchers than the number of vouchers available, and the Philadelphia Housing Authority’s waitlist to apply has been closed for over a decade.

What are housing vouchers? Delve Deeper

The interaction between these changes, and their relationship to Philadelphia’s existing housing policies, is an important area for local officials to think through as the possibility of passage has become more thinkable.

One question is what would happen to housing affordability here in a world with a higher wage floor and more widespread Housing Choice vouchers? One thing we might expect to happen if tens of thousands of Philadelphians all started earning $15 an hour—up from $7.25—or started receiving a guaranteed rent subsidy from the federal government each month to live in a neighborhood of their choosing, is that more people would want to trade up for some better housing.

More people now living with relatives, or with a roommate, or in a crowded group home situation, or in a place with substandard environmental conditions, might decide to strike out on their own and rent an apartment or a rowhouse.

That de-densification at the household level would be expected to create more demand for additional housing—especially rental housing since Housing Vouchers are rental assistance—that city officials should start thinking about when making planning and zoning decisions.

It’s not possible to know whether distributing all that additional money for housing support would lead to more people leaving Philadelphia for the suburbs, or if we’d see more of an influx from people now living elsewhere who could now afford to move.

But local public policy will influence those individual choices at the margin, and the Mayor and City Council should see these federal changes as a growth opportunity for the city, and a chance to sustain a new housing boom driven by the improved economic fortunes of tens of thousands of Philadelphians being lifted out of poverty.

Philly's housing woesRead More

That’s why it’s important to pair support for federal income support with pro-supply changes to the city’s zoning code, with the aim of converting all that new purchasing power into abundant middle-class housing at a rate that can keep up with the demand for city living.

Philadelphia still has an income problem more than an affordable housing problem, and we’re now on the cusp of being able to shrink that income problem in a serious way.

Depending on how things play out early in Biden’s term, we could be on the verge of achieving the inclusive growth moment local politicians have been talking about for decades. It’s time to start thinking more about how to solve the new problems we can anticipate will arise if we win.

Jon Geeting is the director of engagement at Philadelphia 3.0, a political action committee that supports efforts to reform and modernize City Hall. This is part of a series of articles running on both The Citizen and 3.0’s blog.

Header photo by Carlos M. Vazquez II / Chairman of the Join Chiefs of Staff / Flickr