My last two columns focused, respectively, on education and law enforcement under President-elect Donald Trump. This week, we’ll look at federal housing policy and identify major questions likely to surface over the next year.

Unlike education and law enforcement, where Trump made declarative policy statements—for example, against sanctuary cities and for school choice—he has said little about housing policy other than to rail against declining homeownership rates. But given his real estate biography and his perspective on regulations and taxes, we can assume that housing policy will significantly be affected by a Trump administration.

Housing policy related to the tax code and banking regulations may, in fact, be important negotiating points between the Republican-led Congress and Trump. And it will certainly call into question the ability of the Democratic minority to hold the line.

There is an important context to all of this as it relates to the national psyche. Many American households have been on a roller coaster of wealth creation, wealth destruction and partial recovery over the past few decades, caused by a dramatic shift upward and then downward in homeownership rates. The lower your income, the more likely it is that you derive most household wealth from homeowner equity. Higher income families, on the other hand, have more wealth in stocks, bonds, and other assets.

The shift upward began in the mid-1990s with: 1) broad based income growth for a brief period; 2) a proliferation of non-bank subprime lenders and private securitization; and 3) government incentives to increase homeownership rates.

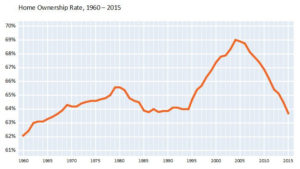

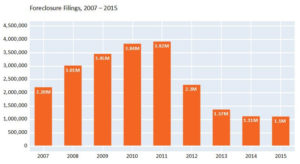

To understand the shift upward and then downward, the charts below are instructive. Chart one shows the rise of homeownership rates beginning in 1995 and peaking in 2005. Chart two shows the rise of foreclosures following the peak from 2007 until 2011. The foreclosure filings gradually drop to pre-crisis levels by 2013.

When Trump talked about economic woes, he prominently mentioned the declining rate of homeownership. He did not mention a homeownership bubble that was a result of a transition in banking and real estate into speculative securities, which was related to a deregulatory climate fostered by both parties. It is hard to see much in his recent appointments that makes me think we may not be moving back to the roller coaster.

While federal housing policy is generally associated with the Department of Housing and Urban Development (HUD), it is influenced more fundamentally by bank regulations, the tax code, and Government-Sponsored Enterprises (GSE) like Fannie Mae and Freddie Mac.

Here are three issues to watch in the early Trump administration:

Dodd-Frank: Does Trump attempt to roll back Dodd-Frank banking regulations, and does the rollback include dismantling the Consumer Financial Protection Bureau? Banking lobbyists—including many of the advisors that surround Trump—are in favor of doing just that. Eliminating many features of Dodd-Frank will be particularly welcome by small banks that have trouble incurring the cost of added regulation. Trump would love nothing more than to get rid of the Consumer Financial Protection Bureau, designed by Elizabeth Warren. But it will not be easy because of its structure and funding source (the Federal Reserve and not Congressional budget authority), and the fact that it has wide consumer support.

If you wanted to disassemble HUD, bringing on Dr. Ben Carson might further the cause. The social values conservative and former pediatric neurosurgeon has no background in housing policy or finance. Republican presidents have often used HUD as a platform for preaching a conservative approach to poverty reduction. Clearly that is the intention with Carson. But HUD cannot be managed by self-help wisdom alone.

As is typical in a crisis, the regulations that follow reflect the problems of the past more than the future. And they often overreach. But Dodd-Frank recognized systemic risks that have to be monitored and the linkage between systemic financial risk and consumer protection. Throwing out all of Dodd-Frank would be a study in crisis amnesia.

The GSEs: Since the financial crisis, the government has owned Freddie Mac and Fannie Mae. While the Feds absorbed the losses in the early years of the takeover, the secondary market behemoths have been profitable since 2012. And since that time, profits have been paid as dividends back to the U.S. Treasury Department. This has resulted in lawsuits by hedge fund investors that now want to also reap the profits after they took losses. They, and many policy makers, are in favor of privatization. Once again several prominent members of Trump’s inner circle have a dog in this fight as investors.

Fannie and Freddie were critical to financing moderate and middle-income homeownership in America but they were swept up in the housing bubble like everyone else, purchasing Alt-A loans that went bad. The GSE structural sin was clear: They wanted a private upside in their business with a public downside guarantee. They were allowed to maintain very thin capital standards and lose their public purpose as they competed with private securitizers anxious to buy and sell subprime loans.

If Fannie and Freddie are privatized the question is: Under what terms? Are they broken up and sold? Will there be an implicit government guarantee? Will they have affordability targets? And how will these moves affect the private mortgage market? Washington, D.C. is filled with GSE reform designs, some of which are moving through banking sub-committees. The Trump administration will play a role in any change of status.

