The Covid-19 pandemic is a powerful mirror for the current state of U.S. society. It has exposed deep, structural racial and ethnic disparities on income, health and wealth, and barriers to social mobility in the country.

In so doing, it has devastated Latino-owned and Black-owned businesses in the U.S., exacerbating what were already substantial gaps in the number, size and growth potential of these firms. It has also catalyzed broader support for racial justice and inclusion across America—recently illustrated by President Biden’s Executive Orders on Advancing Racial Equity and Support for Underserved Communities Through the Federal Government and preserving and fortifying DACA (Deferred Action for Childhood Arrivals).

![]() The social upheaval from the pandemic has also sharpened our focus. Over the past several months, Drexel University’s Nowak Metro Finance Lab has partnered with Accelerator for America and The Mastercard Center for Inclusive Growth to develop a Small Business Equity Toolkit that will be released in the coming month.

The social upheaval from the pandemic has also sharpened our focus. Over the past several months, Drexel University’s Nowak Metro Finance Lab has partnered with Accelerator for America and The Mastercard Center for Inclusive Growth to develop a Small Business Equity Toolkit that will be released in the coming month.

Our objective was to build a tool that helps local leaders take stock of the size, scale and sector orientation of Latino-, Black-, Asian-, and women-owned businesses pre-Covid. In addition, we want to ensure that public and private actions post-pandemic grow not only the number of firms but also these firms’ participation in high wage, growth sectors of our economy.

We believe the tool can achieve both aims. Below we’ve included a preview of the powerful insights the tool can provide for guiding relief and recovery.

In this piece we focus on Latino-owned businesses, since there has been a paucity of focus in the national conversation on the impacts of Covid-19 on Latino-owned businesses specifically.

Such engagement is vital for many reasons. Chief among them is that Latino-owned businesses have been uniquely harmed by the pandemic. According to a recent McKinsey analysis, the five business sectors most affected by Covid-19-related shutdowns generate almost 50 percent of the revenues of all Latino-owned businesses.

If half the revenues of any other group of business owners were suppressed, you can bet there would be a huge outcry. Yet while this five-alarm fire rages, specific coverage of how to support these firms has lacked a clear focus.

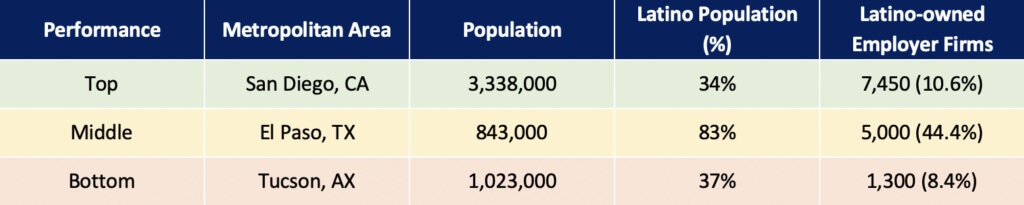

We introduce the Small Business Equity Toolkit by focusing on the relative performance of Latino-owned businesses in three metropolitan areas: San Diego, El Paso, and Tucson. It makes for sobering reading and, we hope, serves as a call to collective action at all levels of government and across all sectors of society.

Context: Latino-Owned Firms in the U.S.

Latino-owned businesses are a major economic driver of the U.S. economy. Prior to the Covid-19 pandemic, the country was home to nearly 4 million Latino-owned firms, of which 323,000 had paid employees. In fact, Latino-owned businesses grew 20 percent from 2012 to 2017—far above the 12 percent average growth rate of U.S. firms.

Yet, deep disparities exist. While 18 percent of the U.S. population identifies as Latino, only 6 percent of employer and 14 percent of non-employer firms were Latino-owned in 2017.

