The Covid-19 pandemic has made one thing clear when it comes to our children’s education: We need more students attending safe, quality schools that are flexible enough to educate students even in the most daunting situations. An expansion of Pennsylvania’s Educational Improvement Tax Credit (EITC) and Opportunity Scholarship Tax Credit (OSTC) programs would provide more students with this chance.

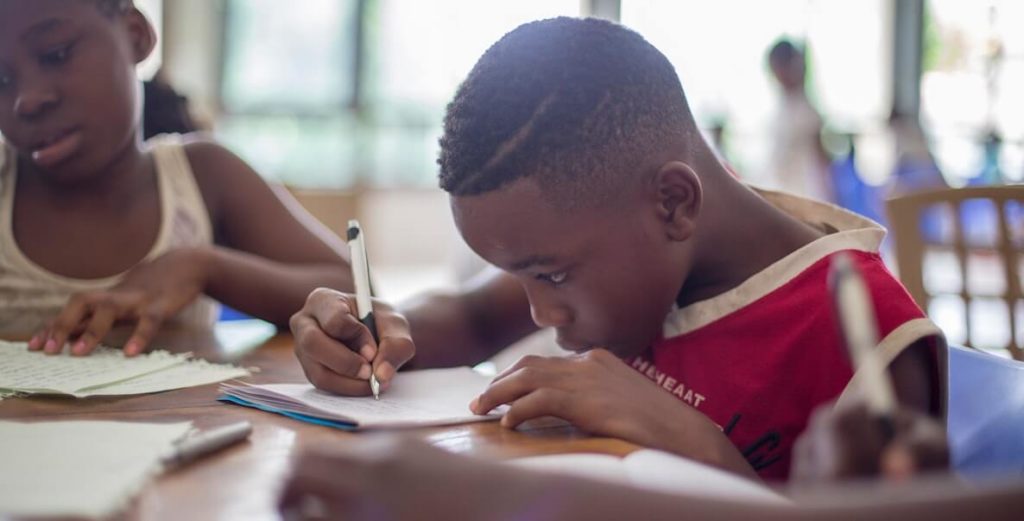

Covid-19 has amplified many existing disparities in schools over the past year. Lacking access to technology and in-person learning, children from under-resourced families are falling behind their peers. In Philadelphia and other large cities, private and parochial schools were able to provide safe, in-person learning earlier and at a higher rate than public schools.

MORE ON SCHOOL CHOICE

A 2020 report from the Philadelphia School Partnership found that six in 10 Philadelphia children attend low-performing schools, and Black and Hispanic students are overrepresented in the city’s lowest-achieving schools. While parental choice in education remains popular across all major demographics, there is especially high support from Black parents for programs that expand choice and access to education options.

When a problem has a solution that works, it should be replicated and expanded. The Pennsylvania state legislature is considering an expansion of EITC and OSTC, the tax credit programs that fund scholarships from Children’s Scholarship Fund Philadelphia (CSFP) and other education nonprofits working to close the achievement gap. These programs enable individuals and businesses to transform their state tax liability into scholarships for kids.

When a problem has a solution that works, it should be replicated and expanded.

A recent study from EdChoice, a nonpartisan nonprofit organization, found that our state’s private school tax credit programs and others across the country have positive outcomes for all students, for taxpayers, and for school districts. Overwhelmingly, research studies on tax credit scholarship programs show positive impacts on academic outcomes and parental satisfaction.

The EITC and OSTC programs also showed positive fiscal effects on taxpayers and public schools. Private school choice programs nationally show largely positive effects on achievement for both program participants and the public school students who remain at neighborhood public schools. Research shows that expansion of our tax credit programs will give more students the opportunity to achieve these positive results without negative impact to public school students.

At a recent CSFP event featuring an educational bipartisan conversation about the state tax credit programs that fund CSFP scholarships, the discussion turned toward what an expansion of these programs could look like for Pennsylvania students. This type of increase to these life-changing programs would give more students the opportunity to receive a great education at a school their families choose. Every year, scholarship organizations like CSFP turn away thousands of applicants because of insufficient funding. More dollars in these programs will mean more students in schools that deliver results.

Demand for an increase to the EITC/OSTC cap exists in the donor community as well. Each year, CSFP’s partner corporations share that they are “maxed out” in their program participation; they would give more to scholarship support if program limits were increased. And year after year, CSFP corporate partners apply to the program but are declined. Increasing the cap would enable corporate partners to have a deeper impact on educational outcomes for under-resourced students—and would give more students the opportunity to succeed.

We cannot ignore the fact that children from under-resourced families are falling further behind their peers.

All students deserve access to a quality education, regardless of their zip code or household income. It’s crucial that we continue to support the organizations that provide these opportunities to students from marginalized communities.

Here are some ways to help:

- Connect with scholarship organizations like CSFP by volunteering your time to support projects or doing outreach in the community to spread the word about scholarships to under-resourced families looking for educational options.

- Be an advocate. Share your story to show your elected officials that you stand for increased access to quality education.

- Donate, either monetarily or through the educational tax credit programs. If you’re in the position to give, every dollar counts toward opening doors to opportunity for students.

CSFP alum Amber, who is in her second year of a PhD program in linguistics at Georgetown University, put it best when she told us: “There’s nothing that separates me from anyone else on my block in West Philly other than opportunity, and a scholarship from CSFP was that chance for my sister and me.”

We cannot ignore the fact that children from under-resourced families are falling further behind their peers. Scholarship organizations stand ready to meet the demand of Philadelphia’s families, and the donor community stands ready to provide more support if funding caps are raised. An expansion of the educational tax credit programs would benefit the Pennsylvania students who need it most.

Keisha Jordan is executive director of Children’s Scholarship Fund Philadelphia.

The Citizen welcomes guest commentary from community members who stipulate to the best of their ability that it is fact-based and non-defamatory.

The Citizen is one of 20 news organizations producing Broke in Philly, a collaborative reporting project on solutions to poverty and the city’s push towards economic justice. Follow the project on Twitter @BrokeInPhilly.