Some people love December for the candy canes or excuses to watch Love, Actually or drink egg nog. Me, too — but I also live for the December look backs and predictions for the next year.

Here are five big ways I think things are going to shift in 2026 and beyond:

1. Attrition

Attrition — in other words, gradual decline — is everywhere you look these days. I’m predicting slow but steady reduction will be the vibe in 2026. For example, this recent New York Times piece about Intel’s shrinking workforce:

Intel, the ailing semiconductor giant, said on Thursday that it expected its work force to shrink by more than 25,000 employees …The chipmaker, which reported 108,900 employees at the end of last year, said it now expected layoffs, attrition and other actions to reduce its head count to 75,000 by the end of 2025.

This happens to be about Intel, but it could be about 100 other companies.

Attrition is also frequently how the war in Ukraine is being framed.

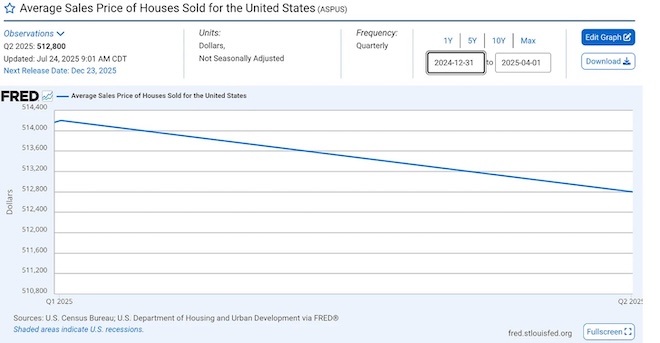

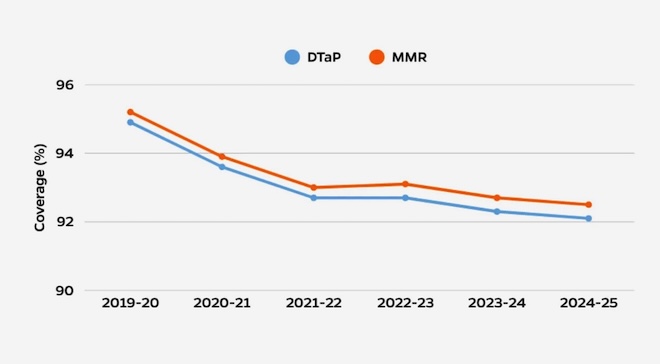

It’s in the charts of housing prices.

It’s the slow decline in weight of GLP-1 users. It’s the reduction of college enrollment — and maybe American population overall. It’s vaccine rates.

I don’t anticipate a massive AI-private-capital-housing implosion next year. I expect a kind of pervasive sense of attrition.

2. 2026 will be the year of the renter

More than 30 years since Jimmy McMillan founded the Rent is Too Damn High party and ran for mayor of New York, Zohran Mamdani successfully won an election on the rallying cry of freezing the rent.

Just last week Los Angeles reformed its rent control for the first time in 40 years and is capping annual rent hikes at 4 percent.

As of today, new laws in Philadelphia go into effect that allow renters to pay security deposits in installments and cap rental application fees at $50.

If 2024 and 2025 were years when everyone focused on innovations in zoning and building codes, I think 2026 is going to be a huge year for policy innovations for renters. There’s going to be a lot to argue over! Break out the popcorn!

2026 might also offer an inflection point for YIMBYism. It can’t be defined by a platform of just building more housing. Additionally, building more housing doesn’t solve how we help renters to build wealth outside homeownership. It’s critical to think about that side of the issue, given how many people are locked out of homeownership.

