Nikia Owens wants Philadelphians to know even if they don’t make enough money to file taxes, they should — because chances are, they’ll actually get money back.

The president and CEO of the nonprofit Campaign for Working Families remembers working with a single mother, who was a seasonal worker, to prepare her taxes. The mother had earned so little that year, she wasn’t required to file a return. But by visiting with Owens, she learned that she could still qualify for a refund via tax credits.

Listen to the audio edition here:

“She left with a $1,000 refund,” Owens says. “It’s really, really important to make sure that you file your taxes, even if you’re not necessarily required to.”

Tax credits allow you to subtract money from the amount you owe in taxes. They’re different from deductions, which reduce your total taxable income (and are often worth less than credits). You might be familiar with them through the Earned Income Tax Credit (EITC), which has been around since the 1970s or the Child Tax Credit (CTC), which was established in the late 90s. Many middle income families qualify for both credits — and can earn nearly $10,000 if they do.

Those dollars help people pay rent and make mortgage payments, put food on the table and spend money supporting local businesses. But each year around 40,000 Philadelphians fail to get this money back because they don’t file their taxes. Owens’s tax preparation work in Philly is part of Claim Your Money PHL, a City-run campaign that reminds Philadelphians that they’re due these credits — and provides them with free tax prep services. Last year, the program helped Philadelphians get $19 million back in refunds.

This year, PA has introduced the Working Pennsylvanians Tax Credit (WPTC), which folks can file with their state tax returns, to help put more money back into the hands of Pennsylvanians.

Show me the money

The City launched Claim Your Money PHL in 2022 after the federal American Rescue Plan expanded the EITC and the CTC, but they’ve long helped connect Philadelphians with free tax services. Before Claim Your Money PHL there was You Earned It Philly — a similar Revenue Department campaign that raised awareness of the EITC.

These programs exist because so many people fail to file for the credits. Some might not apply because they earned less than the minimum to file taxes: $15,750 (for single people) and $31,500 (for married filing jointly). But they can still qualify to receive refunds through some of these credits.

“We want to make sure that Philadelphians know that they may be eligible for these refunds, and also make sure that they can claim them for free,” says Beth McConnell, deputy director of policy and programs with the City of Philadelphia’s Office of Community Empowerment and Opportunity.

“We know that putting that money into the pockets of low income Philadelphians is a big deal. It can be the difference between making your rent or mortgage one month, between not being able to stock that fridge with food, or being able to keep up car repairs or other basic necessities.”

“We see the taxes as a gateway, as a window to household finances and an opportunity to connect them with other things to help them.” — Will Gonzales, CEIBA

