Regular readers will know that we have spent the better part of 2021 focusing extensively on two topics: (1) how local leaders can strategically deploy recovery funds, and; (2) how to drive an inclusive small business recovery. Our argument here, based on a new white paper and research memo we’ve developed over the past month, is that to do both these things well local leaders across sectors must engage their state governments now (and visa versa).

The driver of this engagement should be two relatively flexible pieces of funding in the American Rescue Plan Act (ARPA) that states are receiving (both administered by the U.S. Treasury): the much discussed $350 billion State and Local Fiscal Relief Fund (SLFRF) and the much less discussed, but crucial, $10 billion State Small Business Credit Initiative (SSBCI).

We are clear eyed that calling for state-local collaboration may at first blush seem naïve in places riven by ideological polarization. But small business growth represents a potential pragmatic common ground.

Collaboration is key. Metro leaders in the public, business and civic sectors understandably have their hands full trying to spark a recovery coming off the heels of many months of crisis management. It would nonetheless serve them well to invest time in working with states on designing and implementing the SLFRF- and SSBCI-enabled programs. Metros will need states to recognize, scale, and deliver a range of small business financing and states will need local buy-in to effectively deliver this financing to entrepreneurs. Small business finance, in particular, represents an immediate practical imperative as well as a long-term strategic play. Not coordinating would represent a massive missed opportunity to shape an inclusive and innovative recovery over the course of the next decade.

We are clear eyed that calling for state-local collaboration may at first blush seem naïve in places riven by ideological polarization. But small business growth represents a potential pragmatic common ground. Fostering entrepreneurship, small business growth—the explicit intent of SSBCI—and supporting the Main Streets and commercial corridors where enterprises congregate, represents a potential popular common ground for collaboration.

These efforts, by their very nature, require a multi-sector, multi-jurisdictional approach that crosses traditional partisan and spatial lines. They bring into the mix a plethora of actors—governments, banks, community development finance institutions (CDFIs), investors, intermediaries, procurement entities, business district alliances—that focus on the pragmatic rather than the political and just want to get the job done. They also represent an issue where practitioners in cities, suburbs, exurbs and rural areas have reason to work together around common products, techniques and information systems.

There is recent precedent for this view. Unlike the public health divisions that have roiled state and local politics, the delivery of federally-supported small business relief during the past 15 months has generally been driven by technocratic and technological solutions and collaborative networks of public, private, civic and community institutions and leaders.

The time for action is now. Although ARPA passed in April, end-use policy decisions are being made as we write. As is true of much national policy, the feds design, the states disburse, and local networks deliver. There is currently an opportunity, not seen in 50 years, for a new form of “bottom-up” models of state-local collaboration to drive an inclusive recovery given the flexibility of the SLFRF and the SSBCI.

Whether decisions at the state level are made in consultation with metro stakeholders, or if states choose to go it alone, will have profound implications on how hundreds of million dollars flow, and in turn will shape metro economies across virtually every sector. We are decidedly in favor of the former approach.

State and local fiscal relief fund: mostly unallocated, little transparency to date

As of mid-July, most states have received the first half of their total SLFRF funding. A small group of states have received their entire funding allotment already. A new research memo from Drexel University’s Nowak Lab indicates that most states have either: (a) not allocated any funding from their flexible funds or (b) have allocated far less than half of their total funds. And despite the guidance from the U.S. Department of Treasury, many state legislatures and governors have expressed concern about whether their proposed projects will comply with that guidance.

As states prepare to spend their funds, they should look towards best practices modeled by other states and cities. This is difficult because, in these early stages, only a few states have transparently documented their appropriations. Many states have buried their appropriations of ARPA flexible funding in their normal budgets for the fiscal year. Oftentimes, the funding is spread across multiple different budget documents. In many cases, a program or agency will receive an appropriation with little explanation on how that money is intended to be spent. In many cases, those state agencies will have the authority to allocate that money further but simply have not done so yet.

