Congress’ Paycheck Protection Program (PPP) has garnered national controversy because big business has secured big chunks of funding—but perhaps the bigger outrage is who has been left out of the program altogether.

The Beech Companies is a prime example. Beech has been fighting economic stagnation in Philadelphia neighborhoods for the past three decades, but now in a time of heightened need, the nonprofit has been largely excluded from the biggest spigot of federal funding to small business in history.

“I don’t think that anyone really gave it a thought,” says Beech Companies CEO Ken Scott.

Over the years, the Beech Business Bank, the nonprofit’s lending arm, has supported economic growth in North, West, and Northwest Philadelphia by offering loans to businesses that wouldn’t otherwise be able to tap into credit at bigger banks.

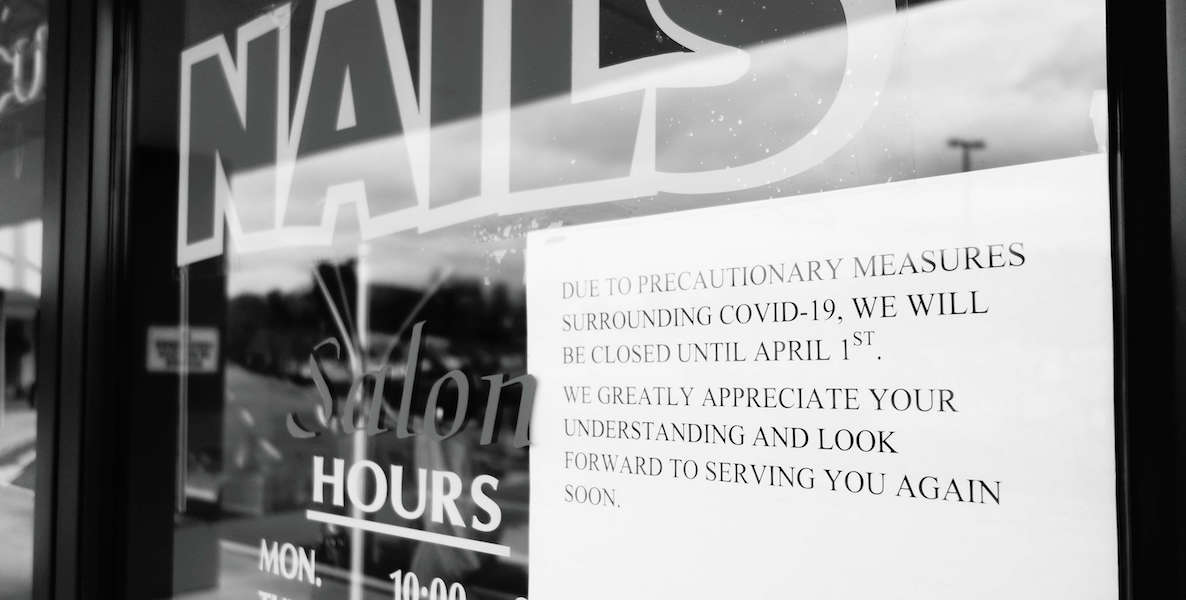

![]() Many of those businesses are small, cash-based operations without the type of financial or legal expertise that businesses traditionally use to raise capital. These small mom-and-pop shops are the same types of businesses now taking the brunt of the economic devastation.

Many of those businesses are small, cash-based operations without the type of financial or legal expertise that businesses traditionally use to raise capital. These small mom-and-pop shops are the same types of businesses now taking the brunt of the economic devastation.

In neighborhoods like North Philly that have undergone historical disinvestment, Beech has been a steady financial partner.

Since its founding in 1990, Beech has leveraged more than $1 billion in public and private dollars. The Beech Companies put together a North Philadelphia Black Biz Directory, and have more recently committed to giving out five $1,000 grants to Philadelphia organizations each week during the lockdown on business activity.

The grants have gone to People’s Emergency Center, Philabundance and other organizations helping people through the crisis.

