In the challenging year that was 2020, people across the city and country spent more time and energy than ever on the causes they care about.

Over the summer, thousands of people took to the streets to protest with Black Lives Matter; more Philadelphians voted early or in-person than in the last 25 years; and many more took daily actions like donating money or volunteering to address Covid-related problems, climate change, social injustice, or other issues.

But even as people become more civic-minded, I think they may be missing out on the most valuable tool they have for social change: their 401(k)s.

Being intentional about where your money is invested is not a new concept. It’s just that our current financial system requires you to do a little diligence.

We are often thoughtful about where we donate or how and where we spend our hard-earned paycheck, but for many, our investments are out-of-sight, out-of-mind, so we don’t contemplate what our money does once it’s invested in the stock market. But in our capitalist system, decisions are usually driven by financial priorities, which means businesses tend to listen when customers and investors voice their opinions with their dollars.

What Is Socially Conscious Investing?

![]() According to Wikipedia, the concept of “socially conscious investing” may have originated in Philadelphia. In 1758, the Quakers refused to invest in the slave trade, a financially prosperous endeavor at the time, because it didn’t align with their religious beliefs.

According to Wikipedia, the concept of “socially conscious investing” may have originated in Philadelphia. In 1758, the Quakers refused to invest in the slave trade, a financially prosperous endeavor at the time, because it didn’t align with their religious beliefs.

So, being intentional about where your money is invested is not a new concept. It’s just that our current financial system requires you to do a little diligence.

Currently, there are 110 million people in the U.S. with $8.4 trillion invested in employer-provided retirement plans. That’s a lot of financial firepower, but most Americans don’t know much about where their money is actually invested. Part of that is because we don’t read those 401(k) statements we receive in the mail and part of it is because the majority of those retirement savings are invested in mutual funds.

Imagine if even some of that $8.4 trillion was invested in ways that help to reduce or solve our societal problems, rather than creating them. What if you could have a role to play in doing that? You do!

While mutual funds enable smaller investors to diversify their portfolios, it also makes it more difficult to know what companies you actually own and whether those investments align with your own personal values. So, if you care about social justice, climate change, or health-related issues, you should know that mutual funds are some of the biggest investors in prisons, fossil fuels, and Big Tobacco.

The good news is there’s a very easy to use tool that can help you with this. The bad news is you’re probably going to have to open your 401(k) statement or remember the login for your online account.

While I’m referencing 401(k)s, this applies to any employer-provided retirement plan like a 403(b) if you work for a nonprofit, or an IRA, and it also applies to non-retirement accounts that are invested in the stock market. I’m just using the term “401(k)” because that’s how many people mentally categorize where they have a big chunk of their savings.

A-ha Moments: Investigating Your Investments

![]() As the executive director of ImpactPHL, I am often in conversations with people encouraging them to take a closer look at where their money sleeps at night. Our goal is to align Philadelphia’s collective financial horsepower in ways that create a more inclusive, more sustainable, and more resilient regional economy.

As the executive director of ImpactPHL, I am often in conversations with people encouraging them to take a closer look at where their money sleeps at night. Our goal is to align Philadelphia’s collective financial horsepower in ways that create a more inclusive, more sustainable, and more resilient regional economy.

Everyone has a role to play, including investors large and small, foundations, family offices, and businesses of every size.

I recently spoke with a Black woman who does Diversity, Equity and Inclusion (DEI) consulting work and when we checked her investments, we found that she was unintentionally invested in the prison industrial complex, which disproportionately affects people of color, via the mutual funds in her company’s 401(k) plan.

In another instance, I spoke with a female CEO to review her company’s retirement plan only to find that the mutual funds they offered employees didn’t score well with regard to gender bias. Both found that, while they were very deliberate about most other aspects of their lives, their money was not in alignment with their values.

To shine a light on mutual funds, I like to use the Invest Your Values tool, which is provided at no cost by a non profit called As You Sow. The genius of this tool is that you don’t have to be a sophisticated investor or know any technical industry jargon. Invest Your Values uses seven “lenses” to evaluate mutual funds on social issues and assigns letter grades. Everyone knows the difference between getting and A or an F.

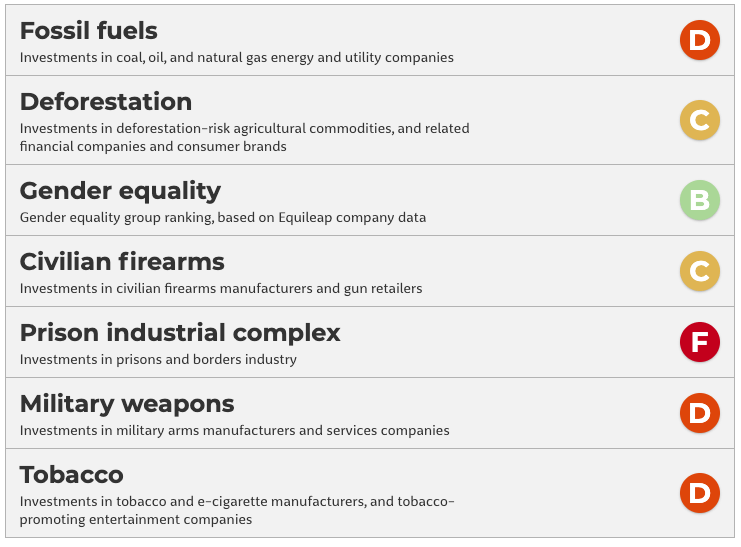

Here’s the report card for the Vanguard Total Stock Market Index Fund (VTSAX), which is a very common offering for employer-defined retirement plans. How would you feel if your money was invested here?

