On June 13, the Port of Greater Cincinnati Development Authority (the Port) launched the $100 million Cincinnati Jobs Bond. With the proceeds of the bond, the Port aims to acquire, remediate, and prepare manufacturing sites in two distressed areas of the city.

As the country witnesses a boom in manufacturing, Cincinnati and the Port aim to show how cities can participate in the new industrial resurgence. If successful, it provides a replicable model that can be scaled across similar legacy industrial cities.

A manufacturing boom, for whom?

The country is experiencing a major industrial transition. A boom in manufacturing, driven by national security concerns, the need for resilient supply chains, and the imperative of decarbonizing the country, will have major ramifications for the U.S. economy.

These investments, in sectors like energy, vehicles and transportation, semiconductors, and major infrastructure, are already making an impact on the U.S. economy. Factory construction in the U.S. has more than doubled since June 2022. This construction boom is distributed across states, metropolitan areas, and industries.

But this activity, so promising for the task of nation-building, shows a risk of bypassing cities. As we have noted, new, major industrial projects are being located disproportionately at the periphery or outside of metropolitan areas. Absent intervention, this activity will promote sprawl, hinder urban residents’ access to well-paying jobs, and limit opportunities for minority-led firms to participate in the industrial transition.

In some respects, exurban areas have inherent competitive advantages over cities to benefit from these major investments. Among these advantages are available land, low land prices, and the relative ease of greenfield development over brownfield remediation.

The Cincinnati Jobs Bond should serve as a blueprint for other cities with the right attributes and strategic focus.

To address the latter issue, the Infrastructure Investment and Jobs Act (IIJA) appropriated $1.5 billion for EPA’s Brownfields Program, which offers grant funding for brownfield assessment and cleanup activities, job training, and capitalizing revolving loan funds. This funding is significant in historical terms; the IIJA funding nearly matches the $1.6 billion in cumulative brownfield grants disbursed between FY1995 and FY2021.

While this funding is historic, it is not by itself sufficient, with the typical brownfield grant set at $500,000. Moreover, cities or their partners must own the brownfield sites before they can be eligible for funding. Although this creates a barrier to much-needed environmental cleanup, it also creates an incentive for cities to find a productive use for cleaned-up parcels that justifies the ROI of acquisition.

The implication is clear: If industrial sites of the past are to serve as economic engines for the future, cities must take the lead. This means building a clear strategy, identifying sites, organizing networks of leaders and institutions, and creatively layering and leveraging resources to bring the strategy to ground.

The industrial city and the Cincinnati jobs bond

The ability for cities to play a leading role in the industrial transition is being tested in Cincinnati. Cincinnati is in many ways a quintessential industrial American city. With its strategic location on the Ohio River and, for a time, at the nexus of north and south, east and west, the city was naturally well-positioned to make and deliver goods, helping to make Cincinnati the sixth largest city in the United States by 1850. The city came to be, in various eras, a leader in the manufacture of pork products, carriages and wagons, cosmetics, machine tools, and automobiles. At its peak in the late 1960s, the manufacturing sector employed approximately 43 percent of the workforce in Hamilton County and was responsible for more than half of its total wages.

What followed was a familiar narrative for Rust Belt cities. Once employing nearly 140,000 people in Hamilton County, manufacturing lost ground in the region, first to non-unionized states, and then to foreign competition and automation. Service sector jobs came to dominate the regional economy. By 2015, the manufacturing sector employed fewer than 49,000 people in Hamilton County, a 64 percent drop from its peak decades before. As manufacturing jobs eroded, surrounding neighborhoods suffered, with the city’s highest poverty census tracts immediately adjacent to Queensgate and Camp Washington — once the epicenter of the city’s manufacturing strength.

Enter into this history The Port. An innovative quasi-public agency operating across Hamilton County, The Port provides a range of financing tools and purchases residential, commercial, and industrial land to foster job creation and promote industrial, neighborhood, and civic development. The Port’s efforts have helped to retain a core base of manufacturing, providing the foundation for the sector’s resurgence in Cincinnati.

Since 2016, the Port has raised $11 million in concessionary capital to support the manufacturing sector and has issued bonds to finance activity on revenue-generating properties. These efforts have helped to facilitate $33 million in overall investment in 160 acres of industrial land.

Two legacy manufacturers in this area exemplify the breadth of Cincinnati’s manufacturing heritage. The first is Kao, a Japanese cosmetics company that now owns the Andrew Jergens Company, founded in 1882. The company capitalized on the by-products of the vibrant stockyard businesses in the Cincinnati Mill Creek Valley. Kao today employs over 700 people and is expanding after The Port’s successful purchase and relocation of a neighboring business.

