The public health system in the United States, suffering from budget and staffing cuts precipitated by the Great Recession and current administration’s decisions, does not have the capacity to address the coronavirus crisis.

We are equally concerned that our current suite of disaster relief and financing programs are unable to respond to the devastating blow dealt to America’s small businesses.

Tuesday evening, Treasury Secretary Steve Mnuchin warned that, absent stimulus and intervention, unemployment in the U.S. could reach 20 percent in the near future.

This depression-level job loss will largely come from America’s small businesses.

Fifty percent of Americans work for or own a small business. Many of these are local face-to-face Main Street services—restaurants, bars, coffee shops, barbershops, hair salons, auto repair shops and dry cleaners that are living on the brink.

The average small business has 27 days of cash flow and for many restaurants, it’s more like 16 days. For these businesses, shutting down operations for even a few days risks running out of cash. And, “when you run out of cash, as a small business you’re dead,” says Karen Mills, former Administrator of the SBA.

Compounding this issue is the nature of the crisis—the paradox of social distancing. People want to be together and share experiences in a crisis, but experiential consumption has been radically curtailed: Rather than being able to go into one place to buy things and share experiences, people must stay within their homes.

Call on our city governmentDo Something

So, what do small businesses need to survive and recover from this coronavirus shock?

They must replace lost income as fast and efficiently as possible. Small businesses need large injections of flexible resources so they can both pay themselves and provide workers with paid sick leave. They need even more resources if lenders and landlords don’t provide mortgage and rental forbearance (and local governments and utilities don’t provide tax and utility relief).

At the time of writing, the U.S. Department of Housing and Urban Development announced a suspension of foreclosures and evictions for HUD-subsidized properties until April (details forthcoming). This may be a good start for businesses, depending on the terms.

The average small business has 27 days of cash flow and for many restaurants, it’s more like 16 days. For these businesses, shutting down operations for even a few days risks running out of cash.

The current response is not up to this task on three counts:

- The amount of funds currently provided are undersized to the scale of the problem

- The tools are not fit to the purpose of helping small businesses survive

- The response is run through an agency that lacks the proper capacity to deliver them in the urgent timeframe.

Without fixing these issues we fear there will be a Main Street bloodbath that, as Derek Thompson points out, will very soon decimate local economies across the country for a long time. A paper released by the Economic Innovation Group as this went to press makes similar arguments.

So how do we proceed?

As the federal government starts what will be a wave of responses, several things are needed:

First, the federal government needs to recognize the scale of the problem

It is relatively easy to assess the economic impact on large industries (e.g., airlines, cruise ships) where the actors are few and the revenue losses are easily calculable. Small businesses—widely distributed across multiple sectors—are a different matter.

To date, the focus has been on making available up to $50 billion in federally backed Small Business Administration (“SBA”) loans to impacted small businesses. This doesn’t seem near enough. Senator Mark Warner has proposed $1 trillion in short-term loans, which begins to handle the scale of the problem.

Help small businessesDO EVEN MORE

However, taking a loan with repayment rates of 3.75 percent over 30 years for an indefinite period of revenue loss is an enormous risk for small business owners to take. And, it’s not just Main Street businesses competing for these funds. If this pool is expanded equally to the nation’s 30.2 million small businesses, the loans shrink to $1,655 apiece.

For most of these businesses it’s much more economical—if emotionally trying—to lower cash outflows by cutting employee hours or firing employees (which is already happening and overwhelming unemployment offices).

Put simply: We need a solution more on the scale of Senator Warner’s proposal, which multiplies all the numbers above by 20. We are heartened by the Trump Administration’s recent proposal, which appears to augment the $50 billion of SBA disaster assistance with $300 billion of loans, focused especially on supporting payroll. But it alone will not be enough to keep up with the wide-array of expenses faced by small business owners.

Second, and equally important, the federal government must provide emergency relief that is fit to purpose

To date, the focus is on shifting SBA into high gear, enabling the agency after it approves a state’s application for assistance, to offer low-interest loans for up to $2 million to small businesses suffering economic injury as a result of COVID-19.

The SBA vehicle may work for some but not all businesses. SBA’s disaster assistance loan programs were mostly designed to deal with the rebuilding necessary in the aftermath of a natural disaster, where multiple businesses in a confined geographic area must renovate facilities and replace equipment battered in a storm or flood as well as deal with the loss of basic infrastructure, power, utilities and clean water.

It is based on the idea that disaster is geographically correlated (not everywhere at once) and time-limited (not weeks-long). The idea is that consumer demand will bounce back as soon as the businesses are back in working order. “Rebuild it and they will come back” in other words. The coronavirus crisis is fundamentally different, and the response to it should differ as well.

The current system struggles to meet the structure and scale of the need in a three key ways:

1. Lending design. The terms and conditions of SBA loans are not fit to purpose. Economic injury loans (EIDLs) carry a 3.75 percent interest rate for small businesses and 2.75 percent for non-profits. Loan periods can be as long as 30 years and generally require borrowers to offer property as collateral for the loan. EIDL assistance is available only to small businesses when SBA determines they are unable to obtain credit elsewhere. These terms do not make sense.

