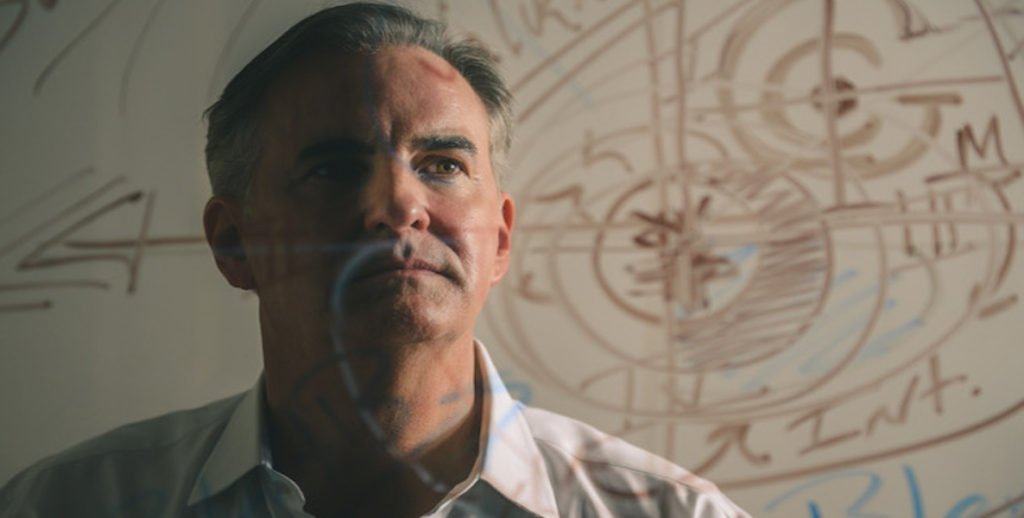

Garrett Melby, before founding GoodCompany Ventures in 2009, spent the better part of two decades working as an investor and an attorney. By the end of the naughts, he’d made his mark—and money—first at Wall Street firm Skadden Arps and then as a venture capitalist at Safeguard Scientifics.

After spending all that time in the cutthroat world of corporate capitalism, Melby found he needed something different—something a little more selfless. He was inspired by what he calls the “radically new, entrepreneurial” philanthropic work of Microsoft’s Bill Gates and eBay’s Pierre Omidyar, men who had made their billions, and now were investing massively in socially-focused entrepreneurial ventures. The venture capital world, as Melby saw it, was maturing; and its heroes, in the wake of the dot-com bubble burst, were shifting away from building monolithic companies and towards trying to change the world.

But what was to be his particular contribution? He wanted to bring capitalist principles to the non-profit world, as Omidyar and Gates had. But how could he best use his own experience to make the world better? After brainstorming with some colleagues he arrived at a notion that was by now familiar to him—a startup accelerator—but with a twist: They would only get behind startups that truly sought to do as much social good as making money. Thus: GoodCompany.

“We had a lot of ideas and concepts,” says Melby, “but we realized that we’d be best at working with individual entrepreneurs to help prepare them to attract capital.”

Startup accelerators are relatively old-hat in the tech world. Venture capitalists look for companies to mentor and ferry toward functionality, via coaching, connection sharing and helping develop market strategies; in return, VC’s get substantial amounts of equity in the company after the mentorship process is over. It stands to be a lucrative game: If you latch on to the right baby startup, you stand to score a couple million and be lauded as a tech Nostradamus. Some companies that went through accelerators include Reddit, Airbnb, Taskrabbit and Disqus.

GoodCompany’s model is a departure from the standard operating procedure for startup accelerators. For one thing, it’s a nonprofit, funded wholly by public and private grants from organizations like the William Penn Foundation, and big law firms; it doesn’t take equity in any startup that it helps accelerate, and therefore has no stake in the profitability of any company that it works with. For another, GoodCompany judges startups equally on their potential social impact and their business feasibility; if doing good is only a byproduct of a business, it doesn’t make the cut.

GoodCompany—based here, but with a national profile—is a notch in Philly’s belt: We’re not the tech capital of the country, or the financial capital. But we could be the socially-conscious business capital, with outlets like GoodCompany shepherding good business entrepreneurs.

In the last several years, GoodCompany has worked with dozens of startups, including a few recognizable Pennsylvania-based brands, such as WashCycle Laundry and Thread, a company that repurposes trash and recyclables from Haiti to use as fabric for clothes, shoes and furnishings. (Timberland is its biggest name client.) The accelerator doesn’t invest, or manage the companies. Instead, it offers them a dynamic, high-stress education in surviving as a socially-conscious startup.