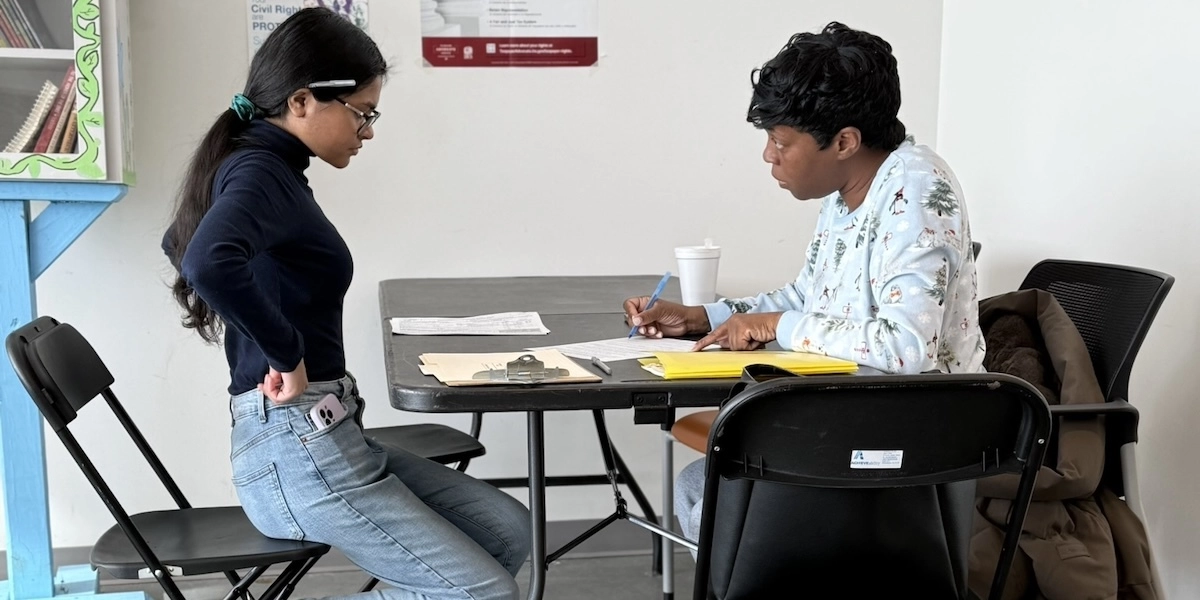

To apply for free tax help, Philadelphians need to go to the Claim Your Money PHL website. There, they can schedule an appointment with one of the three organizations — the Campaign for Working Families, Ceiba and the Philadelphia Chinatown Development Corp — the City partners with to provide filers with free tax prep services. All three are Volunteer Income Tax Assistance (VITA) certified, an IRS designation that confirms they’re qualified to provide free tax help.

They’ll file returns and help people get these tax credits — up to about $8,000 for the EITC and $2,200 per child for the child tax credit — but participants often also get additional money from regular tax refunds too.

Last year the three organizations filed a total of 14,177 state and federal returns — which averages to $1,340 per return. The program costs just $1.3 million to run. “We think it’s a pretty good bang for the buck,” McConnell says. “That’s money that’s then being spent in our local economy and we think has positive spillover effects.”

The tax credits you need to know about

Claim Your Money Philadelphia is targeting three tax credits this year: EITC, CTC and the WPTC. Here’s a quick breakdown:

-

- EITC: The Earned Income Tax Credit has been around since 1975, when President Gerald Ford introduced it to help low- and moderate-income families keep more of their tax dollars. Each year, the now 51-year-old measure brings about 4.4 million people, including more than 2 million children, out of poverty. Single people need to make less than $61,555 and married folks less than $68,675 to qualify. You can get up to $8,046 back.

- CTC: The Child Tax Credit offers parents and guardians up to $2,200 back for each child under 17 in 2025. You can still receive the CTC even if you didn’t earn enough to file taxes. Tax prep providers working with the City can also help you claim CTCs from 2022, 2023, or 2024, if you didn’t file in those years.

- WPTC: Unlike the EITC and the CTC, the Working Pennsylvanians Tax Credit is a state, not federal, measure. It’s equal to 10 percent of the EITC. So, if you qualify for the full $8,000 EITC, you’ll get another $800 from the Commonwealth. You automatically qualify if you file for the EITC. It’s projected to give 1 million Pennsylvanians $193 million in tax relief.

A better financial future

Often, the Claim Your Money Philly Preparers are able to help filers find other tax savings in addition to these credits. There are educator expense deductions for teachers who might spend part of their money on classroom supplies or dependent care credit to help reimburse taxpayers who care or pay for care for a family member while they worked or sought employment.

“Our mission is to build and champion the financial well-being of individuals and families and help them to become more economically mobile,” Owens says. “We want to be holistic in terms of the support and services that we provide to the community.”

These tax credits put money directly into the pockets of Philadelphians, but Ceiba, the Campaign for Working Families and the Philadelphia Chinatown Development Corp have programs that can help folks save money in other areas — including on utility bills, housing, education and medications. When folks come in for tax prep services, they can connect with these other resources.

Last year, Claim Your Money PHL helped Philadelphians get $19 million back in refunds.

“We see the taxes as a gateway, as a window to household finances and an opportunity to connect them with other things to help them,” says Will Gonzales, executive director of CEIBA. “Our goal is not just to help them to get the credits, but to do an accurate tax return and to help them connect with other asset building services.”

The Campaign for Working Families also partners with the Champion for Financial Literacy initiative at Lincoln High School to train students to assist in tax filings as part of one of the District’s Career and Technical education (CTE) programs. The students learn how to prepare 1040s, work with W2s, 1099s and other forms, assist in tax filing, earn an IRS Basic Tax preparer Certification, along with lessons in ethics and handling sensitive information.

About 35 to 40 students work with Stacie Sawyer-Johnson, the CTE Business Pathway Coordinator, on the program each year. Many of them go on to study accounting in college, but those who head into other career paths, still gain the skills they need to file their own returns — and help family members with their taxes as well.

“They learn things that they’ll use for the rest of their lives,” Sawyer-Johnson says. “Kids who weren’t sure if they were on the right path or if they wanted to be in my classroom, they’ve sent me letters and cards thanking me for opening their eyes and getting them some information about adulting.”

![]() MORE ON PHILADELPHIA TAX POLICY

MORE ON PHILADELPHIA TAX POLICY