The Tax Code: Trump promises a lower tax rate and a simpler tax code. His tax plan as it stands today promises to maintain one of the pillars of American real estate: The mortgage interest deduction. He lowers interest deductions on other items primarily used by businesses, but residential mortgage interest deduction remains. Will the lower rates affect investors who currently make use of the Low Income Housing Tax Credit (LIHTC)? It may, but it is likely that there will always be other classes of investors who need the credits. As of now, there is nothing that Trump has said that speaks directly to LIHTC. But when Trump and the Republican Congress try to balance the cost of tax reductions, they could look to programs like LIHTC to cut.

Trump would love nothing more than to get rid of the Consumer Financial Protection Bureau, designed by Elizabeth Warren. As is typical in a crisis, the regulations that follow reflect the problems of the past more than the future. And they often overreach. But Dodd-Frank recognized systemic risks that have to be monitored and the linkage between systemic financial risk and consumer protection. Throwing out all of Dodd-Frank would be a study in crisis amnesia.

The political genius of LIHTC is that it creates allies across income groups, from low-income renters to private investors. Hopefully that coalition can maintain the credit. But there is no absolute certainty.

So what about HUD under President Trump? Here is where biography comes into play. The President-elect is not a fan of HUD.

Trump’s father, Fred, who built housing for returning World War II veterans, was investigated in the 1950’s for unfairly profiteering from FHA-funded housing, before FHA became part of HUD. Ultimately Fred Trump was not charged with anything, but the Senate hearings were an interesting moment in the tension between post-War capitalism and the social contract forged on behalf of veterans.

Then, five years after Donald joined the family business, the Trump Company was sued for racial discrimination. There was a HUD Fair Housing link to the 1970’s suit (that included other developers as well), which was settled in 1974 through a consent decree. This was the beginning of the long relationship between Trump and Roy Cohn, the famous conservative bulldog attorney who taught Trump to always go on legal offense.

If you wanted a management excuse to dismantle HUD you could look at the latest internal audit. While many Federal agencies have issues, HUD has a particular reputation for bureaucratic lethargy and poor fiscal oversight.

The zenith of operational and political chaos at HUD was actually reached during President Ronald Reagan’s term. His HUD Secretary, Samuel Pierce, was a case study of mismanagement. A number of HUD officials under him were indicted.

Indeed there have been periods of leadership creativity at HUD, including Secretary Jack Kemp under the first President Bush and Secretary Henry Cisneros under President Clinton. The Obama HUD, led first by Secretary Shaun Donovan, was overwhelmed by the mortgage foreclosure crisis it inherited. Donovan was a strong housing finance and policy executive but the agency became the overnight backstop for the foreclosure mess, which hampered any capacity to innovate.

If you wanted to disassemble HUD, bringing on Dr. Ben Carson might further the cause. The social values conservative and former pediatric neurosurgeon has no background in housing policy or finance. While I am sure he was a great surgeon, his policy perspectives are the living embodiment of H.L Mencken’s famous quip that “for every difficult problem there is a solution that is simple, neat, and wrong.”

![]() Republican presidents have often used HUD as a platform for preaching a conservative approach to poverty reduction. Clearly that is the intention with Carson. But this is a real agency with billions of dollars flowing through it each year. HUD funds public housing, rental vouchers, income restricted housing insurance programs (FHA), homeless programs, the community development block grant, and fair housing enforcement.

Republican presidents have often used HUD as a platform for preaching a conservative approach to poverty reduction. Clearly that is the intention with Carson. But this is a real agency with billions of dollars flowing through it each year. HUD funds public housing, rental vouchers, income restricted housing insurance programs (FHA), homeless programs, the community development block grant, and fair housing enforcement.

HUD cannot be managed by self-help wisdom alone.

We will have to see the team with whom Carson surrounds himself. If they are ideologues, then we are in for several years of mismanagement a la Reagan. If he takes a page from Jack Kemp, he could run the department in an orderly manner and find room to preach the gospel of social conservatism.

It is instructive that HUD is the only federal agency with urban in its title. But the urban appellation is deceptive. HUD is a housing agency with limited budgetary or policy authority to focus on urban development. There was a brief period at the beginning of the Obama Administration when the President created a White House Office of Urban Policy that many thought would play a significant role in shaping a thoughtful urban strategy. But in the context of delivering fiscal stimulus to counteract the housing and banking crisis, that office was reduced to a coordinating body for inter-departmental press releases.

Where will a broader strategy in support of city and regional development come from within the Trump administration? I would wager that if it lives anywhere, it is related to the Trump interest in infrastructure investment. That will be our topic for next week.

Photo header: Flickr