When they enter the program, Melby says the young ventures are often well-actualized and innovative. But they tend to be unclear on how to secure funding, make a proper investor pitch as a socially-conscious business, or market themselves in the cutthroat world of venture capitalism and startup funding. The founders aren’t necessarily MBA’s or Wharton grads; they’re professionals from outside the startup industry who have workable, interesting ideas, but who haven’t been educated on how to actually run and grow a business. GoodCompany is like that Ivy League education (and is as hard to get into) for a specific niche: It’s a top-flight accelerator school tailored to suit the needs of small, socially conscious businesses as they lurch toward greatness.

Based out of Benjamins Desk in the Curtis Center, GoodCompany’s program runs for 12 weeks, and contains some truly dank perks: Aside from the crash-course education, enrollees receive a $25,000 stipend, and get to work with GoodCompany’s 40+ pipeline partners—non-governmental organizations, universities and social ventures, including Wharton, B Corps, Points of Light and Investors Circle. GoodCompany teachers lead the participants in business strategy and investment workshops, and offer one-on-one coaching and introductions to investors and experts; the course culminates in an investor pitch event. The 75 companies that have gone through GoodCompany so far have raised about $60 million.

For the 2017’s accelerant class, GoodCompany has changed the model slightly: Climate Ventures 2.0 is aimed specifically at startups that target the threat of climate change on farming and waterways. The participants will work with USAID’s Global Innovation Exchange, and pilot opportunities in the Rockefeller 100 Resilient Cities program. The program grew out of work GoodCompany did with President Obama’s Climate Data Initiative.

It’s the second time GoodCompany has run its accelerator around a particular set of problems. In 2013, it launched FastFWD with the Wharton Social Impact Initiative and the city of Philadelphia, with a $1 million grant from Bloomberg Philanthropies. That program accepted young companies that took on public safety issues—including Textizen, a text-based reminder system for the formerly incarcerated; and Chicago-based Edovo, which creates tablet-based education platforms for prisons.

Ten startups will ultimately take part in Climate Ventures. The application window opened up last month, and closes on March 15. Guess how many do-gooder companies have applied to get accelerated by GoodCompany? Hint: it’s more than the number of Spartans who fought at Thermopylae.

“400 have applied,” says GoodCompany managing director Catherine Griffin. “And we’re expecting a lot more. You know how startups are, they tend to wait until the last minute to get applications done and make sure everything’s perfect.”

Of those applicants, GoodCompany will select those that fits its close criteria: A workable social good-to-potential-cash-making ratio, experience in the field their startup seeks to operate in and a very particular stage of its infancy. The elevator pitch, says Griffin, has to be fully-formed enough that it can attract early investments—“friends and family money,” she calls it—but the startup can’t yet have any major outside investors. To be accelerated by GoodCompany, she says, the startup has to need it. They’re not interested in shepherding youngish-companies to more profitability; they’re looking for precocious neophytes who couldn’t survive the game without help. They want to help build socially aware businesses virtually from the ground up.

Gabriel Mandujano, who runs Wash Cycle Laundry, was very much one of those precocious neophytes when he participated in GoodCompany’s 2012 program. “It was our first introduction into the world of impact investing. I had met people at conferences, but I hadn’t really put together a pitch. I couldn’t say I understood all the elements of how the startup world worked until I went through the program,” Mandujano says. “It can be hard when you’re just starting out. They really just helped us get it together.” Most important for WashCycle, Mandujano says, was the help GoodCompany gave the company in preparing them prepare to get equity and introducing them to Investors’ Circle Philadelphia, which made the first investment in the company.

Melby himself is an active angel investor with Investors’ Circle; he also runs iolite Partners, a boutique investment firm. This particular venture, putting social good on par with profit, is a departure for him. But it is a movement that he has noted has Philadelphia at its heart. B Corps, the organization that confers a Good Housekeeping-style seal of approval on companies that do social good, is based here; last year, a coalition of organizations, investors and entrepreneurs launched ImpactPHL, to encourage investments in companies that help make the Philadelphia region stronger. GoodCompany—based here, but with a national profile—is a notch in Philly’s belt: We’re not the tech capital of the country, or the financial capital. But we could be the socially-conscious business capital, with outlets like GoodCompany shepherding good business entrepreneurs.

Still, Melby says the concept of GoodCompany wasn’t always an easy sell. The whole non-profit accelerator thing is novel to begin with, and there aren’t that many of them—maybe two or three other non-profit shops, such as Y Combinator, match or exceed GoodCompany’s profile. “Everyone treated us with suspicion—the VC’s and the social venture startups,” he says. “They were trying to figure out our game, if we were competition.”

About eight years in, GoodCompany has shaken the doubters, and the non-profit is going strong. Many former accelerants are thriving; and GoodCompany has crunched some numbers—using a proprietary, in-house equation—and found that the companies that they work with have created $5 billion worth of social impact.

Correction: An earlier version of this story misstated the name of the company where Garrett Melby worked as a venture capitalist. It was Safeguard Scientifics.