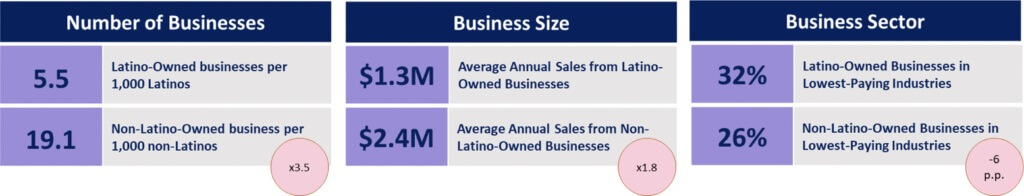

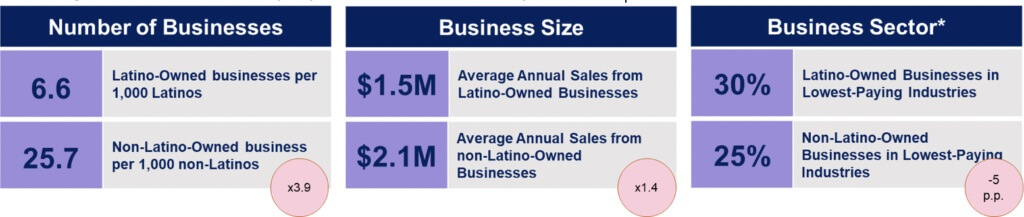

On top of these disparities, Latino-owned businesses tend to be fewer, smaller and lower-paying than their non-Latino counterparts. While there are 5.5 Latino-owned employer firms per 1,000 Latino residents nationally, there are 19.1 non-Latino-owned employer firms per 1,000 Non-Latino residents. But the disparities do not stop there.

On average, Latino-owned employer businesses are almost half the size of non-Latino-owned firms, and one third of them are operating in the lowest-paying industries (while only 26 percent of non-Latino-owned firms operate in these sectors).

These economic gaps are significant and will take intense focus, clear goals, and hard work to close.

National Latino-Owned Employer Business Baseline pre-COVID:

Dashboards in Action: Latino-owned businesses in three selected metropolitan areas

As with all national statistics, there are significant variations that tell different stories on the local level. Some communities are doing better when it comes to the number and performance of Latino-owned businesses. Understanding what these places are doing right is one of the first steps in setting goals and developing strategies for an inclusive recovery. But getting there requires that we have standard, replicable and reliable small business measures for every community across the country.

![]() Over the past several months, we have developed a Small Business Equity Toolkit to start this process. The Small Business Equity Toolkit measures metropolitan areas’ performance across the three standard dimensions—number, size, and sector—that get to the heart of the non-white-owned businesses economy before the coronavirus pandemic hit.

Over the past several months, we have developed a Small Business Equity Toolkit to start this process. The Small Business Equity Toolkit measures metropolitan areas’ performance across the three standard dimensions—number, size, and sector—that get to the heart of the non-white-owned businesses economy before the coronavirus pandemic hit.

To put our Small Business Equity Toolkit into action, we assess the performance of Latino-owned firms in metros that are leading the pack, in the middle of the pack, and following the pack for outcomes of their Latino-owned firms.

While Latino-owned firms perform better in San Diego (California), Latino-owned firms in El Paso (Texas) perform around the average for the largest 100 metros in the U.S. among key metrics. Latino-owned firms in Tucson (Arizona), however, are lagging.

Bottom line: In all these areas Latino-owned firms underperform when compared to their non-Latino counterparts.

Latino-owned Business Index. Ranking of the Largest 100 MSAs, 2017:

Three selected Metropolitan Areas. Population, Hispanic Population (%), and Hispanic-owned employer firms:

Distinct performance across three key metrics (number, size, and sector) drives the overall performance of these metropolitan areas in the ranking. Below, we take a deeper look at the baseline for these three selected metros.

San Diego, California

San Diego ranks 6th among the top 100 metros in the Latino-owned Business Index. While the Metro’s Latino-owned business performance leads its peers, San Diego still has deep disparities between Latino- and Non-Latino-owned firms across all three dimensions measured by our Small Business Toolkit. When compared to other metros with similar demographics, the MSA surpasses Orlando, FL (22nd), Austin, TX (49th), Phoenix, AZ (54th), San Jose, CA (62nd), and Las Vegas, NV (68th).