“When you allocate resources, the people who are historically accustomed to being first need to be second,” says George Burrell. “The way it is today, the people who are accustomed to being first, continue to be first, and the leftovers that are left for the people who are not first are inadequate to change their circumstance.”

While Scott says that $1,000 grants might not sound like a lot in the world of big philanthropy, he maintains they go a long way for many of the nonprofits that receive them.

You would think its track record would recommend Beech to distribute some of the congressionally authorized PPP loans, which are highly sought because they are forgivable—essentially converting into government grants as long as 75 percent is spent on payroll.

But in Congress’s first big, hastily-assembled $2.2 trillion bailout package, non-traditional lenders like Beech Business Bank—which is a community development financial institution (CDFI)—did not meet the asset requirements to participate.

CDFIs were included in a subsequent, more modest, bailout bill, where $30 billion was set aside for lenders with less than $10 billion in assets, according to Forbes. But even there, nontraditional lenders like Beech have to compete against small banks and credit unions in accessing those funds. As of last week, Beech still hadn’t actually distributed any PPP loans itself, Scott says.

Meanwhile, small banks operating in rural white parts of the country have found success dispensing federal funding that has created a lifeline for Main Street businesses there, according to the Wall Street Journal.

Beech has long focused on assisting businesses that are on the economic ropes, and it operates in predominantly black neighborhoods.

Data from across the United States—and even elsewhere in the world—have shown that black people and other racial minorities are suffering from Covid-19 more than their white compatriots.

Rashawn Ray, a professor at the University of Maryland, argues that societal structures that determine where black people live and work—along with other factors like policing and health care—are the main culprits for the racial disparity in the victims of the coronavirus.

“Collectively, these structural conditions and micro-level outcomes equate to a recipe for disaster where the consequences are blacks’ increased exposure, diagnosis, and death from the coronavirus,” Ray writes.

It stands to reason that communities that have been disproportionately harmed by the pandemic will experience disproportionately adverse economic fallout. It is also easy to imagine a disastrous cycle of worsening health and business prospects in neighborhoods that have been shunted to the back of the line for aid and investment.

“The disparities are known,” says George Burrell, an attorney and former City Councilmember who is now serving on a task force to help minority-owned businesses take advantage of economic opportunities brought on by the pandemic.

“The impact of discrimination is known. Yet we have a federal ![]() government that says we’re going to create this bucket of money that is designed to solve the problem. We know where the disparities exist, but we’re not going to make it readily available to the institutions who service those people. When you allocate resources, the people who are historically accustomed to being first need to be second. The way it is today, the people who are accustomed to being first, continue to be first, and the leftovers that are left for the people who are not first are inadequate to change their circumstance.”

government that says we’re going to create this bucket of money that is designed to solve the problem. We know where the disparities exist, but we’re not going to make it readily available to the institutions who service those people. When you allocate resources, the people who are historically accustomed to being first need to be second. The way it is today, the people who are accustomed to being first, continue to be first, and the leftovers that are left for the people who are not first are inadequate to change their circumstance.”

Scott says that leaders of CDFIs are asking Congress for a $1 billion carveout that would be made available exclusively for those non-traditional lenders in the next bailout package. However, Sen. Mitch McConnell, who presides over the Senate, has since sounded critical of providing more federal funding to state and local governments. There is no telling when the window for more federal aid will reopen.

There are about 1,000 community development financial institutions across the country, so if that proposal does become law it would mean roughly $1 million apiece. Burrell said there are dozens of CDFIs in Pennsylvania, so that level of funding could have real impact, but he is still disappointed that those organizations were not prioritized when Congress first passed a pandemic relief bill.

Even without the PPP funding, Beech has been giving out its own loans and lines of credit to local businesses, according to Scott. Beech has also helped local business owners get their paperwork in order to apply for a PPP loan through the larger banks.

In general, small businesses and community banks have been able to plug into the federal funding. According to the Small Business Administration, smaller banks—those with less than $50 billion in assets—have sent out the bulk of the $88.9 billion distributed so far in the second round of PPP. The average size of each loan is $73,000.