Moving forward, all states should adopt transparent methods of allocation for the benefit of local communities, relevant organizations, and other state policymakers—the ones implementing funds. States should publish clear outlines of how they intend to spend SLFRF dollars. Maryland, Illinois, Colorado, and New Jersey offer valuable models for other states on how to explicitly indicate where ARPA funds are going so individuals and organizations can easily find them and provide feedback. Cities, which have by-and-large been more transparent in their decision-making about SLFRF allocations, can also serve as a model for how states should go about this. Cities like Detroit, Dayton, and St. Louis are exemplary—engaging in regular community meetings and presenting a document that clearly outlines priority public investments.

MORE ON INCLUSIVE RECOVERY

States have taken three distinct approaches to govern their SLFRF allocations. The vast majority (80 percent) of states—including those which have at least partially allocated funds and those which have yet to do so—have committed to allocating their funding through a regular budget process. Six states have delegated spending authority of ARPA to a smaller advisory group, usually appointed by the governor. Only one state, Wisconsin, is using a unilateral funding allocation structure, in which the Governor has sole decision-making authority. Three states have so far not indicated who will oversee the distribution of SLFRF funds, but it seems likely they will use the traditional budget process in a special session or future legislative session like the majority of states.

Emerging priorities

Many states are using SLFRF allocations to cover revenue losses during the pandemic. Among states that have made allocations, revenue replacement is often their largest single expenditure so far. Even with the potential for a major federal infrastructure bill, states are also choosing to spend significant amounts of SLFRF allocations on infrastructure projects (water, sewer, broadband). Further details on state priorities can be found in the Nowak Lab’s memo.

Some states like Indiana, Utah, Louisiana, and Colorado are prioritizing economic recovery in their SLFRF allocations. State allocations include small business relief programs, targeted workforce development programs, and tourism initiatives. Indiana is spending $731 million (nearly a quarter of their total funding) on a variety of economic recovery programs, including a regional grant program to uplift 10 struggling regions across the state. Other states aiming to model Indiana’s focus on economic development should note that ARPA funding for economic development must be targeted to mitigate the negative impacts of the pandemic, per the Interim Final Rule from the Department of Treasury.

When it comes to the SLFRF local leaders should consider three key points

- Where possible, city and metro leaders should be in communication with legislators about what’s being funded so as to not be caught off guard and not be able to effectively maximize funds. It’s clear that SLFRF funds come with rules, but collaboration where not politically infeasible will increase impact.

- Much of the funding has yet to be allocated. This means that with future allocations, metro and city stakeholders have leeway still to speak with legislators and advocate for certain things, so they should develop asks and strategies in key areas they feel states are likely to fund.

- City and metro leaders should be in communication with state agencies receiving relevant funding to register their input on how it should be spent and create opportunities for bigger impact by leveraging other funds (e.g., SSBCI, other local funds). This point is crucial since there is a degree of discretion in how agencies allocate funding and local leaders can increase the technical functioning of grants to increase their impact.

SSBCI: “the biggest small business program you’ve never heard of”

Small business relief has been a key component of the federal government’s recovery efforts. For example, the Paycheck Protection Program alone has issued $800 billion in forgivable loans. As our national outlook shifts from economic relief to recovery, the most significant program for follow-on investment and inclusive growth will come online this summer: the Treasury will begin accepting applications from states for the State Small Business Credit Initiative (SSBCI).

Successfully deploying SSBCI funds and reaching a range of entrepreneurs will require states to harness the full energies of local networks and intermediaries. New statutory design allows for greater inclusion than the first iteration of SSBCI in 2010 (SSBCI 1.0). But new design does not ensure effective delivery. This will require a new modus operandi in many states. Below we highlight some of the best examples from SSBCI 1.0, and the lesson is clear: past program success constitutes a two-way street with states leveraging local leaders’ knowledge, and local leaders leveraging states’ scale.

Successfully deploying SSBCI funds and reaching a range of entrepreneurs will require states to harness the full energies of local networks and intermediaries. New statutory design allows for greater inclusion than the first iteration of SSBCI in 2010 (SSBCI 1.0). But new design does not ensure effective delivery. This will require a new modus operandi in many states. Below we highlight some of the best examples from SSBCI 1.0, and the lesson is clear: past program success constitutes a two-way street with states leveraging local leaders’ knowledge, and local leaders leveraging states’ scale.

