Suddenly, there he was, talking, laughing, telling his story. It was days after Rayshard Brooks had been gunned down in a Wendy’s parking lot by an Atlanta police officer, shot in the back, and now here he was, a living, breathing human being, smiling broadly while talking about his children, no longer just a symbol of the scourge of cops run amok seemingly sweeping the land.

![]() It was a powerful moment, this visit from beyond the grave within just a couple of news cycles, and it was thanks to Reconnect, a Maine-based company whose mission is to help solve the incarceration crisis by using technology that takes on the revolving-door nature of the prison industrial complex.

It was a powerful moment, this visit from beyond the grave within just a couple of news cycles, and it was thanks to Reconnect, a Maine-based company whose mission is to help solve the incarceration crisis by using technology that takes on the revolving-door nature of the prison industrial complex.

The company was a social justice finalist for Fast Company’s 2020 World Changing Ideas Award, and one of the investors in its recent $3.7 million raise is right in our backyard: SustainVC, the Radnor-based firm that has long been a leader in the impact investing world. At a time when protesters literally holding pitchforks have become a thing, Sustain VC’s support for Reconnect—and its entire portfolio of companies—is a testament to the notion that capitalism can be a driving force for social good.

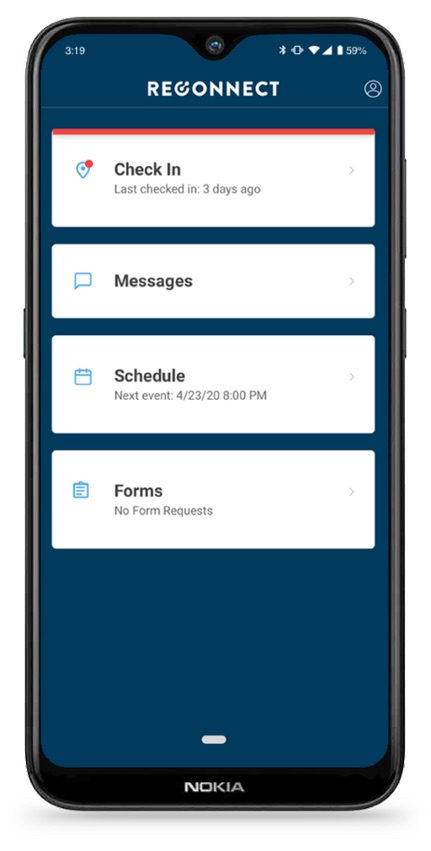

![]() Reconnect Co-founder and CEO Sam Hotchkiss got a glimpse of just how ripe the criminal justice system was for disruption after a friend got a DUI 11 years ago. Soon came Call2test, a revolutionary tool for automated and randomized drug court check-ins. Two years ago, Reconnect launched ConnectComply, an app-based tool for those caught up in drug court to check in with a selfie.

Reconnect Co-founder and CEO Sam Hotchkiss got a glimpse of just how ripe the criminal justice system was for disruption after a friend got a DUI 11 years ago. Soon came Call2test, a revolutionary tool for automated and randomized drug court check-ins. Two years ago, Reconnect launched ConnectComply, an app-based tool for those caught up in drug court to check in with a selfie.

More recently, as Reconnect has sought to mitigate against the vicissitudes of the broken parole and probation system, Hotchkiss’s team came to interview Brooks and others who had been in and out of it, as part of its deep dive into the problem it aimed to solve. And that, says SustainVC Managing Principal Eric Chapman, is precisely why the venture fund wanted to place a bet on Reconnect.

“When you describe what Reconnect does, it sounds like a technology play,” says Chapman. “And it does involve using tech. But they’ve really become experts when it comes to finding solutions. They have a deep understanding of the whole problem from the participant perspective.”

Essentially, Reconnect serves two constituencies: Caseworkers—the probation, parole, bail and court officers who manage criminal justice caseloads; and “participants”—those, like, Brooks, who get caught up in the system. By figuring out the “pain points” of both, their technology—now utilized in courts, probation and parole offices in 32 states—not only streamlines the bureaucracy, but also mitigates against recidivism.

Its platform provides both caseworker and participant with remote check-in capability, (a particular benefit in the age of Covid-19), with calendar alerts and reminders, and a more flexible GPS system so participants on, say, their way to work don’t have to worry about inadvertently stepping over the arbitrary geographic boundaries the court has laid out for them.

There are 4.5 million adults on probation or parole, all of whom face 18 to 20 purely technical violations every day that can send them right back behind bars. To be clear: These are not illegal acts. They include missing or being late for a parole or probation office visit; unpaid court fines or fees; breaking curfew.

According to a report from the Institute for Justice, Research and Development at Florida State University’s College of Social Work, of the 600,000 Americans who are reincarcerated every year, nearly 200,000 are sent back for such technical violations, like failing to register a new car change or new phone number with the sheriff’s office.

Perhaps that’s why Brooks freaked out when those Atlanta cops started to cuff him; he knew he was about to get sucked back in to an unwieldy, inefficient and often unjust system that defaults time and again to incarceration.