The fund scores a D in the fossil fuels tobacco and military weapons categories; Cs in deforestation and civilian firearms; a B in gender equity; and an F in the prison industrial complex.

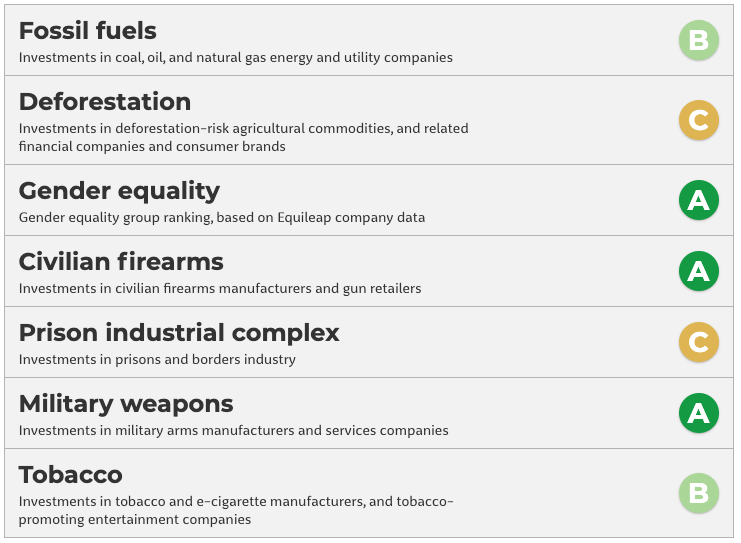

Now, a lot of people I talk to assume that you can’t have your cake and eat it too—meaning, you have to make significant financial sacrifices if you want to do better on the values front. And that’s not true. Here’s the report card for Vanguard FTSE Social Index (VFTAX).

This fund scores As in the gender equity, civilian firearms, and military weapons categories and Bs in tobacco and fossil fuels. Its lowest grade is a C in the deforestation and prison industrial complex categories.

This fund scores As in the gender equity, civilian firearms, and military weapons categories and Bs in tobacco and fossil fuels. Its lowest grade is a C in the deforestation and prison industrial complex categories.

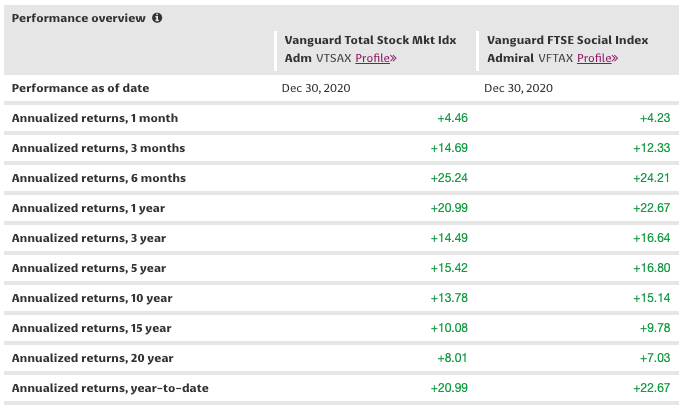

Consider the comparison of these two funds. Both track the S&P 500 and have similar holdings. But one uses an ESG lens to screen for companies that don’t perform well on Environmental, Social, & Governance factors. And historically, it equals or outperforms its counterpart.

Using the Invest Your Values tool is a quick and easy way to evaluate whether your money is working with you or against you. The first step is knowing where your money is now. So, pull out that quarterly 401(k) statement you get in the mail. Select one of the seven social/environmental rating tools from Invest Your Values and then search for the funds listed on your 401(k) statement.

Take a look at their reports cards. Are you comfortable with what you see? If you are, that’s wonderful. You can go back to eating that box of Cheez-Its. If you don’t like what you see, then it’s time to think about making some adjustments. If your employer doesn’t offer mutual funds that score well on ESG issues, you might have to speak with your HR department to request better options.

This is also a good time to talk to your financial advisor. Get their input before making any changes and make sure they know what issues are important to you so your non 401(k) assets are also in alignment with your values.

Then you and your money can rest easy.

Cory Donovan is executive director of ImpactPHL, a nonprofit dedicated to growing the Greater Philadelphia region’s impact economy.

Header photo: Katt Yukawa / Unsplash