Prior to the pandemic, San Diego hosted more than 75,400 Latino-owned firms. In other words, Latino-owned firms accounted for 21 percent of all firms in the metropolitan area, while 34 percent of San Diego’s residents identify as Latino.

This is better than most places. However, the Latino-owned firm participation is significantly unequal when we only consider employer firms. Before the Covid-19 pandemic, only 10.6 percent of firms with paid employees in San Diego were Latino-owned (around 7,450 firms).

San Diego Latino-Owned Employer Business Baseline pre-Covid:

Our Small Business Toolkit reveals two crucial insights about San Diego as the metro seeks to hone its focus and build a more inclusive post-pandemic economy:

Lagging Firm Density: the number of Latino-owned firms in the San Diego Metropolitan Area are lagging. Even though the Metro performs better in the overall index than Orlando (FL), it trails it in terms of the business density of Latino-owned firms (Orlando has 8.1 Latino-owned businesses per 1,000 Latino residents and the gap with non-Latino-owned firms is smaller). San Diego should look to Orlando for strategies to grow its number of Latino-owned firms.

Sectoral Emphasis for Growth: Latino-owned firms are overrepresented in Construction, Accommodation and Food Services, and Administrative and Support. Simultaneously, they are underrepresented in the Professional and Technical Services sector (15 percent vs 20 percent for non-Latino-owned firms). A strategic long-term approach should target sector diversification in San Diego.

El Paso, Texas

El Paso ranks 42nd among the top 100 metros in the Latino-owned Business Index. When compared to other metros with similar demographics, the MSA trails San Antonio (20th) and Albuquerque (24th). Prior to the pandemic, El Paso hosted more than 53,000 Latino-owned firms.

In other words, Latino-owned firms accounted for 74 percent of all firms in the metropolitan area, while 83percent of El Paso’s residents identify as Latino. However, disparities start to be revealed when we break down employer and non-employer firms.

The participation of Latino-owned employer firms is much less equitable: There are 11,300 firms with paid employees in El Paso, and only 44.4 percent of them are Hispanic-owned firms (a total of 5,000 Latino-owned employer firms).

El Paso Latino-Owned Employer Business Baseline pre-Covid:

Our Small Business Toolkit reveals three crucial insights about El Paso as the metro seeks to hone its focus and build a more inclusive post-pandemic economy. Taken together, the data shows significant limitations for the ability of Latino-owned firms in the Metro to grow and scale. Addressing this challenge is one of the most important steps to building a more inclusive post-pandemic economy in El Paso.

Low business density for employer firms: The business density of Latino-Owned employer firms is 4.5 times lower than the business density of Non-Latino-Owned firms. The metro should focus on growing the number of employer firms for an inclusive recovery. One option for doing so, would be to focus on helping the high number of non-employer firms grow into employer firms.

Focus on growing the Size of Firms: Non-Latino-owned firms in the El Paso Metro are more than double the size of Latino-owned businesses (this gap is larger than what we observe nation-wide). A closer look at the data shows that among its peers, El Paso ranks around average in annual sales for its Latino-Owned Firms, but far below Knoxville ($2.1M), Raleigh ($1.7M), and Baton Rouge ($1.6M). El Paso’s Latino-owned firms are, on average, smaller than Latino-owned firms nationally. A recovery strategy should focus intensely on reducing barriers to Latino-owned firm growth in El Paso.

Diverse Sector Makeup of Latino-Firms: El Paso is unique in its sectoral distribution of Latino-owned firms: Latino-owned firms are more distributed across Industries than in many metros in the country. Thus, a strategic approach involves more than sector diversification: scaling existing Latino-owned firms across sectors in El Paso is one of the key pathways forward to a more inclusive economy.

