Since the beginning of the Covid-19 crisis, my colleagues and I have chronicled the impact of the economic shutdown on small businesses in general and on small businesses owned by people of color in particular.

This research has taken on new significance in recent weeks with the civil unrest following the horrific death of George Floyd and the intensified focus on police brutality and entrenched racial disparities in income, health and wealth.

We now have new data about the state of Black-owned businesses on the eve of Covid-19.

About a month ago, the U.S. Census Bureau released its 2018 Annual Business Survey. The survey provides information on selected economic and demographic characteristics for all businesses and business owners by sex, ethnicity, race and veteran status. It thus is the most recent national data source that establishes what the small business world looked like pre-crises.

This article is intended to unveil the top-line national findings of our analysis. It makes for sobering reading and, we hope, serves as a call to action at all levels of government and across all sectors of society.

It is the first in a series and builds on the research expertise of a close colleague at Drexel University, Kevin Gillen, as well as the remarkable talents of a group of summer interns from MIT, the Harvard Kennedy School, the University of Pennsylvania and Yale Law School. It also builds on the practical knowledge and inspiring work of a growing group of reflective practitioners at Accelerator for America, Forward Cities, Next Street, The Enterprise Center in Philadelphia and the Minority Business Accelerator in Cincinnati.

Small business is routinely extolled as the lifeblood of the U.S. economy and the path to prosperity for millions of people. The Annual Business Survey reveals that our soaring rhetoric does not match performance reality.

One caveat at the beginning: the Annual Business Survey is an imperfect data source, representing a scaling back of census-provided data from surveys in prior years. Historically, the Survey of Business Owners (SBO) was conducted every five years, and covered the universe of both employer and non-employer businesses; more than 2 million business owners were surveyed in 2007, as compared to 850,000 in 2017 from the Annual Business Survey.

This reduction likely stems from significant reductions in federal spending on the collection of economics statistics. While the U.S. Census Bureau spent $127 million on the Economic Census in Fiscal Year (FY) 2008, that number had shrunk to $105 million in 2018, a reduction of 30 percent in real dollars. As the Annual Business Survey only covers employer businesses, it excludes 80 percent of all firms in the United States, and approximately 96 percent of Black-owned firms.

With such a small sample size, the granularity of information has been reduced at small geographies. We’re thus forced to evaluate the current state of businesses with subpar information, due to substantial lack of investment from the federal government in data-gathering on characteristics and trends for business owners.

Initial Findings of the Annual Business Survey

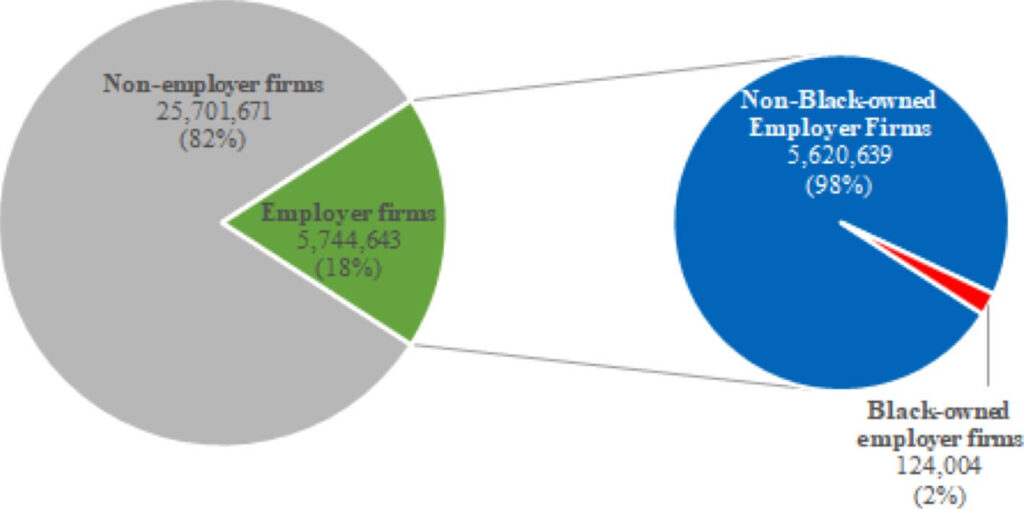

In 2017, the most recent year for which data is available, there were 31.4 million businesses in the United States. Of those, approximately 5.7 million firms had employees, representing 18 percent of all firms in the U.S..

