I first met Pete in late 1997. I knew Safeguard Scientifics as the center for venture capital in Philadelphia but came to know Pete as the man that made Safeguard and created the venture capital community in Philadelphia and so many of its successful entrepreneurs. You can trace countless successful entrepreneurs and investors back to an association with Safeguard.

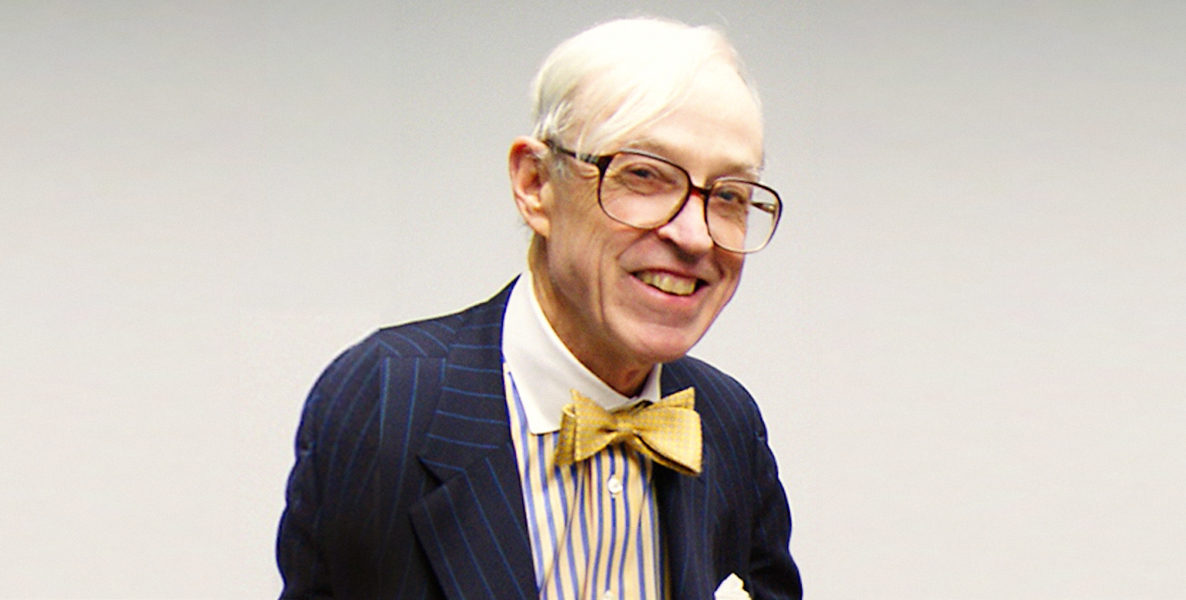

But it was mostly Pete, Safeguard’s gregarious and visionary CEO and frontman that discovered, backed and supported these dynamic leaders, all of whom are indebted to him for his unwavering guidance and support. I met Pete right around when he turned 70; you would have thought he was 50 given his boundless energy, sharp mind and youthful presence.

Many of today’s investment and entrepreneurial luminaries in Philadelphia got their start either at Safeguard or through funding from one of the Safeguard-affiliated funds: Ira Lubert; Bob Keith; Buck Buckley; Mike DiPiano; Steve Zarrilli; Mike Hagan; and Jerry Sweeney.

Throughout his life, Pete’s advice was sought and valued and his family of admirers loyal. What was Pete’s superpower? His unwavering optimism. This allowed Pete to see the good when others focused on the bad. It allowed him to see opportunity where others saw a threat. And as a result, a conversation with Pete often provided the positive fuel to propel and challenge your own perspectives. Pete was so liberal with sharing his superpower that the fuel continues to grow. It continues to live, inside all of us impacted by Pete, and it continues to spread—through his countless legacies:

A Legacy of Leaders: Beyond his investments, Pete was a very giving advisor to so many entrepreneurs and investors. The penultimate achievement for many an entrepreneur or investor was a breakfast with Pete at the Radnor Hotel where he “held court” daily at “his” table which included a chair with his name on it. Safeguard was a pioneer of the incubator model and used the office space that it owned—the Safeguard “campus,” as it was known—a collection of office buildings owned by Safeguard along Devon Park Drive—to house startups and investment funds that spun out over time.