3. Old (places) will get a glow up

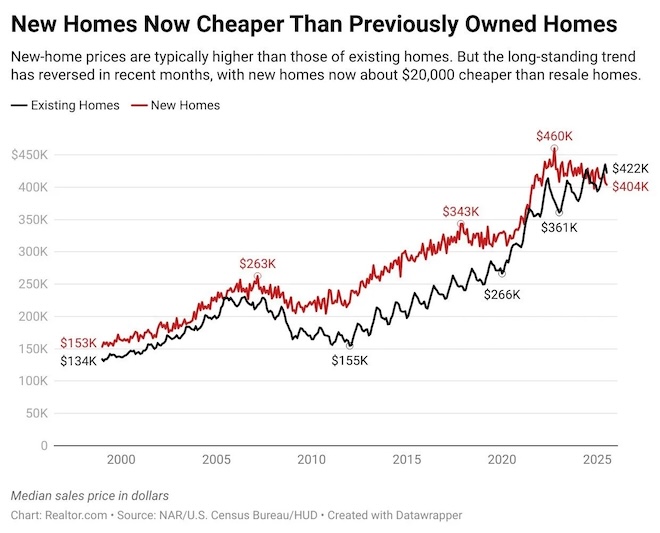

There was a fascinating housing tidbit recently. New homes are now cheaper than old ones.

Why is this happening? According to a good piece on Realtor.com:

Builders are more motivated sellers. Most sellers of existing homes have an inventory of one, while builders have hundreds or even thousands of homes to sell … Weak buyer demand this summer has builders scrambling to move inventory, and they’re pricing more aggressively as a result.

But it could also be that old places and old homes have been really undervalued for a long time.

Redfin and Zillow are all predicting that the hottest markets in 2026 will be places like St. Louis and Cleveland, as well as some of the oldest states Connecticut and New Hampshire.

The big 250th will be celebrated in old cities like Philly, Boston and Charleston. 2026 is going to be a year when America revels in what’s old.

4. A business case for presence

I bought a dumb VPN internet enabled land line for my kids so they could talk on the phone with their friends like their parents did. The kids never use it and I wonder how I ended up spending $90 on this phone. Is this nostalgia? Is this an analog fetish? I think it’s about presence — the sensorial experience of the phone and of hearing a person’s voice rather than texting.

Increasingly there’s awareness that analog, nostalgia, and presence are not just cute, but indicators of a viable market. The PG movies that have been killing it at the box office are just one example — people could just stream these movies but families want to go for the whole experience of popcorn, Twizzlers, revisiting their own childhood memories of movies.

The same could be said of the booming market for used clothing. Why buy boring same-y, internet clothes when you could buy something that feels like it has a story and adds to the experiential quality of both buying clothes and creating a look?

After years of companies monetizing the elimination of presence in everything from self check-out to DoorDash, perhaps there will be a business case to bring presence back?

5. The great wealth transfer will have implications

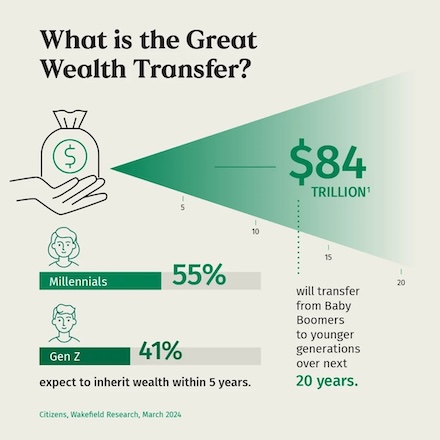

I just read about Michael Dell giving away $250 to all kids under 11 years old who live in areas where the median household income is less than $150,000. This is big news, but it seems like every single day there’s a piece about the Great Wealth Transfer (GWT). Not from mega billionaires, but from regular Baby Boomers to younger generations.

Trillions of dollars are going to be passed down as Baby Boomers can’t take all their wealth with them! It will be fascinating to see how the GWT plays out — and as Dell’s example shows, there’s potential policy implications. Indeed, if the great fortunes of 2026 are likely not to be made from new jobs and businesses (that produce income and capital gains taxes), but inherited, how should communities rethink their revenue streams?

Diana Lind is a writer and urban policy specialist. This article was also published as part of her Substack newsletter, The New Urban Order. Sign up for the newsletter here.

![]() MORE FROM THE NEW URBAN ORDER

MORE FROM THE NEW URBAN ORDER