In many ways the SSBCI faces an inverse problem to the SLFRF: while it can be used flexibly for inclusive economic development, many local stakeholders have not heard about the program and many more are not yet aware of how best to make use of the dollars. That is why Drexel’s Nowak Lab recently released a white paper to inform local leaders on lessons from SSBCI 1.0 and how they can localize and thereby maximize SSBCI 2.0.

Our point in this report is simple: to drive a recovery that expands opportunity and innovation, local leaders would be well put to think about ways they can best leverage SSBCI usage. While “local” may not be in the program’s title, its success will ultimately hinge on the hard-won efforts of local leaders and networks.

A few key lessons and illustrative examples are highlighted below

- Tap into existing networks: In SSBCI 1.0, many states had existing capital provider networks ready for investment. This enabled them to increase the program’s impact.West Virginia effectively executed this strategy. The state deployed SSBCI 1.0 through its own, 19-year-old public venture capital fund: the West Virginia Jobs Investment Trust. This fund successfully deployed SSBCI equity investments in a state not known for venture capital, supplemented by its highly successful Capital Access Program through an existing network of local economic development entities.

- Stand up new networks: Not every state has a comprehensive network of small business support organizations immediately ready to deliver funds. This doesn’t have to hamper states’ performance. In fact the program is well-suited to strengthening these networks. Georgia provides an illustrative model. The state lost many of its community banks during the Great Recession but used its SSBCI funds to stand up a new network through its Funding for CDFIs program. The state contracted with six CDFIs based upon their track record for reaching and providing technical assistance to under-served entrepreneurs (together, the six also covered the entire state). As of 2015, Georgia had quickly deployed its initial allocation, and invested nearly half its dollars in low-income areas, above the national program average.

- Create new, evergreen funds: Some states allowed intermediaries to keep and reinvest returned funds. By doing this, states incentivized smart investing. When executed well, this enabled states to use SSBCI funds to stand up new small business investment vehicles, especially for under-banked and -capitalized states (e.g., Georgia). Out west, Colorado and Alaska capitalized publicly-backed evergreen funds to do just this—both of which are still operational today.Colorado is an exemplary state model. The state has been quite successful with its Cash Collateral Support (CCS) program. It fed its $17 million SSBCI allocation into the program, which provided collateral deposits to a wide range of local capital providers issuing small loans across the state. With CCS humming through an extensive delivery system, Colorado was the first state to expend its SSBCI 1.0 allocation. The fund continues to serve Colorado entrepreneurs, sustained by its low fees and interest payments and incurring zero losses thus far, creating added flexibility headed into SSBCI 2.0. Anchorage, Alaska offers a novel local approach. The city capitalized its 49th State Angel Fund (49SAF) with SSBCI dollars. This fund (new then, and now evergreen) provides risk capital, first and foremost, but also fostered the state’s entrepreneurial ecosystem. The City of Anchorage applied in lieu of the state of Alaska, which withdrew its SSBCI application, an action allowed by the statute for municipalities within states that rejected SSBCI funds (North Dakota and Wyoming also declined SSBCI 1.0 dollars).

- Leverage wrap-around services. Getting businesses capital-ready often requires VC-level coaching and technical assistance. Some states were able to successfully pair SSBCI 1.0-funded capital products with wrap-around services that expanded programs’ reach into historically marginalized neighborhoods and improved businesses’ odds of success (and repayment). This will be made easier this time around with SSBCI 2.0’s $500 million technical assistance fund. Georgia was again exemplary. For its Funding for CDFI’s program, Georgia contracted with CDFIs based upon their existing TA infrastructure and record for reaching MWBEs. This practice paid dividends as the state was able to track MWBE lending and to reach 20 of its most economically challenged counties.West Virginia presents another model. The state supplemented its SSBCI funds with state-funded marketing dollars to reach local lenders across the state, and a philanthropic grant came through from the Claude Worthington Benedum Foundation to provide technical assistance to help businesses become application-ready. This created a pipeline of previously excluded and more diverse entrepreneurs.

You can find more key lessons from SSBCI 1.0 that should guide SSBCI 2.0 deployment in our latest piece.

