John Fry is not the kind of guy often described as “giddy.” In fact, he’s pretty much the opposite. Though amiable, he’s always a serious man doing serious things. What makes him a great leader is his serene unflappability.

So it was a surprise earlier this week, when he called me, wondering if I’d take a call from Spark Therapeutics founder and CEO Jeff Marrazzo. He sounded worked up. “I’ll let Jeff tell you what’s going on, but it’s big,” he said, the words flowing a bit faster than usual. “I don’t want to step on Jeff’s toes. But it’s big news.”

Around the third time he mentioned the bigness of what was to come, I knew he was dying to come clean about it. But he remained disciplined. When the call from Marrrazzo came—last month, we’d hosted both men as the kickoff to our Development…For Good speaker series at Fitler Club—Fry’s giddiness came into focus.

In a city desperate for economic growth, this news from Roche and Spark is a much-needed shot in the arm.

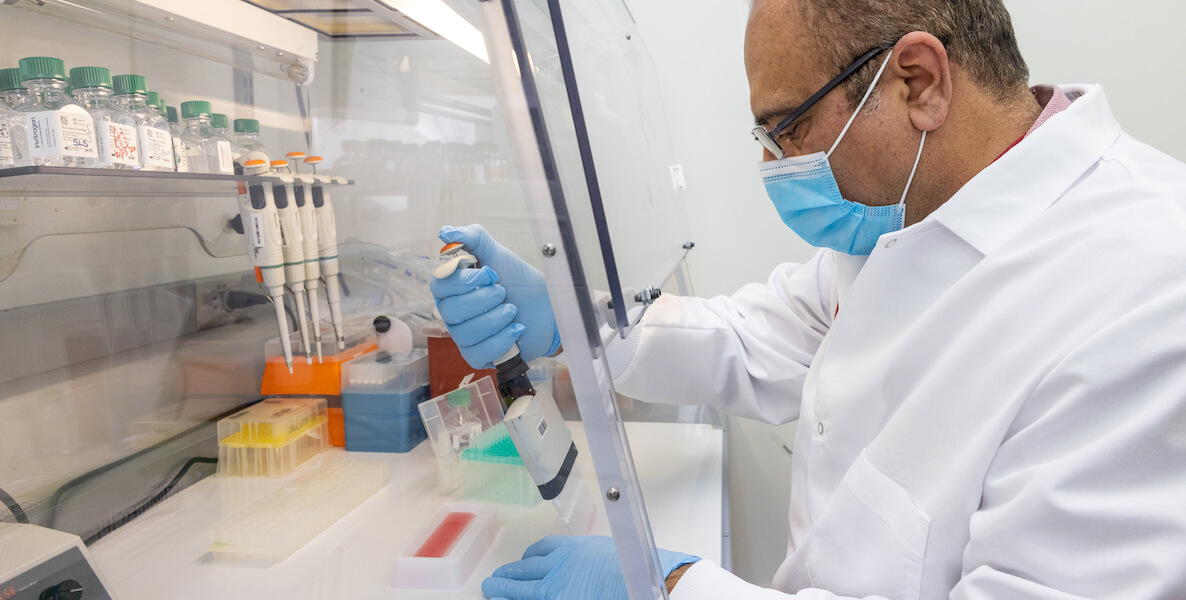

Marrazzo’s Spark, which was bought for $4.8 billion by the giant Swiss healthcare company Roche in 2019, is making as big a bet on Philly as any company in recent memory: A $575 million, 500,000 square foot, state-of-the-art gene therapy innovation center at 30th and Chestnut on Drexel’s campus. A research, development and manufacturing hub in one of the most dynamically growing fields of healthcare.