Given the nature of the crisis, we believe that SBA loans should be zero interest, with minimal requirements, flexible repayment schedules and non-collateralized. Repayment terms could be forgivable based on conditions like maintaining or partially maintaining employee pay. Moreover, rather than a traditional loan against an asset, SBA should lend to deliver critical cash flow and income smoothing to businesses that expect future cash flow, but don’t know when.

2. Capacity to Deliver: The Small Business Administration does not currently Get help for your small businessLearn More

Several proposals have suggested intermediaries, such as community development financial institutions, to deliver these loans. Fintech lenders with established virtual infrastructure such as Fig, PayPal, Lending Club, Funding Circle, Venmo, Kabbage, and CashApp could also be enlisted as “rapid response” liaisons between the federal government and local businesses. The Administration should also enlist the active engagement of financial institutions (e.g., commercial banks, credit card companies) to ensure that access to needed capital is widely available on reasonable terms. It is highly likely that small business owners will turn to these institutions before they try to engage the SBA.

3. Ability for entrepreneurs to navigate the system. Veterans of the Great Recession of 2008 say that entrepreneurs’ ability to navigate the existing resources that were offered was a huge rate limiter. Emergency loan applications need to be simple, with quick underwriting. Within the next week, we need to mobilize and create resources that help entrepreneurs quickly navigate what tools are available to support them—all over a virtual, not-face-to-face, platform.

Finally, cities, counties and states have a special role to play to facilitate the flow of capital to small businesses or provide capital themselves

Cities and counties are networks rather than governments. Given the constraints described above, cities need to organize economic stabilization teams of local government, landlords, banks, merchants, utilities, business chambers, philanthropies and others to offer short-term, focused relief until the federal government can offer some direct relief. The most immediate responses will be in the form of direct rental and mortgage relief (defer all payments for two months and extend leases).

Innovative practices and responses invented in a few cities will then move across the country quickly as well as provide a weekly feedback loop for any and all federal action so that interventions that are not working can be quickly adjusted.

These city- and state- wide efforts are already underway across the country—from San Francisco and Seattle, to Birmingham and Erie, to Massachusetts and Wisconsin. Because these local approaches warrant in-depth examination, we will write a separate piece about the innovations to date in the coming days.

There is so much at stake as the nation scrambles to help small businesses survive. These firms are not just the engines of our economy but the heart and soul of our communities. By using the wrong tools or not acting fast enough, we run the risk of building an economy that preserves larger companies that can stay afloat or have large logistics arms—the Amazons and Targets of the world—at the cost of smaller businesses that power much of the country. There is a risk, in other words, that without adequate support, the coronavirus crisis fuels another: the further hollowing out of the country.

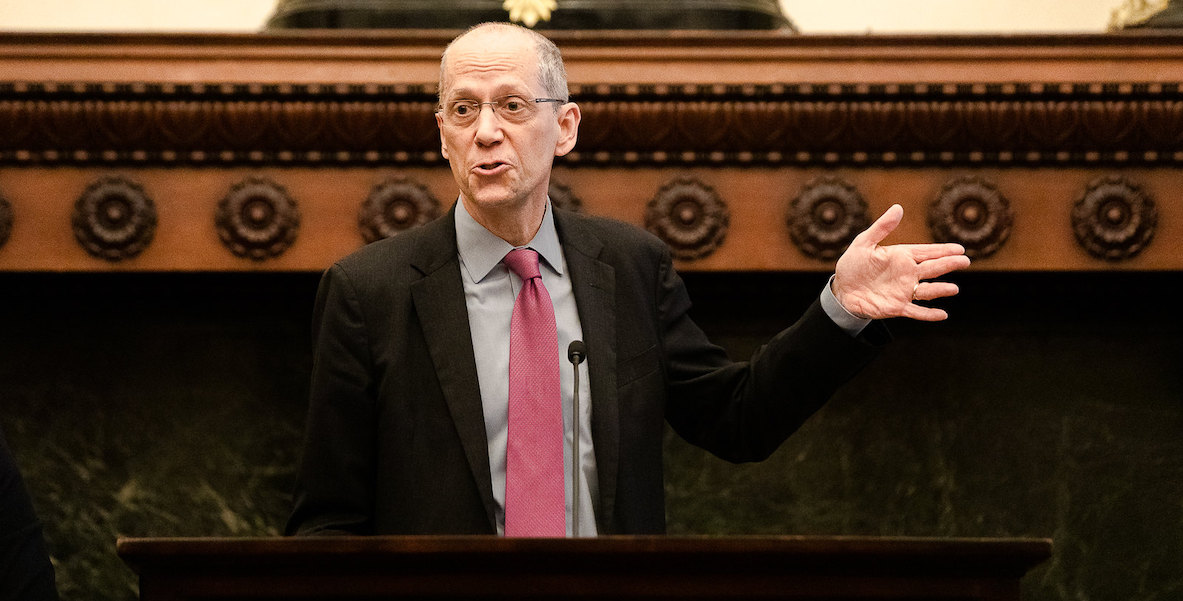

Bruce Katz is the director of the Nowak Metro Finance Lab at Drexel University, created to help cities design new institutions and mechanisms that harness public, private and civic capital for transformative investment. Colin Higgins is a Program Director at The Governance Project. Ross Baird is CEO of Blueprint Local and author of The Innovation Blind Spot.

Header photo: FullyFunctnlPhil,licensed under CC BY-NC-SA 2.0