Out of the 5.7 million employer firms in the U.S., approximately 124,000 are Black-owned employer businesses, representing 2.2 percent of all employer businesses.

For context, according to the 2012 Survey of Business Owners, Black-owned businesses with employees represented ~4 percent of the total number of Black-owned businesses. As the U.S. has a Black population of nearly 14 percent, it shows that Black Americans are vastly underrepresented among business owners.

Since the Census Bureau began tracking the demographics of business owners in 1972, the number of Black-owned employer businesses has grown by 288 percent, barely outpacing overall business creation, which has grown by 260 percent.

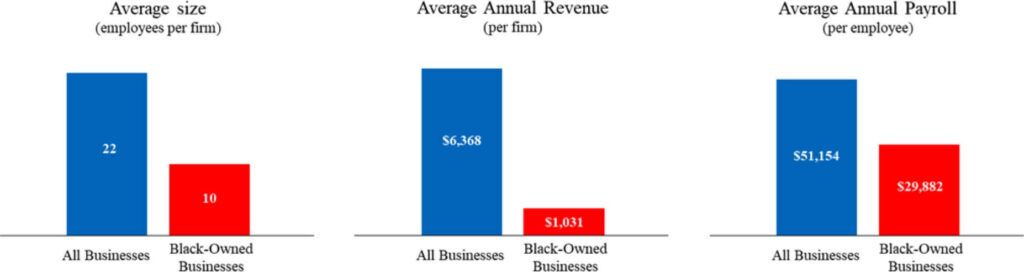

Black-owned employer businesses are smaller, with fewer employees, lower average revenues, and lower average payroll expenditures, than businesses overall.

Specifically, Black-owned businesses have average annual revenues of $1 million, 84 percent smaller than average revenues for all firms. They have an average of 10 employees, compared to 22 employees for all firms. Their annual payroll per employee is almost $30,000, as compared to $51,000 for firms overall. These differences may be explained by industry and geography, but it points to a dire need for Black-owned businesses to scale both their number of employees and revenues in order to reach equity with overall U.S. firm performance.

Nonetheless, Black-owned employer businesses have been growing at a fast clip in recent years. Compared to 2012, Black-owned businesses saw total annual revenues grow by 23 percent, twice as fast as U.S. employer businesses overall.

Black-owned businesses have also been adding employees, with the number of employees at Black-owned businesses growing at 24 percent, compared to 10.8 percent for all U.S. businesses.

Finally, the total annual payroll at Black-owned businesses increased by 30.4 percent compared to 24.8 percent at all U.S. businesses.