Cincinnati’s combination of logistical, business, educational, and cultural amenities make it well-positioned to rise to the top among American cities seeking to attract advanced manufacturing.

Meyer Tool and Die started in Camp Washington in 1951 and has evolved over the years into a leader in turbine technologies for the military and aerospace industries. The firm is vertically integrated and serves as North America’s largest EDM (electrical discharge machining) shop. Over half of the firm’s 1,500 worldwide employees work in historic Camp Washington.

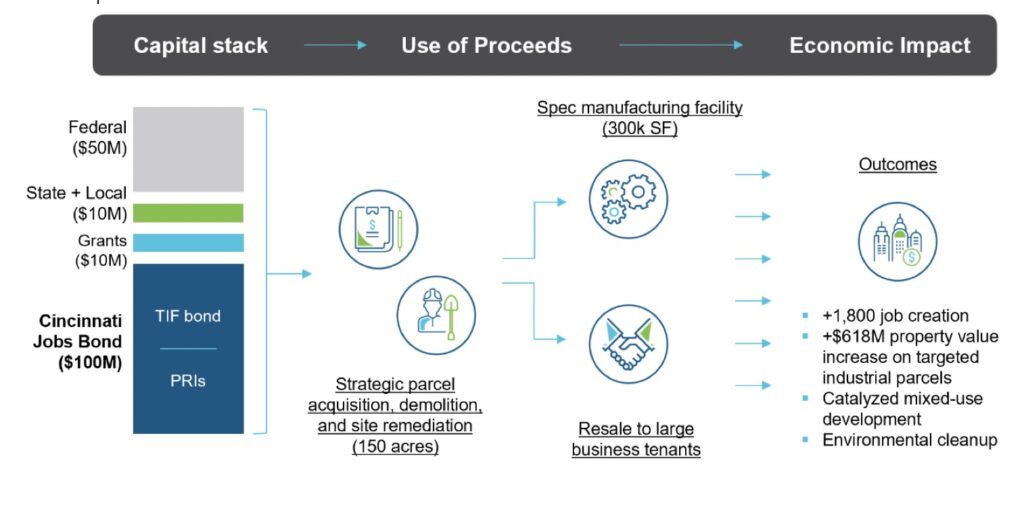

With the Cincinnati Jobs Bond, the Port is assembling a creative capital stack to build off the strength of companies like Kao and Meyer Tool and Die and foster industrial development within the city limits to ensure the region’s participation in the national manufacturing renaissance.

Cincinnati Jobs Bond overview

The Cincinnati Jobs Bond is a $100 million blended capital tool to acquire, remediate, aggregate, and resell 150 acres of highly targeted, industrially zoned land to attract job-creating manufacturing and mixed-use development as part of the broader U.S. strategy to re-shore producers. The Jobs Bond will help retain legacy manufacturers like Kao and Meyer Tool and Die and attract upstream suppliers and complementary firms. The result will be a next-generation urban manufacturing hub in the Midwest, growing the city’s economy and improving quality of life for its residents.

The Port is targeting its efforts in the Queensgate and Camp Washington neighborhoods. Located immediately west of downtown Cincinnati, these areas have access to premier air, rail, ship, and road transportation networks. More than 48 million tons of goods are transported through Cincinnati ports annually. The city is home to the 5th largest rail yard in the CSX network and is close to the seventh largest cargo airport in North America.

The Cincinnati Jobs Bond and associated funding comprise three tranches of capital:

-

- Grants and loans from local and federal sources;

- Grants and loans from national and local philanthropies and;

- Tax-Increment Financing (TIF) bonds.

The Cincinnati Jobs Bond blends concessionary loans in the form of Program Related Investments (PRIs) from foundations and universities with local, state, and federal grants. Its TIF bond financing will leverage future tax benefits from bold investments into Cincinnati’s neighborhoods today. The concessionary loans and grants reduce bond buyer risk and lending rates, thus driving down the City’s cost for this initiative. The blended capital stack also provides critical flexibility to align with investors’ varying preferences for risk, return, and duration. Shorter term capital in the stack (i.e., PRIs) enables rapid acquisition of parcels, while TIF bonds align with longer-term property appreciation and economic growth. By blending capital sources, Cincinnati can move forward with numerous activities today that will directly benefit the under-resourced communities directly adjacent to new manufacturing jobs.

Leveraging The Port’s public finance capacity will also unlock access to an estimated $60 million in local and federal funding for remediation and demolition on the front end, and industry reinvestment on the back end. The city, county and state governments have been partners in the work done to date, albeit on a project basis. The city and county have often matched grants received by the state for the demolition and remediation costs, while impact funds have been used for acquisition.