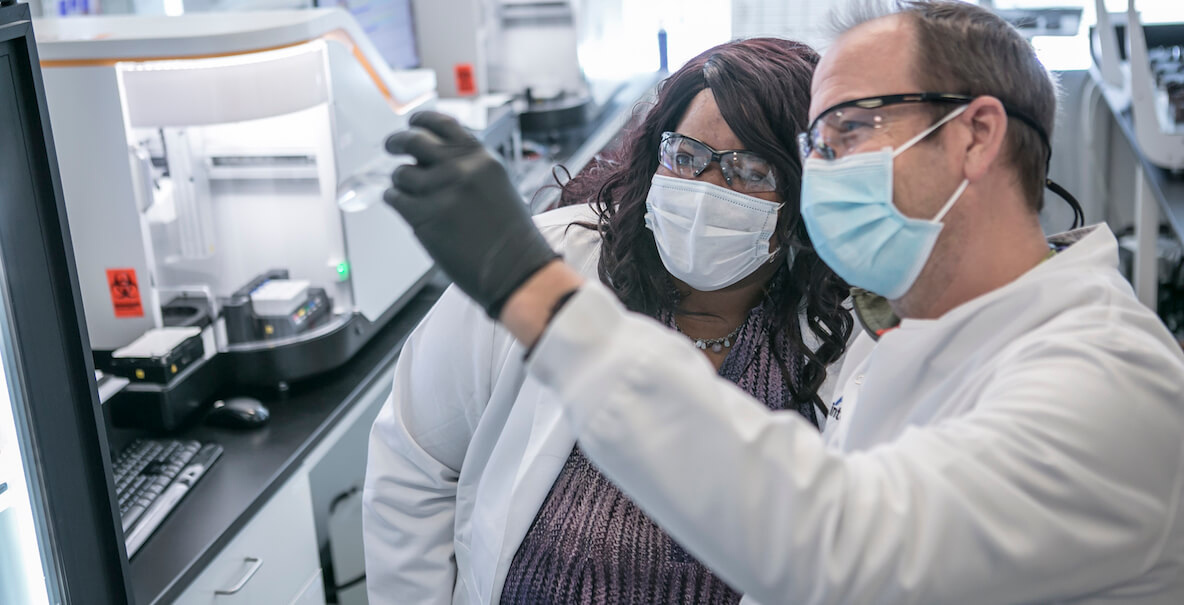

The move might just catapult Philly to the top of the world’s biotechnology industry. Already, Philly’s emerging biopharma cluster in West Philly had earned the city the moniker “Cellicon Valley.” After all, Penn Medicine leads all universities across the globe in cell and gene therapy-related patents and has launched a boatload of startups in the field—including Spark eight years ago.

In a city desperate for economic growth, this news from Roche and Spark is a much-needed shot in the arm. We’ve become a branch office town that celebrates incremental—or, worse, symbolic—gains. Remember when Mayor Kenney held a press conference when Aramark decided not to leave the city? I’m pretty sure Roger Federer doesn’t go around high-fiving folks when he holds serve.

With this move, Roche, headquartered in Basel, Switzerland and the world’s 29th biggest company—a few spots ahead of Comcast—is adding Philadelphia to its list of worldwide product development sites. According to the company’s press release, the goal is to bring “the greatest minds in gene therapy together under one roof to drive science forward, challenge the inevitability of genetic disease, and serve as a Roche global center of excellence for gene therapy manufacturing.”

Imagine the power of changing the narrative of Philadelphia—going from the city that booed Santa Claus to the city that saves lives worldwide. That has been the promise of Spark since 2017, when the startup—staked by CHOP with a $50 million early stage investment—developed Luxturna, the first approved gene therapy for an inherited disease. Luxturna treats patients who suffer from a retinal disorder that, without such intervention, leads to blindness.

For the city— and for the average Philadelphian—Spark’s ascendance means not only the potential to rewrite the city’s story, but also job growth on a grand scale. Prior to Roche’s investment this week, it had been forecasted that close to 10,000 new cell and gene therapy jobs would be created in the Philadelphia region over the next 10 years. That number just got turbocharged, as my conversation with Marrazzo makes clear.

Here is an edited and condensed version of it, starting with my surprise that he and Fry kept this news a secret when we all gathered last month at Fitler Club.

Larry Platt: Remind me never to play poker with you and John Fry. You guys showed nothing.

Jeff Marrazzo: [Laughing] We had thought we might be able to announce it that night, but we couldn’t pull it together in time.

LP: So tell me about this. I’m interested in the genesis of it, and in its impact on the city.