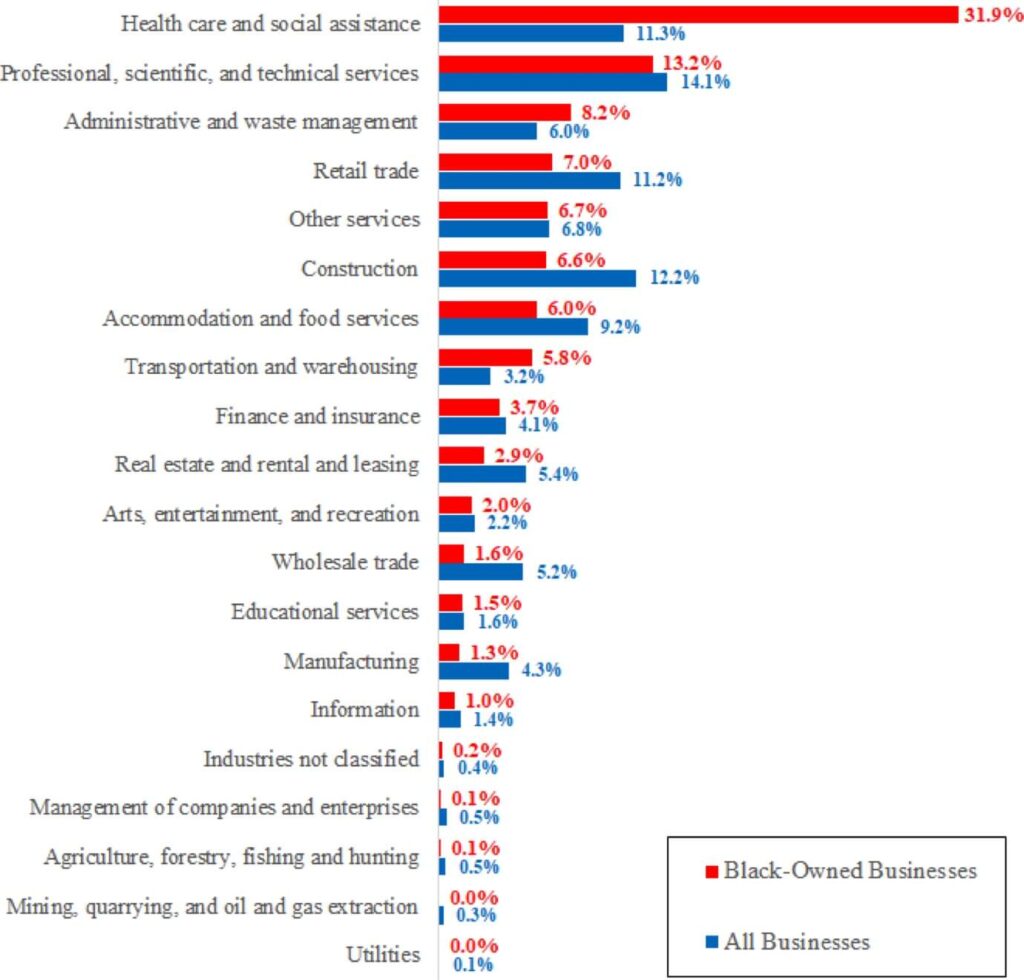

At the national level, data can be disaggregated by race and industry altogether. A main finding that emerges from this analysis is that Black-owned businesses are highly concentrated in a few economic sectors.

Of the 19 industries analyzed, two thirds of Black-owned businesses can be found in only five sectors: health care and social assistance; professional, scientific and technical services; administrative, support, waste management and remediation; retail trade; and other services.

These five sectors are composed of smaller sized firms, and underperform in economic terms when compared to others: average sales and payrolls are lower than average levels (with the exception of retail trade and professional services respectively).

Employment at Black-owned businesses exhibits an even higher degree of industry concentration, as only three sectors have 67 percent of the jobs generated by Black-owned businesses: health care and social assistance; administrative, support, waste management and remediation; and accommodation and food services.

Past research from the Association for Enterprise Opportunity has shown that, within the sectoral clusters for Black-owned businesses, they are also concentrated within lower-revenue subsectors. For example, within health care and social assistance, Black-owned businesses are overrepresented in childcare and home health, and underrepresented in medical, dental, and mental health provider facilities. Black-owned businesses are also relatively underrepresented in industries such as retail, manufacturing, and construction, which are generally higher revenue industries.

What this Means

The Covid-19 crisis and subsequent social unrest is wreaking havoc on Main Street small businesses across the United States. Millions of small businesses have shuttered for the duration of the crisis.

The hardest hit are Main Street enterprises living on the brink—restaurants, bars, coffee shops, barbershops, hair salons, auto repair shops, dry cleaners and others that provide face-to-face services. (These are all categorized as “other services” within NAICS.)

With data showing the strong concentration of Black-owned businesses in these sectors, people of color are among the most impacted by the current pandemic.

We’re already seeing the effects. As was shown recently in a working paper from the National Bureau of Economic Research, Black and Latinx business owners have been disproportionately impacted by the Covid-19 pandemic.

While the underlying survey, the Current Population Survey, includes both business owners for both employer and non-employer businesses, the numbers are stark. Comparing February and April 2020, the author found a 41-percent decrease in active Black business owners, and a 32-percent decrease in active Latinx business owners, as compared to a 22-percent decrease of active business owners overall.

During the early days of the crisis, many cities enacted local emergency relief funds to give small businesses the capital infusions they needed to survive until larger pools of capital were made available through the federal government.

The CARES Act (and subsequent legislation) has deployed several relief vehicles overseen by the Small Business Administration, most prominently a new Paycheck Protection Program, as well as the traditional Economic Injury Disaster Loan program.

