The Citizen will publish guest articles, like this one, that add to the local civic discussion. To submit, click here.

As a small businessperson, my family and most of my employees are dependent on the Affordable Care Act (ACA), so I have a hard time understanding the controversy. The majority of Americans who rely on their jobs to provide them with health security don’t have any concept of what it means to be on your own, and subject to the flawed U.S. health care system.

When I first set out on an entrepreneurial path I was ill-prepared for the evaporation of financial and health security that would come upon entering the individual insurance market. I had entered the dystopian world of the individual market, pre-ACA, where quotes meant very little and consumers were forced to commit to the plan without any guarantee that the rates would hold or the coverage would meet our needs.

Before the ACA, insurance companies could require “exclusions” in policies that eliminated coverage for certain health concerns. In my case, ALL treatment for back issues were excluded because of a back surgery I had five years earlier with no back issues from that point onward, so it was not a pre-existing condition, just a risk they didn’t want to take. Fortunately I had no more back problems, because they would have likely bankrupted us.

Before the ACA, insurance companies “re-rated” your policy at each renewal so actually using your insurance could lead to huge premium increases so every trip to the doctor had to be carefully considered. Moreover, the ability to exclude pre-existing conditions made it almost impossible to switch policies. Our son had a blood test that indicated Celiac disease, but confirmation required extensive testing including an endoscopy that, due to the high deductible, would have been totally borne by us. So, we elected to assume our son had the disease and restricted his diet accordingly rather than risk bearing the cost and then being subject to huge rate increases. The insurance that we paid more than $2000 a month for wasn’t suitable for any health needs other than total catastrophic coverage.

Then, the ACA passed and for us, it was a godsend. Right away the limits placed on price gouging helped us. In the two years before the exchanges were active, our policies increased over 20 percent each year, but the ACA requires insurance companies spend 80 percent on actual care, which resulted in pretty much all rate increases being refunded to us. The law also made basic health care such as regular checkups available even in high deductible plans. In the first year the exchanges were active, the ACA cut our premiums by $1000 a month and we had coverage without ANY exclusions.

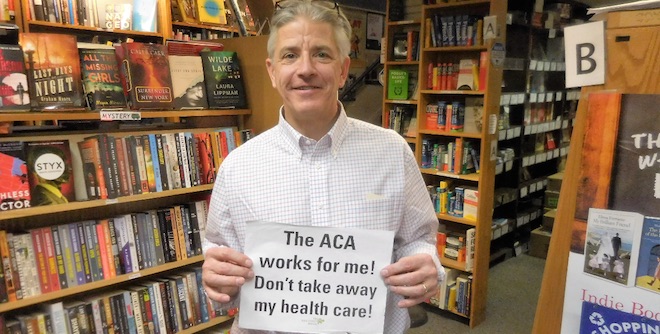

The ACA didn’t just benefit my family. We own a bookstore and we create local jobs here in Philadelphia. We’re too small to provide employer-provided coverage, so we’ve encouraged our staff to sign up through the health care marketplace. Some of our folks are on their parent’s plans, another provision in the ACA, while others have used the ACA as their first opportunity to plan for their health care needs and provide themselves and their families with coverage. And what it’s done for us and our employees, it’s surely done for our customers. Customers who now have the peace of mind in knowing they are covered if an unexpected health issue should arise and enjoy the financial security that enables them to spend more of their hard-earned money at local shops like mine.

All of this is not to say the ACA is the only answer. Premiums and deductibles are on the rise and the cost-containing provisions in the law are too weak. Before the law passed, it was watered down to court lawmakers on both sides of the aisle. Take, for instance, the loss of medical device taxes that was little more than pandering to the industry while destabilizing an important funding mechanism in the process. Without subsidies and tax breaks, this decision and other compromises would put health care costs out of reach for the majority of small business owners, our employees, and our customers.

Proponents of repealing the ACA want to have their cake and eat it, too. When Mr. Trump’s audiences cheered his campaign rhetoric around killing the ACA they too easily forgot what the health care market looked like before the law or their employer-provided coverage allowed them to have little knowledge of that health care market.

As a small business owner, I’ve grown accustomed to dealing with the complicated health care market and I know keeping the ACA in place puts Pennsylvania’s businesses and customers in the best place to succeed. Not without its flaws, it’s the best approach to a market dominated by powerful drug manufacturers and health care providers with a storied history of putting profits before patients.

Michael Row owns Penn Book Center in Philadelphia and is a member of the Main Street Alliance, a national coalition of small business owners.

Photo header: Flickr/LaDawna Howard