There’s a peculiar convergence these days of policy proposals in the Pennsylvania state legislature that’s probably not getting as much attention as it deserves, as does much business in Harrisburg. But should these proposals quietly find their way to passage, the political, economic and social impact consequences could be enormous for Philadelphia.

What’s happening, in fairly stealth fashion, is an aggressive class of Pennsylvania legislators, from both sides of the aisle, pushing for an expanded “sin tax” state. That could mean more gambling and much more liquor along with it in a city that probably has too much already—not to mention the volatile cocktail of social ills once Philly’s stressful high poverty rate gets thrown into the mix. Lots of folks want in on the gaming action: based on industry estimates, it apparently generates more than $6 billion in statewide economic activity, including nearly $2.4 billion in federal, state and local tax revenue, and another $1.7 billion in wages for nearly 34,000 employees statewide.

Bullish on games of chance, many lowly Keystone State legislators—nearly $87,000 in base annual salary (the second highest state legislator salary in the nation) isn’t enough—seem eager to squeeze more out of the state’s dozen casinos to help fix the deficit and create more “walk around money” for themselves. The casinos probably balked at that (feeling squeezed and fiscally fondled enough) and have pushed legislators to explore more creative ways to expand the gaming tradition in PA. That’s led to the mammoth 675-page, heavily marked-up H.B. 271, which passed the PA House by a vote of 102 yeas and 89 nays. While it was mostly Republicans, especially from the west and rural regions of the state, who voted for it (78 Rs in total), 24 Democrats joined along, see the roll call vote here for yourself. The more contentious aspect of H.B. 271 is the creation of more than 40,000 digital slot machine terminals in bars, airports, lounges and truck stops.

On WURD’s Reality Check this week, Philadelphia NAACP President Rodney Muhammad was deeply worried about where this goes, especially in a city as poor as Philadelphia. Suddenly, the state is relying on cash-strapped, impoverished folks to help it climb out of its deficit hole by having them drop money into slots. “To extend that now into areas where people are living in food deserts or places where people don’t even have money for transportation is not good,” Muhammad told Reality Check. “So how do you expect them to find money to gamble?”

Muhammad spoke for a large consortium of area African American pastors known as the Black Clergy of Philadelphia, which held an impassioned press conference the day before. “In many of the neighborhoods where slot machines would end up, you have some of the poorest and vulnerable demographics,” he added. “There is a devastating, chronic state of poverty. We also have a problem with these stop-and-go set-ups, they are a nuisance, we’re not interested in seeing more of that. They don’t comply like they’re supposed to with the liquor licenses. And then to bring in four or five slot machines in there is a nuisance and exploitation of the weaker ones in our society.”

Suddenly, the state is relying on cash-strapped, impoverished folks to help it climb out of a $1 billion deficit hole by simply throwing booze and slot money at it. That’s much simpler than coming up with innovative ideas to leverage state industries, skill-sets and talent.

Gaming and liquor are about the only ways, these days, that state lawmakers can figure out how to close a gaping $1 billion budget deficit. That’s a serious deficit, and now there’s a mad rush to close it by simply throwing booze and slot money at it, because that’s just much simpler than coming up with innovative ideas to leverage state industries, skill-sets and talent. So, lawmakers have put a lot of energy into the ideal policymaking environment for 1) expanding gaming and 2) privatizing liquor sales throughout the state, a measure that could add 2,000 liquor stores to the state. On the latter, House lawmakers already passed H.B. 991 in April.

Meanwhile, the third card in this game of policy monte is a plan by Philly-area State Senators to somehow re-direct some casino revenues from public school budgets—where they’re supposed to go—and into an area “economic development and revitalization” fund, which some critics are slamming as “walk around money.” Translated: The cookie jar. The way it is now, casinos like SugarHouse pay $10 million in local assessments to Philadelphia and the schools get $5 million of that. But, if the Senate bill passes, rather than give the schools more money, that remains flat while $2 million is taken away from the city for a local “special projects” fund.

There’s a lot of confidence in the ability of gaming and liquor to add cash to state coffers. And policymakers are usually quick to use the kids as cover for sin tax schemes: it’s always good, right, when the money goes to schools? So what’s the deal?

A group of Philly-area State Senators are seeking to re-direct some casino revenues from public school budgets—where they’re supposed to go—and into an area “economic development and revitalization” fund, which some critics are slamming as “walk around money.” Translated: The cookie jar.

“We had the Parking Authority taken over by the Republicans and it was supposed to generate, like, $200 million, and I don’t know if they’ve done $10 million,” says Muhammad. “The largesse is incredibly obscene and the public schools remain sorely underfunded. There will be a social fallout that will not be good, even as they’re attempting to privatize liquor sales.”

Charles D. Ellison is Executive Producer and Host of “Reality Check,” which airs Monday–Thursday, 4-7 p.m. on WURD Radio (96.1FM/900AM). Check out The Citizen’s weekly segment on his show every Tuesday at 6 p.m. Ellison is also Principal of B|E Strategy, the Washington Correspondent for The Philadelphia Tribune and Contributing Politics Editor to TheRoot.com. Catch him if you can @ellisonreport on Twitter

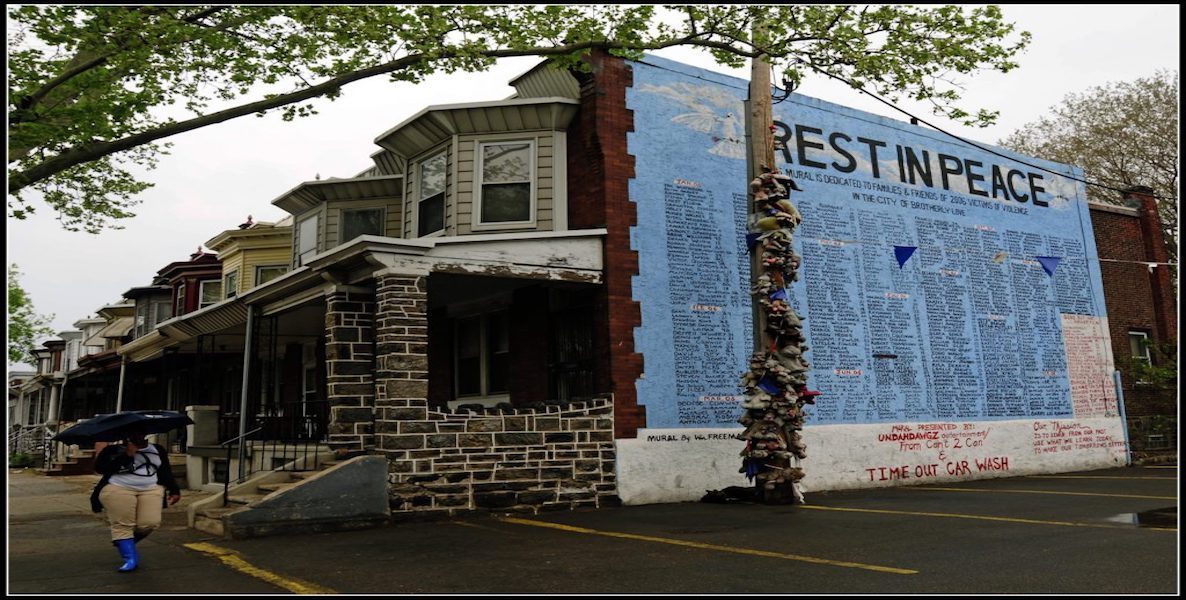

Header Photo: Ed Savaria Jr. for GPTMC