Despite the extraordinary efforts, it is clear that the federal lending products offered and delivery system used were not aligned with the many small businesses that operate on the periphery of our economy, particularly underserved small businesses that are owned by persons of color and/or located in low- and moderate-income neighborhoods.

The nation’s starting point on Black-owned businesses is particularly challenging. Data on Black-owned businesses helps explain three main limitations of federal relief efforts to date:

- Black-owned businesses are usually sole proprietorships or businesses with employees that tend to be small in size and primarily situated within non-advanced sectors of the economy with lower pay and benefits. Black-owned businesses do not have close ties to the mainstream banking system, are unlikely to tap the SBA relief programs, and are in dire need of objective technical guidance and support. Black-owned businesses’ economic performance combined with decades of redlining and structural racism in the financial industry put people of color in a particular vulnerable situation to handle financial imbalances and pressures. Recent research from the Federal Reserve Bank of New York found that over 50 percent of Black-owned businesses were financially at-risk or distressed prior to the current pandemic, with shutdowns and lower consumer demand making them more likely to close, take out debt, or use the owner’s personal wealth to prop-up the business.[11]

- The structure of PPP has also overwhelmingly disadvantaged Black-owned businesses. Smaller firms, with fewer employees, and less access to the mainstream banking world were less likely to access the program as it was originally designed. Indeed, according to a survey from Goldman Sachs, fewer Black business owners applied for a PPP loan during the initial funding round, and they were approved at a lower rate than businesses overall. With the SBA having not required demographic information on PPP loans, we may not know the extent to which minority business owners were disadvantaged by the program.

- The Annual Business Survey also shows that Black-owned businesses are also younger than most firms, with nearly 50 percent of Black-owned businesses being in businesses 5 years or less, compared to 36 percent of all firms. Younger firms may have more residual debt from the startup phase, less savings to cushion an economic disruption, and a shorter track record to show to lenders if they seek emergency capital during the crisis. A study by the Center for Responsible Lending found that 46 percent of white-owned businesses were able to obtain credit from a bank over the last five years, while only 23 percent of Black-owned businesses were able to do so. Thus, the structural legacy of Black-owned businesses generally being undercapitalized combined with the fact that they skew younger than most firms puts them particularly at risk during the crisis.

As I have written before with multiple colleagues, we need a different playbook going forward. There are several pieces of good news. The most recent expansion of the Paycheck Protection Program mandated portions of the capital pool to be distributed through community banks and Community Development Financial Institutions (CDFIs); CDFIs, in particular, are sensitive to and engaged with the Black-owned businesses. In addition, a growing number of states are using CARES funding to create small business relief funds that target diverse business owners.

Yet more capital that is fit to purpose needs to flow. The RELIEF for Main Street Act, a bi-partisan bill co-sponsored by Senator Cory Booker and the subject of multiple newsletters, deserves particular attention.

The federal government, of course, only plays a partial role in nurturing and growing businesses owned by people of color. As we reveal subsequent findings from the Annual Business Survey, we and our colleagues will discuss multiple components of the ecosystem to create demand (e.g., supplier diversity, anchor procurement), provide support for new and existing businesses, enhance access to new forms of capital and regenerate nodes of commerce and community life.

Small business is routinely extolled as the lifeblood of the U.S. economy and the path to prosperity for millions of people. The Annual Business Survey reveals that our soaring rhetoric does not match performance reality. This is just the latest indication of a policy and market failure that is systemic and deeply rooted.

Only a well thought-out structural response and a radical surge in public, private and civic investment in all aspects of the small business ecosystem will yield different results.

Bruce Katz is the director of Drexel Metro Finance Lab, created to help cities design new institutions and mechanisms that harness public, private and civic capital for transformative investment. Kevin Gillen is a senior research fellow at the Lindy Institute for Urban Innovation at Drexel University. Ben Preis is a doctoral student at MIT’s Department of Urban Studies and Planning and is currently a graduate research analyst at the Nowak Metro Finance Lab at Drexel University. Victoria Orozco has recently completed the Master in Public Administration in International Development at the Harvard Kennedy School and is currently a graduate research analyst at the Nowak Metro Finance Lab at Drexel University.

Photo courtesy Stuart Price