Tucson, Arizona

Overall, Tucson ranks 76th among the top 100 metros in the Latino-owned Business Index. The Tucson MSA trails almost all demographically similar metros. Among the three dimensions included in the index, Tucson MSA is particularly lagging in the number of Latino-owned firms, both in absolute and relative terms.

Before Covid hit, Tucson housed more than 19,800 Latino-owned firms. In other words, Latino-owned firms accounted for 24 percent of all firms in this metropolitan area, while 37 percent of the MSA’s population identified as Latino.

These disparities are even larger when we focus on employer firms. Of the 15,600 employer firms in the Tucson MSA, Latino-owned firms only account for 8.4 percent (a total of 1,300 Latino-owned employer firms).

Tucson Latino-Owned Employer Business Baseline pre-Covid:

An initial look at the Tucson Latino-owned Business baseline shows the stark inequalities that Latino-owned employer firms face. As Tucson develops strategies to build a more inclusive post-pandemic economy, it should focus on strengthening the whole small business ecosystem. The city should especially focus on helping new firms start and grow, especially in higher wage sectors.

Low business density: With a business density of 3.4 Latino-owned employer firms per 1,000 Latino residents Tucson’s business density lags far behind non-Latino-owned firms (which is almost 6 times larger). This local gap surpasses gaps observed at the national level.

Small business size: On average Latino-owned firms have half the sales of non-Latino owned firms. This local gap surpasses gaps observed at the national level.

Relatively diverse sector makeup: Tucson’s Latino-owned firms are not overrepresented in the Accommodation and Food Services and Health Care and Social Assistance sectors, but they are overrepresented in the Construction sector (17 percent vs 11 percent for non-Latino-owned firms), which may partially explain the lower size of Latino-owned businesses in this metro.

Building an Inclusive Small Business Ecosystem

While each metro we profile has unique baselines and strategies, moving forward in each place requires a whole-ecosystem approach.

The venture capital world often talks about startup ecosystems: overlapping networks of institutions that deliver coordinated, multifaceted support to grow and scale startups. This concept tends to conjure up images of the newest Silicon Valley app and be very race-agnostic. However, like our colleagues at Next Street, we believe it should be applied to growing Latino-, Black-, minority-, and women-owned businesses.

We call the various institutions that make up ecosystems “intermediaries” because they serve as connections between public sources of funding, entrepreneurs of color, potential private sector customers, investors and partners.

Intermediary institutions provide mentoring, help access capital, create marketplaces to connect companies and potential clients, aggregate supply from small companies to match with demand of large institutions, foster communities of practice, and help with critical transition points in the business life cycle.These ecosystems perform similar functions in the predominantly-white Silicon Valley tech world, we believe these functions should be applied to achieving inclusive growth.

We identified seven functions that the government, nonprofit, and private ecosystem organizations should individually or collectively perform to best support small businesses:

Maintain Market Data through Scorecards: Maintaining real-time information on the number, size and sector of small businesses in general and minority and women-owned business enterprise (MWBE) in particular is vital to set benchmarks and goals. Local ‘scorecards’ with this data will help communities set reasonable targets for recovery from Covid-19 and measure progress against ambitious targets for small business creation. A local scorecard should also capture capital flows into small businesses, the availability of debt financing, and similar measures.

Build Markets Through Procurement: Routinely collecting data, setting goals and publicly reporting progress on the procurement spend of large “anchor institutions” from MWBE vendors is crucial to growing market demand to support growth in the number and size of MWBE firms. By anchor institutions, we mean public sector entities, educational and medical institutions and major corporations. Ideally, a strong ecosystem should be capable of matching the demand coming from anchor institutions with the supply of MWBE businesses that can meet these needs; in other words, market-matching and market-building.

Education & mentorship: Identifying, nurturing, and supporting firms as they develop intentional business strategies and gain access to the network of business service providers is vital to foster growth. Providing easy-to-access up to date information on practices such as accounting, borrowing, leasing, legal, tax, hiring, technology, marketing and customer and supplier relationships is a must. A strong ecosystem should also provide access to investor networks to marry technical assistance with capital provision, along with practices to support financial planning and fundraising.