Conclusion

SSBCI and much of the SLFRF funds are distributed through states. The ultimate effectiveness and broad-based impact of these programs will depend on the strength of underlying local ecosystems. Specific programs and pools of money come and go, as we saw with the parade of SBA-directed Covid support programs. Lasting impact, on the other hand, is made by ecosystems and local leaders.

As is so often true, the federal government designs policy and locals deliver. The SSBCI and creative uses of the SLFRF are special cases in point as they implicate multiple layers of government and multiple sectors of the economy to drive inclusive growth. This is especially true for SSBCI where, as with version 1.0, effective delivery of SSBCI 2.0 will be a two-way street: states need a variety of local intermediaries to deliver capital to entrepreneurs, and local leaders will need to connect with states in order to achieve scale.

Building back better through these state programs is a chance to do things differently. If done well, they represent states’ chance to broaden their reach and break new ground. They can develop new operating models and funds that could become regularized and evergreen. This work will not happen by itself and will require thoughtful and tenacious engagement between local leaders and states, but we are hopeful about the prospects of these state programs, alongside the EDA’s newly announced suite of programs, to spur a recovery that brings along more neighborhoods, entrepreneurs, and industries.

Bruce Katz is the founding director of the Nowak Metro Finance Lab at Drexel University, Ian O’Grady is a research officer at the Lab, Colin Higgins is a senior research fellow and Michael Tolan is a research analyst.

The Citizen is one of 20 news organizations producing Broke in Philly, a collaborative reporting project on solutions to poverty and the city’s push towards economic mobility. Follow the project on Twitter @BrokeInPhilly.

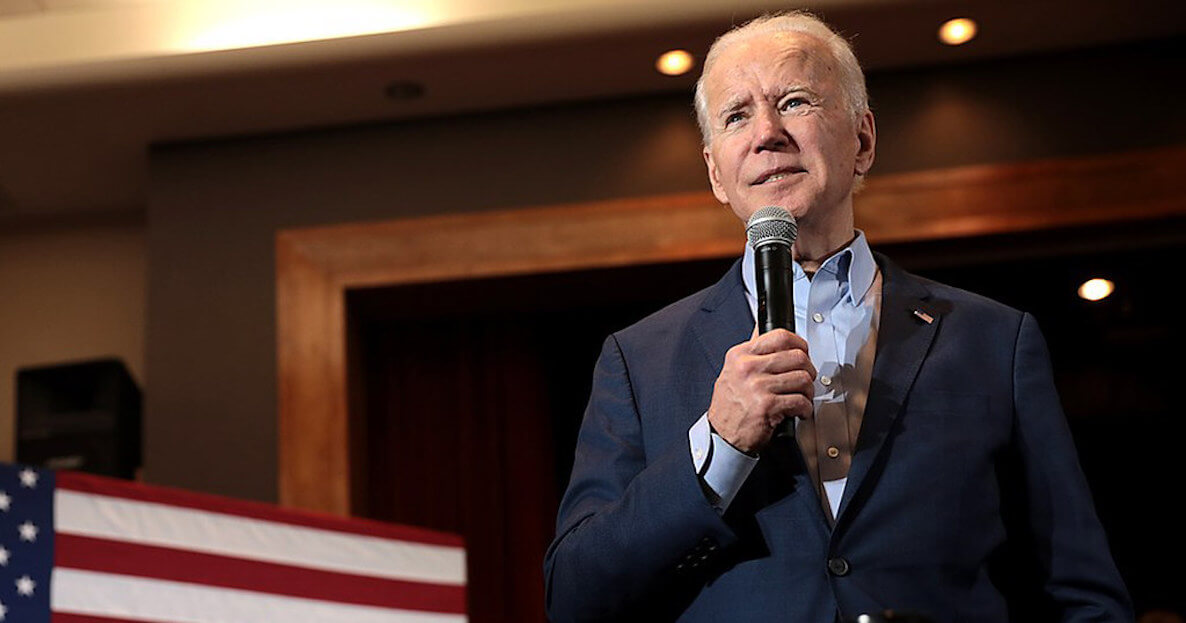

Header photo by Gibson Hurst™ on Unsplash