It is hard to say with certainty whether—despite the sidelining of Beech—the PPP money has landed in the hands of small business owners in North and West Philadelphia.

While there have been scattered news reports about particular businesses receiving federal bailouts, and the Small Business Administration issued state-level aggregate data on the amount of PPP money distributed, City Hall doesn’t have a view into how many of those loans have gone to Philadelphia businesses.

Being overlooked and disregarded by power brokers is a long-running and shameful story in North Philly, the neighborhood where Beech is located.

“The lower economic people always get overlooked or wind up getting slighted with less resources than a wealthier community,” says Scott.

It stands to reason that communities that have been disproportionately harmed by the pandemic will experience disproportionately adverse economic fallout. It is also easy to imagine a disastrous cycle of worsening health and business prospects in neighborhoods that have been shunted to the back of the line for aid and investment.

In the 20th century, people looking for loans for homes and businesses in North Philadelphia were shunned by financial institutions through “red-lining”—a longstanding practice where lenders grade whiter neighborhoods more favorably when choosing where to invest.

While it was outlawed generations ago, the spirit of redlining has lived on. After recent published reports that found that black people had a harder time obtaining loans from banks in Philadelphia and elsewhere, Pennsylvania Attorney General Josh Shapiro launched an investigation into mortgage discrimination.

Just as the Civil Rights movement was making strides for black people around the country to gain a more equal footing, North Philadelphia was wrecked by riots in the summer of 1964. The disruption was sparked by tense interactions between city police and the black community. In the decades that followed, the neighborhood continued to suffer as people and businesses moved out, sapping life from the once vibrant area.

In the 1970s when Frank Rizzo was mayor, there was a policy within the city’s housing and community development arm to “withhold funds” from distressed neighborhoods such as North Philadelphia, according to James S. White, who subsequently served as the city’s managing director.

The Beech Companies were established by The William Penn Foundation in the 1990s, and they helped to bring new investment and vitality back to North Philadelphia. There had been some new investment in the neighborhood before the pandemic struck.

![]() The city’s database of “opportunity zones” shows a neighborhood that still suffers, but also one with signs of growth. Several North Philly census tracts have more than 100 vacant buildings. An area of Glenwood has 182 vacant buildings—or one for every 15 residents, nearly all of whom are African American, according to census data. But the city’s dataset also shows that the number of permits for new construction or improvements often outnumbers the number of vacant properties in North Philly.

The city’s database of “opportunity zones” shows a neighborhood that still suffers, but also one with signs of growth. Several North Philly census tracts have more than 100 vacant buildings. An area of Glenwood has 182 vacant buildings—or one for every 15 residents, nearly all of whom are African American, according to census data. But the city’s dataset also shows that the number of permits for new construction or improvements often outnumbers the number of vacant properties in North Philly.

Scott had sensed a recent “entrepreneurial spirit” in the area and says there had been new investment in the last couple years.

“Sadly, a lot of them had just gotten started,” says Scott, who notes that he didn’t learn that his bank would not qualify for the coveted PPP loans until a meeting with others in the same boat.

After the first big federal relief bill, Congressman Dwight Evans, Mayor Jim Kenney, and others called for CDFIs to be included in future legislation.

“In Philadelphia, small businesses that access capital through CDFIs help revitalize communities, grow the local economy, and create jobs and build wealth for those who are trying to grab the first rung of the economic ladder,” Kenney and the whole Council wrote in an April 6 letter to Treasury Secretary Steven Mnuchin.

Evans, who represents West Philly and much of North Philly, joined several of his colleagues in Congress calling for changes to the bailout program that “has barred some of the most vulnerable small businesses from being able to apply for PPP loans.”

It wouldn’t take much to make sure that, in a time of crisis, federal dollars promptly get into the hands of the small and minority-owned businesses that need it the most. Sadly, we have yet to see that effort truly being made.