According to the FDIC, more than 95 percent of Americans have a bank account. Banks work, Ali Velshi says, in a symbiotic ecosystem.

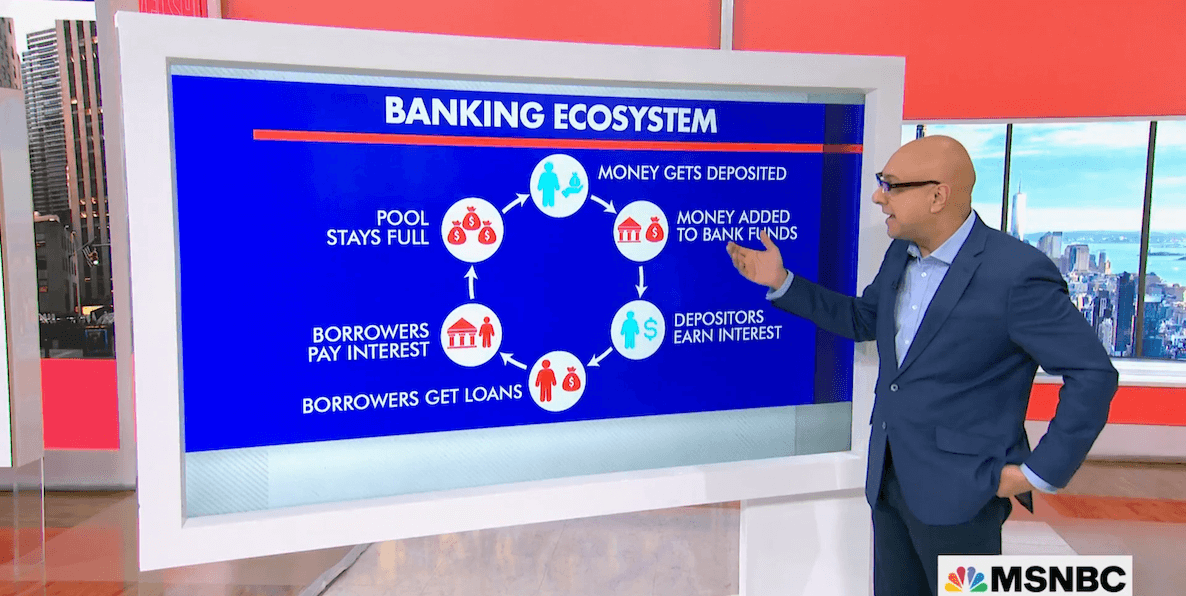

There are two kinds of bank customers (and you can be both): Depositors and borrowers. Depositors give their money to banks to keep safe while earning interest for themselves. Borrowers withdraw that same money and pay interest, which earns the bank money. It all works pretty well — unless all the depositors try to withdraw all their money at the same time.

The FDIC insures bank deposits up to $250,000. Anything over that, you can deposit — but, in the event of a bank run, you might not get back. The government, says Velshi, should guarantee that all deposits are insured.

Insuring all deposits, he continues, “would force regulators to make sure banks wouldn’t do anything too risky” — and banks could make less money. But insuring all deposits would also go a long way in preventing bank runs.

“Whether your bank account has one thousand or one million dollars in it, your money deserves the same protections,” says Velshi, “If you guarantee people’s deposits, they will keep coming, and banks will stay safe.”

LISTEN: ALI VELSHI ON FIXING BANKS BY INSURING ALL BANK ACCOUNTS

WATCH: ALI ON BANKS ON MSNBC

![]()

MORE FROM MSNBC’S ALI VELSHI