Access to Capital: Providing access to high-quality, affordable, and responsible capital across a broad continuum that’s aligned with the needs of small businesses at different stages of their lifecycles and in disparate sectors is vital to nurturing growth. The continuum of capital should extend beyond traditional debt products and include grants, equity investments, equity-like products (e.g., revenue-based financing) and tax advantaged capital. Doing this well takes skilled small-business finance professionals who understand how to structure transactions and the full range of capital sources. Good delivery systems also have robust customer-referral mechanisms, to ensure different organizations meet the unique needs of small firms.

Business Districts: Managing and marketing the business districts and commercial corridors where many small businesses congregate and co-locate is crucial to growing the number and size of businesses. Special intermediaries include merchant associations, business improvement districts, community development corporations, and (where they exist) entrepreneurial incubators and accelerators.

Streamlined Rules: Streamlining the paperwork required for starting small businesses, for example, is especially vital for reigniting entrepreneurship coming out of the pandemic. Many federal rules, in particular, have evolved over time, making effective and efficient administration incredibly difficult and rewarding economic incumbents with the expertise to navigate them.

Sector Diversification: Local leaders need to develop strategies to foster strong sector diversity. Having a clear idea of the sectors where Latino- owned businesses are concentrated on a local level is vital information for developing strategies. For example, many Latino-owned businesses on a national level are concentrated in the construction and food service sectors. Understanding this is important for procurement goals, but also in targeting growth-focused resources.

In performing these functions, ecosystem institutions should mobilize local, state and federal resources as available and create channels to help entrepreneurs navigate public programs. New initiatives are cropping up to do just this.

![]() In the supplier diversity space alone, the Economy League of Greater Philadelphia is bringing together, with funding from the federal Economic Development Administration, area hospitals, universities and leading corporations to use purchasing by large institutional buyers to grow Black- and Brown-owned small businesses via the Philadelphia Anchors for Growth and Equity (PAGE) Initiative.

In the supplier diversity space alone, the Economy League of Greater Philadelphia is bringing together, with funding from the federal Economic Development Administration, area hospitals, universities and leading corporations to use purchasing by large institutional buyers to grow Black- and Brown-owned small businesses via the Philadelphia Anchors for Growth and Equity (PAGE) Initiative.

On the public side, LA Metro has developed a highly innovative two-tiered certification program to help firms in the construction industry benefit from federal infrastructure spending.

The Aspen Institute Latinos and Society is gearing up to pilot Aspen E-Labs, an eight-month mentoring and national resource network program for high growth Latino-owned companies seeking to become “contract-ready.”

These are only a few of the multitude of examples which are emerging as best-in-class practices that can be replicated and scaled, the subject of a subsequent newsletter.

The bottom line

The Covid19 pandemic has devastated businesses in the U.S., exacerbating what were already substantial ethnic and racial gaps in the number, size and growth potential of employer firms. A clear understanding of the pre-Covid baseline for Latino-owned firms is a needed step to ensure that our actions post pandemic grow not only the number of firms but their participation in high wage, growth sectors of our economy.

As the baseline varies, so do the priorities in the small business ecosystem: while supplier diversity may offer opportunities for scaling Latino-owned businesses, education and mentorship may be more appropriate emphases in metros with a significantly low number of Latino-owned businesses. We hope that the Small Business Equity Toolkit provides a first step in giving metros a better idea of where they stand, goals they can set, and strategies they can pursue to grow Latino-owned businesses in the post-pandemic recovery.

RELATED VIDEO CONTENT

Bruce Katz is the founding director of the Nowak Metro Finance Lab at Drexel University. Domenika Lynch is the executive director of the Latinos and Society Program at The Aspen Institute. Victoria Orozco and Colin Higgins are senior research fellows at the Nowak Metro Finance Lab.

Alma & Marcos, owners of Marcos Fish & Crab House and Alma Del Mar on the Italian Market