The implication is clear: If industrial sites of the past are to serve as economic engines for the future, cities must take the lead.

This manufacturing hub will create more than 1,800 high-quality jobs, each paying more than $72,000 annually. The property value of the 150 acres is expected to increase by $618 million, from $375 million to $993 million, with TIF district property taxes and proceeds from the sale of developed parcels covering interest and investor payments. The Port also aims to foster mixed-use development around the manufacturing sites, recreating the live/work/play environment that existed decades ago.

Cincinnati’s combination of logistical, business, educational, and cultural amenities make it well-positioned to rise to the top among American cities seeking to attract advanced manufacturing. The city is home to five Fortune 500 companies and 12 colleges and universities. Moreover, it is well-positioned to create and capture regional synergies in aerospace manufacturing, with GE Aviation’s presence in Evendale and an estimated $16 billion in economic activity and 80,000 jobs at Wright-Patterson Air Force Base some 65 miles to the north. Importantly, it also has a network of government, business, educational, and philanthropic leaders rowing in the same direction to attract advanced manufacturing and the economic opportunities that come with it.

Will it scale?

Other American cities seeking to participate in the new industrial paradigm should take note. The Cincinnati Jobs Bond aims to serve as a blueprint for cities to use public finance tools to create jobs, rebuild an urban middle class, and redefine urban manufacturing for the 21st century.

As reflected in the Jobs Bond’s blended capital stack, it ‘takes a village’ to capture macroeconomic trends and revive urban manufacturing. Neither federal funds nor The Port, as innovative and forward-thinking a quasi-public agency as they come, can make this happen alone.

Importantly, the Cincinnati Jobs Bond is replicable. The Bond is a strategic and creative stack of familiar capital products that, with the right conditions and financial acumen, could be scaled to a cohort of cutting-edge cities.

To be part of the conversation around attracting advanced manufacturing and the quality jobs that come with it, a city should possess these attributes:

-

- An industrial legacy and tracks of available real estate that can be acquired, remediated, and re-imagined to host modern advanced manufacturing;

- The right transportation infrastructure, with sites at the crossroads of major air, rail, shipping, and road networks;

- A willing labor force and outstanding partner universities to create job training hubs;

- Existing multi-sector collaboration among government, business, educational, and philanthropic leaders, and an integrated industrial strategy; and

- A high-capacity, quasi-public intermediary to work on behalf of the collaboration that possesses the ability to issue bonds, hold real estate at lower costs and absorb risk.

But this is only the starting point. Even with these prerequisites, cities will only win if they develop a clear, multi-sector playbook that leverages their strengths and take a coordinated, proactive approach to activate that playbook. The winning urban strategies should, at a minimum, incorporate 5 key elements.

-

- Leverage local and state spending power to match multiple funding opportunities to worthy parcels of land and projects.

- Modernize industrial policies to secure competitiveness in the modern market. Zoning should prohibit low-value uses such as storage and parking, and streamlined permitting will be important to move at the speed of business.

- Transform urban cores by using multiple types of capital to reinvest in communities.

- Develop, attract, and train high-quality talent to address the ongoing advanced manufacturing workforce shortage.

- Ensure equitable spending and procurement particularly for diverse local small businesses.

Conclusion

The federal government has set national priorities and provided unprecedented levels of support for the new industrial order. Funding for mega-deals is being announced almost on a weekly basis. Yet harnessing these macroeconomic trends and bringing them to ground in cities will be the work of innovative networks of cross-sector leaders working at the city and metro level. While funding for mega-deals appears plentiful, preparing urban sites for emerging new technologies, the re-shoring of industrial companies and the attraction of foreign direct investment requires a careful blending of public, private, and civic capital.

The Cincinnati Jobs Bond should serve as a blueprint for other cities with the right attributes and strategic focus. To facilitate adoption of this model, we are hoping to bring together 5-10 older industrial cities that have networks of public, private, and civic institutions that are ready to do what is necessary to acquire and remediate key parcels of industrial land and put them back into productive use.

If the Cincinnati approach can scale, the country in general and industrial cities in particular could witness a new era of urban manufacturing and economic prosperity. Who will join us?

Bruce Katz is the Founding Director of the Nowak Metro Finance Lab at Drexel University. Bryan Fike is a Research Officer at the Nowak Lab. Eric Letsinger is the Founder and CEO of Quantified Ventures. Laura Brunner is the President and CEO of the Port of Greater Cincinnati Development Authority.

![]() MORE FROM BRUCE KATZ AND THE NOWAK METRO FINANCE LAB

MORE FROM BRUCE KATZ AND THE NOWAK METRO FINANCE LAB