Now let’s think of this from, say, the probation officer’s perspective: It’s late in the day, and you have 20 cases to check on. Rather than having to make 20 house calls, you use the Reconnect video app on your phone, with its biometric and GPS sensor. In minutes, you know if there’s a problem you need to focus on. It makes the ankle bracelet, with its hyper sensitivity and false alarms, seem positively antiquated.

For the participant, the little-known economic burden of the ankle bracelet becomes a thing no more. They cost roughly $300 each, and that cost is passed on to the wearer in the form of regular payments. Then there’s the fact that the ankle bracelet only has a six-hour charge. Imagine being a recently returned citizen, fortunate to be starting a new gig, only to have to go on break around 3 pm to sit near an outlet while you charge up. Not exactly the best way to make a good impression.

![]() “Part of our ethos is to either back entrepreneurs who come from marginalized communities, or fund solutions to help uplift marginalized or underserved communities,” says SustainVC’s senior analyst Jazmine da Costa. “Given that those in the probation, parole and court system are disproportionately Black and Brown, that checked off in a big way the populations we’re looking to serve with this fund.”

“Part of our ethos is to either back entrepreneurs who come from marginalized communities, or fund solutions to help uplift marginalized or underserved communities,” says SustainVC’s senior analyst Jazmine da Costa. “Given that those in the probation, parole and court system are disproportionately Black and Brown, that checked off in a big way the populations we’re looking to serve with this fund.”

The fund to which da Costa refers is worth $27 million, closed by SustainVC early this year, with the mission of investing between $250,000 and $1 million in companies that create social and environmental impact while generating market-level returns—a signpost of the conscious capitalism movement’s animating idea that doing well and doing good need not be mutually exclusive.

Ergo SustainVC’s slogan: Positive Impact. Positive Returns.

“We look for companies where impact is built into what they do,” says managing partner Tom Balderston. “We focus on three buckets: Climate and sustainability; equality and empowerment; and health and education.”

Balderston has long been a mainstay of Philly’s impact investing community. In fact, when Balderston and fellow managing partner Sky Lance first started their investing for good strategy, it was 13 years ago, before the term impact investing had even entered the lexicon.

“Part of our ethos is to either back entrepreneurs who come from marginalized communities, or fund solutions to help uplift marginalized or underserved communities,” says SustainVC’s senior analyst Jazmine da Costa.

Today, Balderston reports, impact investing classes at Wharton are more popular than traditional investment courses. Back then, though, he wasn’t aware he was in on the ground floor of a movement. He was just a successful private equity guy looking for meaning.

“I wasn’t cut out for a pure financial engineering life,” he says. “I wanted the opportunity to invest to make a difference. This was a way to find work that mattered.”

Balderston and Lance, who’d also had much private equity success, met through Investors’ Circle, the network of angel investors that came together to really drive impact investing in the last decade. They were both looking for something deeper than the bottom line, a not uncommon story in the impact space.

![]() In fact, SustainVC’s Chapman, who’d spent over 20 years as an international consultant for Accenture, says he remembers hearing in B-school lectures that one’s career would ultimately be divided into three phases: Learn. Earn. Serve. Implied in the pithy phrasing was that the third item—serving—would come in a presumably early retirement. But…why wait?

In fact, SustainVC’s Chapman, who’d spent over 20 years as an international consultant for Accenture, says he remembers hearing in B-school lectures that one’s career would ultimately be divided into three phases: Learn. Earn. Serve. Implied in the pithy phrasing was that the third item—serving—would come in a presumably early retirement. But…why wait?

“There’s a whole generation that wants meaning right now,” he says.

Enter da Costa, SustainVC’s resident millennial. She speaks with an intensity about Reconnect and its targeted constituency, and her story perfectly illustrates what conscious capitalism has sought to embody: the melding of the personal and the professional, the marriage of values and business, the idea that one ought not to have to shed communitarian principles in order to make money, the notion that you can bring your whole self to your work.

Her CV reads like she’s been on a lifelong intellectual road trip: Inner-city Queens, New York, upbringing, single motherhood, Princeton for Anthropology, writing oral histories of resilience for the 9/11 Memorial Museum, Yale grad school for an MBA in economic development and sustainable cities and a Masters in Forestry, consultant for social enterprises in Cape Town, Quito and Appalachia. Just reading her resume exhausts me.

But, at a moment when the political back and forth has become, if possible, even more simplistic and canned than ever—Marxist! One Percenter!— it is that energy that just might get us to a new place. I’m all for tearing down statues, but not if that comes to be seen as the work; how about also affecting some actual Black lives today, with new solutions to until-now intransigent problems?

That’s what funds like SustainVC try to do. They find thinkers and doers who look at timeworn systems through fresh eyes, and then problem-solve. From Reconnect to Aunt Bertha—the largest online search tool connecting people with social service programs; to Pigeonly—a simple and affordable way to stay in touch with an inmate via phone, tablet or computer, founded by a returning citizen; to Philly’s own United By Blue, SustainVC ultimately doubles down on the notion that there is a better way.

They place bets on hope, in a darkly cynical age.

“It is possible to invest with a purpose,” Balderston says. “There are lots of problems business can help attack.”

Header: iStock