JM: This is really a continuation of the whole merger with Roche in 2019. We weren’t looking to sell. But one of the things we talked about with them was making real investments in gene therapy. They could give us more capacity by investing in our research and development. The last two years, since we closed the deal with Roche, they’ve invested so much in our R & D that we’ve been able to publicly announce our first non-genetic disease therapy, for epilepsy.

The other thing I’m excited about is our partnership with Drexel. Together we can shape the future workforce of life sciences. And then there’s the profile Roche will take on in Philadelphia. People here don’t know Roche that well—the largest biotech company in the world, and the 29th largest company in the world. For context, Comcast is the 33rd largest company in the world. Roche made Philly one of a handful of places in the globe for its physical presence.

LP: The other thing this does, I presume, is underscore the importance of ecosystem. I was concerned last spring when Penn Medicine announced it was moving its gene therapy lab to King of Prussia for more space. Talk to me about why clusters of innovation matter. You’re a young guy, but you were a pioneer, the first startup in this space—

JM: And now there are 40 cell and gene therapy startups in the area, the vast majority in West Philly. It starts with one or two big players who grow to have deep pockets and they invest everything back into their businesses.

It’s great running a successful business, but there’s nothing like being a great neighbor and being civically impactful.

The biggest thing holding back growth is the challenge of finding talent. We’ll be building a world-class innovation facility, with manufacturing capabilities—before, we outsourced manufacturing. We’ll have 500 employees, most of that in new jobs in manufacturing personnel. Those are middle class jobs, at least. The data suggests that for every job in the biotech space, five jobs outside of biotech get created— all those vendors, suppliers, accountants, lawyers and caterers.

LP: I know that everything you do runs through your bottom line, but at our event last month, I got a sense of just how committed you are to Philly. Why is that?

JM: It’s just a natural connection. I was born and raised here. I lived in five or six different neighborhoods here. The city is literally in my DNA. But a city can also become part of a company’s DNA. I remember a few years ago, during a board meeting, the subject of moving came up. It was an inflection point. A board member said to me, “When I think of Spark, I think of West Philly.” I think I said this that night at your event. It’s a great feeling when you first bring to market life changing meds for patients. It’s great running a successful business, but there’s nothing like being a great neighbor and being civically impactful.

LP: Your growth has been eye-opening. I believe you’re up to about 800 employees, with the majority of that coming in the last few years. But were there moments, especially early on, where you thought this would never happen?

JM: Oh, we certainly had plenty of those moments early on. One day when we were public our data didn’t look like we wanted it to, and it cost us about $1 billion that day.

LP: One billion in one day?

JM: One day. So when I started to talk to Roche, what appealed to me was that they wanted to invest in transformational science over a long period of time. They knew that cell and gene therapy is where everything is headed. It’s like in hockey, where the saying is to “skate to where the puck is going.” Well, cell and gene therapy is where most meds are going to be coming from in the future.

LP: Have you ever made a profit?

JM: We did in one quarter, to be technically accurate. We sold a $100 million voucher that quarter, and that was why. Otherwise no, never made a profit. We’ve been too busy reinvesting in research and development. As a private company and then a public company, we raised about $1.3 billion up until about the end of 2019, when Roche bought us. And since that time, Roche has invested north of $1 billion—in operating and capital investments, like this one, which we’ve never been able to do before.

LP: Was this all a happy accident, or did you see the cell and gene therapy trend coming?

JM: I saw it in 2008. I was working on a different venture, a company that was helping to facilitate genetic testing. The mapping of the human genome meant we were starting to understand the causes of genetic disease. Two years later, the idea was to close the gap between the diagnostic power of genomics and its therapeutic potential. I knew that therapeutically we’d soon have the ability to be so precise and targeted, going right to the root of a problem, affecting something inside the cell of a patient without side effects.

LP: Finally, as you make this big bet on the city, what do you need back from the city?

JM: Infrastructure. We picked this location because of its advantages as a transportation hub. I think it’s the third most traveled corridor throughout Amtrak. And it still has a lot to be improved upon.

LP: Jeff, thanks and congrats. I’d like to continue to talk about this, because at The Citizen we’re interested in chronicling—and championing—inclusive growth.

JM: By all means, there will be a lot more to talk about.