![]() Pete also had a longstanding practice of allowing executives and entrepreneurs to use open desks and offices within the Safeguard building—a space and collection of people he affectionately called the ‘Orphanage’—when they needed a place to work or to incubate their ideas. To be a FOP (Friend of Pete) often meant you had access to the Orphanage (a desk, phone and computer), as well as Pete, the Safeguard team, and the countless investors and executives on the campus. Many of today’s investment and entrepreneurial luminaries in Philadelphia got their start either at Safeguard or through funding from Safeguard or one of the Safeguard-affiliated venture funds. The list is long and includes Ira Lubert (Independence Capital Partners); Bob Keith (TL Ventures); Buck Buckley (ICG/Actua); Mike DiPiano (NewSpring Capital); Steve Zarrilli (Safeguard and Science Center); Mike Hagan (VerticalNet and Nutrisystem); and Jerry Sweeney (Brandywine Realty Trust).

Pete also had a longstanding practice of allowing executives and entrepreneurs to use open desks and offices within the Safeguard building—a space and collection of people he affectionately called the ‘Orphanage’—when they needed a place to work or to incubate their ideas. To be a FOP (Friend of Pete) often meant you had access to the Orphanage (a desk, phone and computer), as well as Pete, the Safeguard team, and the countless investors and executives on the campus. Many of today’s investment and entrepreneurial luminaries in Philadelphia got their start either at Safeguard or through funding from Safeguard or one of the Safeguard-affiliated venture funds. The list is long and includes Ira Lubert (Independence Capital Partners); Bob Keith (TL Ventures); Buck Buckley (ICG/Actua); Mike DiPiano (NewSpring Capital); Steve Zarrilli (Safeguard and Science Center); Mike Hagan (VerticalNet and Nutrisystem); and Jerry Sweeney (Brandywine Realty Trust).

Growing an Entrepreneurial Ecosystem: Eastern Technology Council and Philadelphia Alliance for Capital & Technologies (PACT): Pete was one of the founders, in 1990, and long time financial backers of the Eastern Technology Council, an investment rooted in his desire to see more cohesion, celebration and growth among the region’s growing entrepreneurial base. The ETC was ultimately merged with the MAC Alliance to create PACT in 2010, an enduring legacy of Pete, and one which I am honored to lead. The organization’s annual Enterprise Awards is in its 27th year and the list of Legend Award recipients is a Who’s Who of Philadelphia leaders. Pete Musser was the inaugural Legend Award winner and the only two-time winner, repeating in 2007.

What was Pete’s superpower? His unwavering optimism. This allowed Pete to see the good when others focused on the bad. It allowed him to see opportunity where others saw a threat. And as a result, a conversation with Pete often provided the positive fuel to propel and challenge your own perspectives.

Loyalty: Pete was loyal to all—his companies and CEOs, his investors and his friends, his employees, and his dogs, all of which were golden retrievers over a 40-year span. A golden retriever is often referred to as the best example of Man’s Best Friend. Pete’s golden retrievers were a constant presence with Pete in the Safeguard office and around the Safeguard “campus.” Many of his “Higgins” (the name shared by most all of his retrievers) often delivered special gifts to Safeguard employees and companies on the campus on holidays like Valentine’s Day. To Pete, Safeguard was a big family and his loyalty to his family was evident throughout.

A Legacy of Philanthropy: If you read the headlines you will find stories of Pete’s passionate support for the Boy Scouts, American Red Cross, City Year Philadelphia and Lehigh University, his alma mater. But if you dig deeper, you will find that Pete was deeply and broadly philanthropic to so many causes. Pete could be counted on to lead fundraisers for organizations doing good in and around the Philadelphia region. I would argue that this is Philadelphia’s biggest loss—the Philanthropic Pete.

A Legacy of Entrepreneurial Success: Make no mistake, like all venture investors, Pete had his failed investments. However, he also invested in some incredible successes that created significant value including: the cable TV system that the Roberts family would eventually grow into Comcast (Pete sold the system to Ralph Roberts in 1963); QVC; Cambridge Technology Partners: Novell (at one time a $10 billion computer networking company, whose IP alone was purchased by a Microsoft-led consortium of tech companies for $450 million in 2010); and CompuCom (an $11B company still thriving today).

In the last 10 to 15 years, the act of building “ecosystems” has become an article of faith in the business world. Well, Pete Musser was building ecosystems right here before there was even a trendy name for it. His vision and optimism was matched only by his kindness, and he will be missed.

Dean Miller serves as President/CEO of PACT, the largest resource in the Philadelphia region for investors and entrepreneurs, and as Managing Director of the PCOM Primary Care Innovation Fund, a venture capital fund focused on healthcare innovations.